Early in Shakespeare’s "Macbeth," Lord Banquo asks the prophetic three witches, "If you can look into the seeds of time, and say which grain will grow, and which will not, speak then to me." Banquo’s turn of phrase reminds us that if a farmer planted the wrong grain he could yield a poor harvest, or worse, he might even starve.

I thought about this recently when asked about the outlook for U.S. interest rates. Investors, like farmers, have a sense of the seasons that guides which grains, or investments, are more likely to yield favorable results. While I have no special divining powers, I can draw on our macroeconomic research team that employs the not-so-mystical forces of data and analysis.

Based on macroeconomic research, we estimate “normalized” real interest rates could justifiably be 100 basis points higher than they are today. The U.S. economy is certainly doing well enough to suggest higher interest rates ahead. With quantitative easing ending in the United States this month and the U.S. Federal Reserve preparing investors for a higher federal funds rate in 2015, the stage is set for U.S. interest rates to move higher. But that may not be the grain that grows: The reality is that, despite a strengthening U.S. economy, the greater risk is that interest rates head lower, not higher, in the near future.

Looking at the world today, there are a number of forces that could keep rates low. The first is the impact higher rates would have on the U.S. economy. Remember what happened following the “taper tantrum” last year? Before rates were able to reach historical norms, the average rate on a 30-year mortgage spiked almost a full percentage point in two months—the sharpest rise since the late 1990s—resulting in an abrupt housing slowdown, which slowed the U.S. economy materially. The impact of higher interest rates on the housing market and the broader U.S. economy is something the Fed is extremely mindful of, especially after the first quarter winter soft-patch where the U.S. economy contracted by 2.1 percent.

Next, U.S. Treasury yields are materially higher than those in any other developed market. The spread between 10-year U.S. Treasuries and comparable German bunds reached 157 basis points in September, its widest level since 1999. After inverting in late 2011, the Treasury/bund spread has steadily risen for the past three years as U.S. yields have moved higher while German rates have dropped. The spread between 10-year Treasuries and 10-year Japanese government bonds is now 189 basis points. With developments in the Middle East resembling something from the Bible’s New Testament Book of Revelation and turbulence continuing elsewhere from Ukraine to Hong Kong, the relative price value of U.S. government bonds versus other safe haven investments should continue to be a factor keeping U.S. interest rates low.

Elsewhere in financial markets, the U.S. stock market is vulnerable to higher volatility over the short term. I told my investment team in a meeting on Sept. 23 that, were I a trader, I would tell them to go short stocks, but I am not a trader, I am an investor, and the long-term trends of this bull market still look solid. To paraphrase Shakespeare’s witches, while in the near term something wicked may come this way to markets, the evil portends of this wicked season of volatility may sow new seeds of yet one more rally for U.S. stocks and bonds.

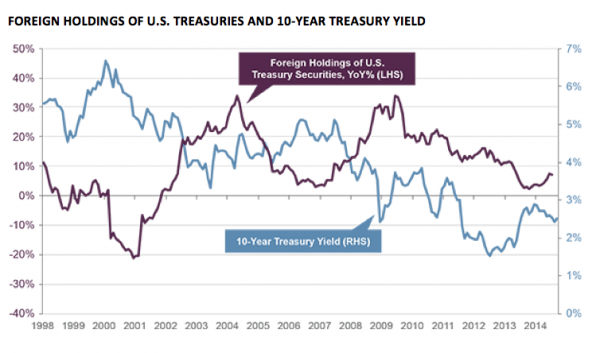

Increased Foreign Buying Pushes U.S. Interest Rates Down

Foreign investors will likely look to the United States for higher yields on government bonds as foreign central banks increase monetary accommodation in their own economies. Historically, rising foreign purchases of U.S. Treasuries have pushed U.S. yields lower. So far in 2014, foreign buying has accelerated—a trend likely to continue, putting downward pressure on U.S. Treasury yields.

Source: Haver, Guggenheim Investments. Data as of 9/30/2014.

This material is distributed for informational purposes only and should not be considered as investing advice or a recommendation of any particular security, strategy or investment product. This article contains opinions of the author but not necessarily those of Guggenheim Partners or its subsidiaries. The author’s opinions are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. ©2014, Guggenheim Partners. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Scott Minerd is Chairman of Investments and Global Chief Investment Officer at Guggenheim Partners