Let’s Go Crazy is one of the top songs written and performed by ‘80s superstars, Prince & The Revolution, whereas “simply crazed” is the best way to describe my more contemporary state of mind in observing global financial markets. Considering the stellar (yet questionable, by sheer magnitude) recovery of stocks since the August “air pocket,” it is quite something to witness the uncompromising confidence investors are willing to place in the robustness of economic and market conditions. I cannot help but continue to offer a voice of reason (or caution), but developments have proven me wrong for longer than necessary. Some clients, on the other hand, may very well scratch their heads over my apparent inability to assess opportunities more accurately, or even over my choice of music: Your pick.

Staying on the topic of catchy tunes, Prince originally became well known for his millennium-turning theme song, 1999. No, this is not the time to spit out data in a desperate attempt to compare today’s stretched and richly valued conditions with the height and might of the dot-com era (as this exercise would simply fail), but there is one striking similarity between now and then: very vividly, I recall the tone of numerous client interactions, review meetings, and “predictions” of what promises markets would hold in the years leading up to the 2001 equity bust. Even though today’s investor sentiment is still far from extremes—and possibly even a bit bearish—I observe the same willingness to depart from thoughtfully crafted and implemented investment policies, paired with an inclination to accept more risk than one should.

Perceived risk, from a qualitative perspective, is often the result of what one thinks the future may hold, in terms of either opportunities or fallouts (i.e., expected positive/negative returns, for our purposes). As every recent ten-percent (plus) correction and subsequent increase in volatility has been aided by central banks, and consequently presented a buying opportunity, today’s risk perception simply must be skewed—quantitatively and qualitatively! The pressing question now is how to address currently understated risk with the right mindset and investment allocation. An additional challenge is that the benefits of diversification are not so clear anymore, since equities and fixed income have traded in “tandem” in recent years, and liquid domestic equities have achieved better results than most international choices and/or illiquid non-traditional investments.

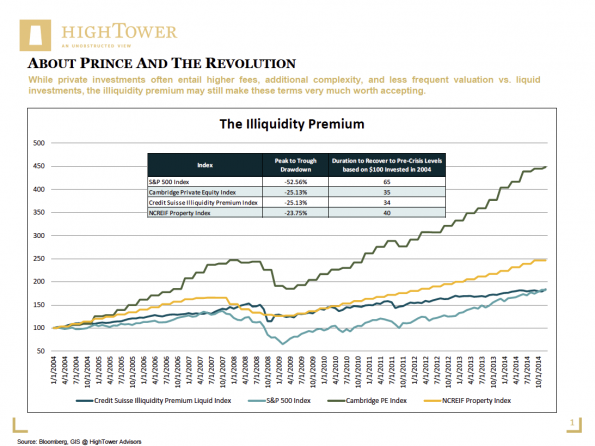

As we discussed in Back to the Future (This Time for Real), investors should not only stay diversified for optimal outcomes, but should also consider non-traditional, illiquid private investments (PE) as part of their asset mix. Recency bias is what lies in the way of this logic; why bother with something that does not seem to create added benefit, and that is illiquid? The reality is a different one, as a recent study underlines: an allocation to PE not only offers opportunities for more significant returns, but can also dampen the volatility of a given portfolio. While private investments often entail higher fees, additional complexity, and less frequent valuation vs. liquid investments, the illiquidity premium may still make these terms very much worth accepting. This notion is especially relevant in an environment where more-liquid choices may be “topping out.”

Investors who are “all in” for U.S. equities today will likely not receive the results they desire. Now is the time to maintain utmost discipline, not only adhering to a goals-based financial planning framework, but also allocating money to asset choices that are considered less attractive, purely based on qualitative and “gut” feelings. Our findings are far from revolutionary, but are necessary to guide investors in an environment where policymakers have spoiled natural price formation and investors’ risk perception.

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.