eMoney launched its Foundational Planning solution, a simple, scaled-down financial planning tool built on the same engine that powers the firm’s Advanced Planning tools. The firm was originally aiming for a launch last month.

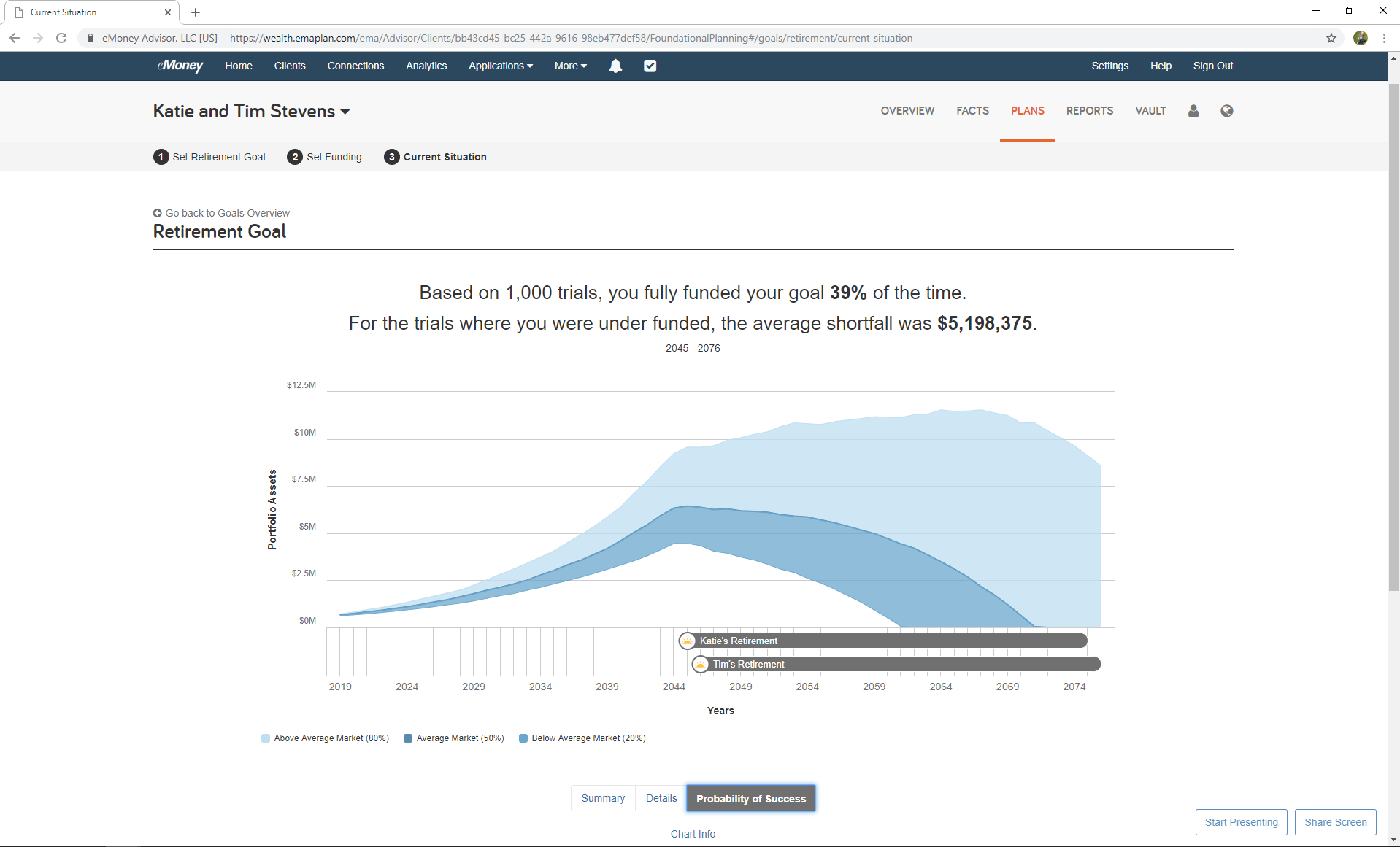

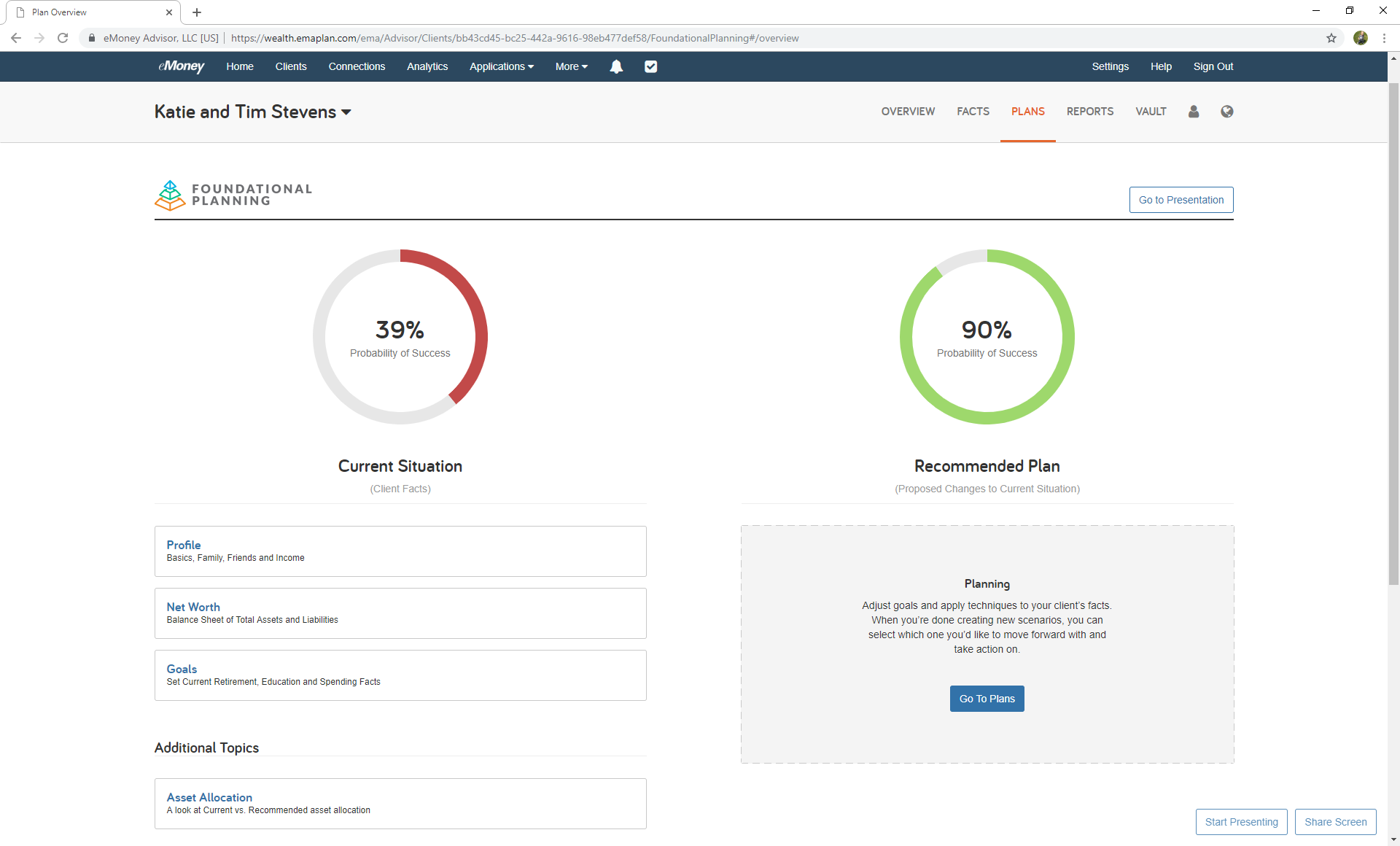

The tool’s true power lies in its concentrated workflow. Instead of capturing every nuance of a client’s financial picture, advisors using the tool will be able to focus on a handful of key inputs to provide immediate feedback on the feasibility of a proposed financial plan. Either clients or advisors can input information into the tool while engaging in a conversation about planning and do so either in office or virtually via an online session.

While the tool has plenty of sliders and customizable fields, the advisor will still be responsible for putting forth a plan that best meets the clients’ needs—giving the advisor the opportunity to demonstrate his or her planning acumen. Client goals to plan for include retirement and education, and an insurance module will be added in the coming months.

The new tool provides key benefits at two levels, said Jess Liberi, head of product at the firm. First, advisors, or staffers assisting with data collection and input, will be able to gather and add the data necessary to kick off a plan quickly, thereby increasing the scale of the planning they’re able to provide. And on another level, large institutions that often chafe at the thought of working with multiple tech vendors will be able to provide their advisors with a single vendor that can provide a spectrum of planning, from Foundational Planning’s basic offering to more-sophisticated offerings like Advanced Planning’s estate-planning tool kit.

"With Foundational Planning it is more about how we have streamlined the experience and simplified the workflow," and not about new features not found in any of eMoney's other offerings, Liberi said in reiterating the value proposition to advisors.

As of the end of 2018, eMoney serves 3.1 million end-clients across 12.7 million aggregated accounts, according to company figures. There are 2.5 million financial plans in service, provided by 57,000 eMoney subscribers.