In a paper for last week’s IMF annual research conference, William English (head of the Federal Reserve Board’s Monetary Affairs division) discussed current monetary policy strategy, with a focus on threshold rules and forward guidance. The paper caused a stir in markets but we do not think it signals a fundamental change in Fed communication. Small changes to the so-called “Evans Rule” are possible, but the basic framework will probably remain in place even as QE tapering begins.

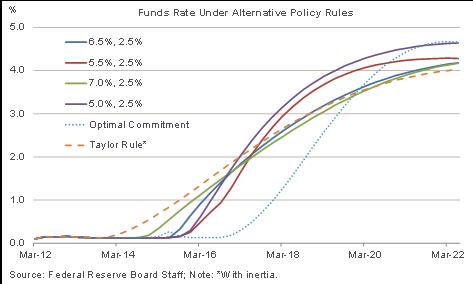

The core of the paper was a set of simulations for the funds rate and economy under a variety of policy rules. These included versions of the Taylor Rule, and versions of the Evans Rule with different thresholds for unemployment and inflation. They also included a simulation under something called “optimal commitment,” which is like a promise to follow a history-dependent path for policy. The paths for the funds rate under a few of these rules are shown in the chart above (the first four are versions of the Evans Rule with different unemployment thresholds; all with a 2.5% inflation trigger).

If the FOMC were considering adopting the “optimal commitment” policy, then this would constitute a fundamental change in direction. The optimal commitment rule calls for a lift-off date for the funds rate (defined as >50 basis points) in Q3 2017, while the current 6.5%/2.5% rule calls for a lift-off date of Q4 2015. The unemployment rate also falls below 6% three quarters earlier under the optimal commitment rule.

However, it seems relatively clear that the FOMC is not moving toward an optimal commitment policy rule. English’s paper calls this approach “possibly infeasible.” And New York Fed President Dudley recently had this to say: “Consider a scenario in which the central bank decided to increase monetary accommodation by committing to maintain a low short-term interest rate for a long time even if this commitment resulted in inflation overshooting the central bank’s objective in the future … this is not a policy that has been adopted by the Federal Reserve. There are implementation challenges with this approach. In particular, it is difficult for a monetary policy committee today to institutionally bind future monetary policy committees to follow actions that could conflict with their objectives in the future. Without such a credible forward commitment, such policies would likely be ineffective in affecting expectations in the manner needed to provide additional monetary policy accommodation.” (October 15)

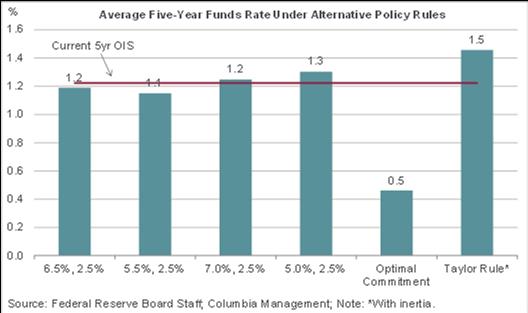

We therefore think the relevant question is much narrower: will the FOMC reduce the unemployment rate in the Evans Rule to 6.0% or possibly lower? From a broad market and economic perspective, we do not think the precise unemployment threshold makes a great deal of difference. For example, consider the chart below, which shows the five-year average funds rate under these six rules. The optimal commitment rule implies a much different outcome for policy, and therefore a much different fair value for longer-term rates. But the various versions of the Evans Rule imply similar rate paths, all of which are close to current market prices Overnight Indexed Swap or OIS rates reflect the average expected federal funds rate over time, and may also include some risk premia.

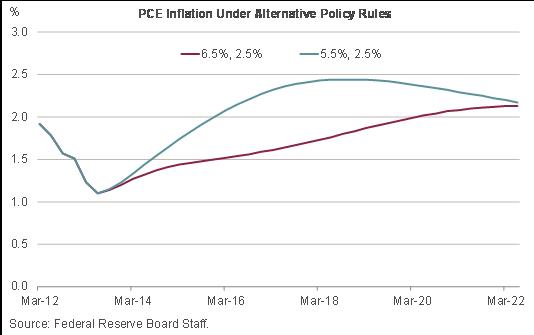

The same goes for macroeconomic outcomes. The paper notes that moving the unemployment threshold from 6.5% to 5.5% improves social welfare in the baseline simulation. However, the paths for unemployment are remarkably similar, and the two policy rules differ mostly in outcomes for inflation (see chart below).

Lastly, although the Evans Rule with a 5.5% unemployment rate has the best outcome in the base case, it does not perform as well in all scenarios. With random shocks to the model, the authors show that rules with 6.5% unemployment thresholds more often improve social welfare. The current 6.5%/2.5% rule also “triggers” the inflation threshold less often than the 6.0%/2.5% or 5.5%/2.5% rules.

So will the FOMC lower the unemployment threshold? We still think probably not. There are some possible advantages to a change, including those demonstrated by the Bill English paper, and also the clarification of where the committee stands on the labor force participation issue. But change also brings some downsides, such as the risk that the public thinks the threshold could be adjusted upward at some point—as mentioned in the July FOMC meeting minutes. There are also questions about whether such a change improves or worsens the credibility problem (due to greater time-inconsistency tensions), and what it means for the FOMC’s “threshold not a trigger” mantra. Thus, while we cannot rule out a change, we suspect that inertia will prevail, and they will stick with the 6.5% threshold at upcoming meetings.

Disclosure

The views expressed are as of 11/11/13, may change as market or other conditions change, and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances. Investment decisions should always be made based on an investor's specific financial needs, objectives, goals, time horizon, and risk tolerance. Asset classes described may not be suitable for all investors. Past performance does not guarantee future results and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that the forecasts are accurate.

This material may contain certain statements that may be deemed forward-looking. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those discussed. There is no guarantee that investment objectives will be achieved or that any particular investment will be profitable.

Investment products are not federally or FDIC-insured, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities products offered through Columbia Management Investment Distributors, Inc., member FINRA. Advisory services provided by Columbia Management Investment Advisers, LLC.

© 2013 Columbia Management Investment Advisers, LLC. All rights reserved. 764699