Financial advisors looking for new clients won't have to open their wallets to participate in the latest lead generation platform, but they will have to share their expertise and remain patient. Called Finny, the research-turned-financial-education platform opened its user forums in November to vetted financial advisors and consultants, offering select financial professionals a free digital marketing outlet in exchange for participation as a “Coach” on the Reddit-like discussion forums.

For the right advisor it could be a perfect fit: Advisors can dispense their financial know-how in forums filled with curious users, while receiving their own profile pages to park a biography, a link to their website and even a meeting scheduling portal, via services like Calendly. For now, the service is free to financial professionals, who are vetted by Finny’s co-founders, Chihee Kim and Milan Kovacevic.

The Right Advisor

The platform has already attracted advisors' attention. So Young “Stella” Choi, a financial planner and advisor based in Orange County, Calif., signed up as one of the first Coaches on the platform. (Choi and Kim worked together at investment management firm Lattice Strategies LLC.)

A 20-year-veteran of financial services, with experience in multi-family-offices and advising high-net-worth clients, Choi is currently considering launching her own registered investment advisor and wanted to get a better sense for the financial issues facing Finny users, who tend to have earning potential but are still in their 20s and 30s. At Finny, she saw opportunity.

“Finny’s crowd is people who have financial questions but are a little intimidated to go around and ask about them. This becomes a place for them to share,” she explained. “As forum participants are evolving, starting from asking their questions and [progressing to the] conclusion that they may have to hire someone more professional … you could actually make a successful advisory business.”

There are opportunities for brand- and trust-building via the platform, as well as attracting the next generation of HNW clientele. “It’s attracting a lot of IT workers,” she said, as well as people who might inherit sizable wealth, or need an advisor for guidance on stock options and vesting.

Learning and Discussion

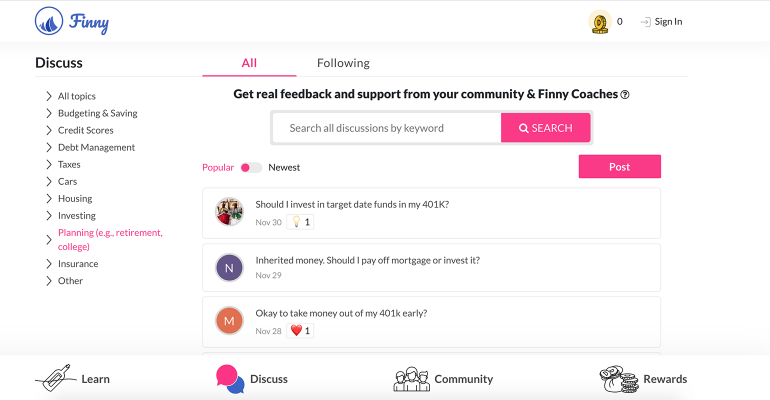

Finny began as an outlet for fund and stock research, but Kim, who spent years working at firms including Merrill Lynch and Citigroup Private Bank, and Kovacevic realized that a financial literacy service was more urgently needed. The self-funded company switched gears, setting out to create the “Duolingo for personal finance,” called Learn, a place where users could use games and quizzes to learn personal finance basics. They also added forums, called Discuss, to their site.

Finny now has around 60,000 active monthly users and a lively set of forums, according to its founders. And while it may not see forums like Bogleheads or NerdWallet as competitors, Finny has ground to cover if it wants to see massive user growth. Bogleheads has more than 750,000 registered members and more than 4 million posts, with an average of 2 million visits per month, according to the site. Although not limited to personal finance, NerdWallet saw more than 11 million visitors per month on average in 2018 and has been expanding, with its first international acquisition in 2020. Meanwhile, Reddit's Personal Finance forum has 14.2 million registered members, which doesn't account for visitors who come across the subreddit.

Calling All Advisors

But unlike websites like Reddit, which tend to be hostile to financial advisors, said Kovacevic, Finny is encouraging advisors to join its platform.

In fact, it’s giving financial advisors a special “Coach” badge, along with individual profile pages with business and calendar links. All advisors are vetted by the co-founders, said Kim, to ensure that advisors have the proper licenses and are registered with regulators. The co-founders want to see four to five “Coaches” per 100 active users, she added. Coaches are not employed by Finny but do provide “an authoritative voice.”

“If you’re a one-and-done-type advisor, this might not be the best place for you,” said Kim. “It’s a cool opportunity to become part of a company from the ground up.”

Advisors should be ready to share their badges with “cash flow consultants” and other financial literacy educators, who run budgeting and savings classes, but aren’t regulated financial advisors. Coaches with licenses, however, are encouraged to state their qualifications in their profiles.

For individual or small advisors, particularly those reluctant to compete against advisor networks, Finny could present a unique opportunity, she added. Because larger firms will most likely have trouble getting their compliance departments on board with the forum-like nature of Finny, “most likely, larger shops might stay away,” she said.

While free, Finny isn’t a place for quick lead pickups, said Choi. She likened it more to a digital version of the event circuit that advisors often attend, where an advisor will attend community functions and occasionally attract the attention of a potential client.

Passion Required

In that way, a sense of purpose is just as important as a nose for business.

“My goal is not necessarily just to get clients,” Choi said. “I want to help this particular generation.”

She isn’t the only financial professional impressed by the quality of discussions on the site. Forum participants are “professionals. They’re thinking through things,” said Vineet Prasad, an Accredited Financial Counselor and founder of Savings Academy, in San Francisco. “I’ve been really impressed by the caliber of the community so far, as opposed to some of the places like Reddit.”

As Finny "Coaches," financial professionals like Choi and Prasad co-exist, even though they have different qualifications. There’s little risk of the public confusing consultants for advisors, he said, because each professional is able to designate his or her own specialty on the Coach profile.

For advisors, he echoed Choi’s assessment. “It’s an exciting way to connect with potential customers,” he said. “The discussion piece is the most helpful for financial advisors and that’s what I’ve been most impressed by. People are hungry for answers from financial professionals.”

According to Finny's founders, the platform has the potential to become a part of workplace benefit packages. They have been in discussions with human resource benefit consultants to make Finny available to employees, opening another avenue for advisors to grow their businesses.

While Finny is free to advisors today, it might not stay that way. Should the site's "Coaches" model take off with advisors, the firm might start charging them in exchange for access to the forums.

“This is the one place of aggregation for passionate personal financial advice,” said Kim. “We want to encourage a thoughtful community.” Advisors interested in gaining access to that community should be ready to participate in it, and, should they prove successful, they could come away with the next generation of clientele.