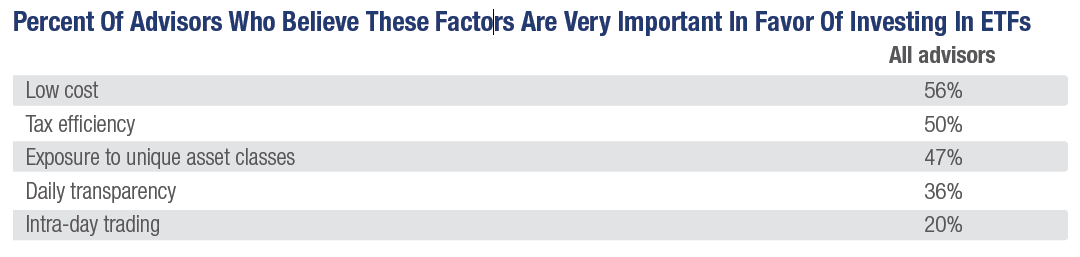

When choosing passive strategies, 60% of advisors surveyed select ETFs, while the remainder use mutual funds. Advisors who are using ETFs tend to focus on three main factors: low cost (56%), tax efficiency (50%) and exposure to unique asset classes (47%). There are a few notable differences among advisor channels, however. Advisors from larger firms were less attracted by the low costs of ETFs than was the broader industry—cost was a very important factor for just 34% of large-firm advisors surveyed, which was 22 percentage points lower than the industry average.

Low fees topped the list of factors that advisors use to compare target date funds: Fees were very important for 58% of advisors surveyed, ranking higher than glide path (36%) and manager brand (32%). Manager brand was slightly more important to advisors from larger firms (36%) than it was to advisors from independent broker dealers and RIAs (30%).

Download the Investment Trend Monitor: Top Trends in 2016 Report

Click to Enlarge

Click to Enlarge