One year ago, a 10-year U.S. Treasury bond yielded around 3 percent, up from around 2.50 just months earlier. At the time, the market fretted that rates would continue to rise; our view was the opposite. Today’s market is a different beast, however. With rates now around 1.8 percent—the lowest level since May 2013—we see Treasuries as overvalued and the recent rally getting long in the tooth.

At current levels of overvaluation, the only factors holding interest rates down are the expectation of declining inflation as a result of the oil shock and the prospect of quantitative easing in Europe. This means we may be facing the old Wall Street adage of “buy the rumor, sell the news” when it comes to Treasury prices. Once the one-time effect of declining oil prices has passed, inflation is likely to return to the underlying trend, which is higher than today. This, combined with a European Central Bank announcement of quantitative easing, could mark the end of the recent spike down in interest rates.

Even at a paltry 1.81 percent, U.S. 10-year Treasuries easily compete with Germany’s 0.41 percent bund yield today. While there is some prospect that QE in Europe will be announced at the ECB’s meeting in March, any announcement, especially if done in January, is likely to limit QE to a size smaller than what will be ultimately necessary. But if the ECB is able to implement a QE program of sufficient scale, the monetary elixir should cure fears of economic contraction, causing rates in Europe to rise.

Likewise, while the oil supply shock has created a spike in Treasury prices, it is transient. When we emerge from this oil tantrum, we are likely to experience a fairly vicious snapback up in rates.

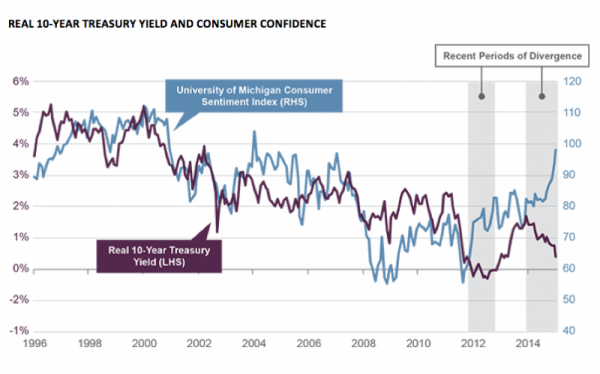

A key indicator that rates in the U.S. are nearing an unsustainable degree of overvaluation is the divergence of real 10-year Treasury yields, currently 0.40 percent, from the University of Michigan Consumer Sentiment Index, which shot up to 98.2 in the latest reading, an 11-year high. Real 10-year yields usually rise as the economy, and hence consumer confidence, improves.

We are currently witnessing the widest divergence between real rates and consumer confidence since May 2012 (see Chart of the Week). Then, as today, real yields headed south while consumer confidence shot upward. Subsequently, from July 2012 to December 2013, the nominal 10-year yield rose by 153 basis points, which closed the divergence. The current surge in consumer confidence suggests that the real yield should be somewhere around 3 percent (rather than its current reading of 0.40 percent). This large of a divergence is something to watch, as it is not sustainable.

While the near-term risk remains that interest rates in the U.S. may head even lower—we could easily get some piece of news that pushes the yield down to 1.6 percent—I believe this recent flight to ultra-low rates will draw to a close by the end of the second or third quarter. The bottom line is that we are closer to the end of this rally than its beginning.

As for the equity markets, the near-term outlook for major advanced economy stocks is positive, despite recent volatility. In addition to a brightening economic outlook due to falling energy prices and lower mortgage rates (which has led to a surge in new purchase applications), the expected announcement of quantitative easing by the ECB should help to push stocks higher over the next few months. Recent QE programs in the U.S., Japan, and the U.K. saw local stock markets rally in the months after they were announced, which is a near-term positive for equities, and Europe in particular.

Improved Consumer Confidence Points to Higher 10-Year Yield

With a rapidly improving labor market, plunging gas prices, and GDP growth at 5 percent, consumer sentiment is near 11-year highs. Historically, an improved consumer outlook has been associated with higher real yields on the 10-year Treasury. This is likely due to expectations of strong economic growth. Recently, though, we have seen a wide divergence between the two series. The last time we saw such a divergence was in May 2012, after which real yields adjusted fairly rapidly to sync up with the view of consumers.

Source: Haver, Guggenheim Investments. Data as of 1/16/2015. Note: Real 10-year Treasury yield is calculated as nominal yield minus core PCE year-over-year change.

This material is distributed for informational purposes only and should not be considered as investing advice or a recommendation of any particular security, strategy or investment product. This article contains opinions of the author but not necessarily those of Guggenheim Partners or its subsidiaries. The author’s opinions are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. ©2015, Guggenheim Partners. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Scott Minerd is Chairman of Investments and Global Chief Investment Officer at Guggenheim Partners