With its main competitor moving further towards traditional wealth management, Wealthfront is doubling down on its bet that fully automated advice is the future.

Now, the Silicon Valley "robo advisor" is introducing automated financial planning, which Founder and Chief Strategy Officer Dan Carroll believes makes the tool more personal and connected to investors than a human advisor could ever be.

“Going to a human advisor is completely dehumanizing,” Carroll told Wealthmanagement.com. “If you meet twice a year get a single form—they don’t know your life."

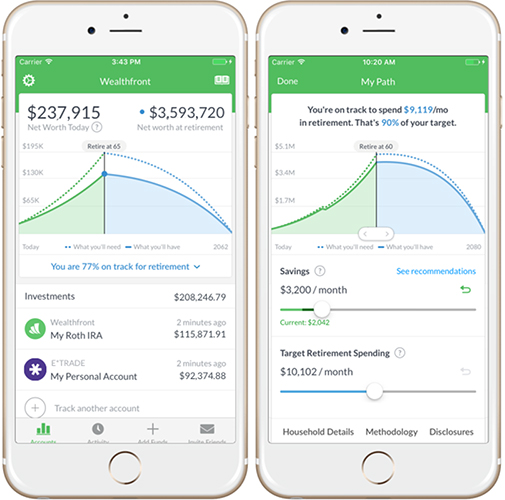

Wealthfront is calling the new service Path, and it puts financial planning at the center of the digital experience. Path aggregates data from all of a user’s accounts connected to Wealthfront to automatically determine how much a client is saving and spending.

“[There is] no judging. When you log in, we don’t show you right away how much you need to save,” Carroll said, adding that advisors sometimes tell people they need to be saving more they can afford or are comfortable. “We don’t want to be tone deaf if you log in and see you’re supposed be saving $4,000, but you can't afford it.”

Thanks to an integration with Redfin, Path can factor in the value of a customer’s house, which Carroll said is valuable for Wealthfront’s client base of young professionals. Its algorithms also make their own assumptions about Social Security, inflation and investment returns, to spare clients from guesswork required by most retirement calculators.

“We then use your actual behavior to forecast the future; not what you say you want to do, but what you are actually doing,” Carroll said in a Wealthfront blog post detailing Path.

Path gives advice on where customers should save for retirement, prioritizing tax-advantaged and low-fee accounts, and factors in annual contribution limits. Carroll said the algorithm gives unbiased advice, even if it means contributing more to a held-away retirement account rather than the Wealthfront brokerage account.

Carroll says Path was designed specifically for use on a mobile touchscreen, with factors like retirement age, savings and spending all adjustable by sliding scales. The idea is to let people get answers to simple financial questions, such as how much more a person should start saving after a raise, or if they can retire and travel the world, without having to schedule an in-person meeting, phone call or even video conference session with a financial advisor.

“Young people want the service and to get it right now,” Carroll said. “They don’t want to use Skype. If an advisor thinks clients want to Skype, they’re crazy."

Path does not allow for goals-based planning, which Carroll described as a “gateway drug for financial advisors to sell expensive products.”

“Goals are often putting the cart before the horse,” Carroll said. Wealthfront targets a younger demographic with smaller accounts, so there’s more of a need to focus on building a strong foundation for investing. What he calls the “piggy bank approach” of saving for a car or wedding in addition to retirement just doesn’t work. “Not starting with goals has been so much more powerful. Starting with needs before getting to wishes. The two need to talk to each other. A lot of goals-based planning technology doesn’t work with retirement.”

So, how does Path compare with digital financial planning tools available for advisors? Carroll said Wealthfront’s is a better mobile experience and delivers what young investors actually want, not what financial institutions think they want.

“Our clients pay us not to call them. We not only respect that, but specifically build products for this preference,” Carroll said in his blog post. “Software is our method of persuasion to encourage you to take the right actions so you can reach your goals, and we believe if done right, software can be a far more powerful motivator than the human conversation.”