Charles Schwab officially launched the advisor version of its automated portfolio allocation service, Institutional Intelligent Portfolios, on Tuesday, three months to the day after the custodian unveiled its plans for the new platform.

In those three months, Schwab increased the number of ETFs available on the platform from 200 to 450.Those ETFs now represent more than 80 percent of total ETF assets currently held by advisors' clients at Schwab.

Other than increasing the amount of available ETFs, the launch of Intelligent Portfolios delivered what Schwab promised in March. The platform will be available for free to advisors with at least $100 million in assets custodied with Schwab; advisors with less than $100 million will be charged 10 basis points on their total assets on the platform.

The idea is to help advisors reach next generation investors and serve smaller accounts in a cost-efficient way, but Naureen Hassan, Schwab’s executive vice president of investor services segments and platforms and leader of Intelligent portfolios, said the technology can also help advisors manage high-net-worth clients.

“It’s about the full breadth of need, and this is about automating the portfolio management function,” Hassan said. With portfolio management taken care of, advisors are freed up to serve other high-net-worth needs, such as estate planning, that can’t be automated, she said.

Though Schwab did not run a pilot program of Institutional Intelligent Portfolios, Hassan said interest has been high among advisors. More than 1,000 firms indicated they were either ready to go or evaluating how to incorporate the robo-advisor into their practice.

“We think we’re going to see strong adoption,” Hassan said.

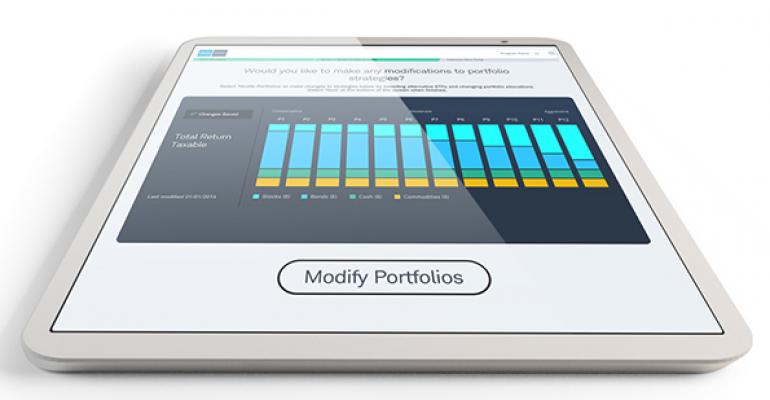

The technology is customizable, the firm said. Advisors can craft their own portfolio strategies, create their own asset allocations, select the ETFs and brand the user experience with their firm’s logo and contact information.

Advisors must allocate a minimum of 4 percent of a client’s portfolio to cash, a requirement that has generated some controversy. In the retail investor version of the platform, users must keep at least 6 percent in cash, but no more than 29 percent.

Client assets are automatically assigned to one of the advisor-designed portfolios based on the client’s responses to an online risk questionnaire. Advisors cannot customize the questionnaire; it was designed using Schwab’s latest research by an internal team, said Neesha Hathi, Schwab’s senior vice president of advisor services technology solutions.

After the assets are allocated, the advisor can perform a review and manually make any adjustments necessary before money is invested. At that point, an account can be automatically opened, and all documents will be delivered digitally.

Schwab also stressed Institutional Intelligent Portfolios’ integration with existing advisor services. Accounts on the robo-advisor will display in Schwab’s desktop client management systems alongside other accounts, and data can be downloaded to use in advisors’ portfolio management systems. Schwab OpenView Gateway users can also access data from the robo accounts through third-party applications.

“One of the big advantages of the platform is all of the accounts are custodied at Schwab,” Hathi said. “This is going to feel to the advisors like a lot of their other accounts.”

Like the retail-facing Intelligent Portfolios, the institutional version does not charge clients service fees, trading commissions, or custody fees. Schwab profits from the yield spread of the cash allocation. Advisors are free to set their own management fees with clients.