During the pandemic, developers at Edward Jones have been busy creating multiple apps to help advisors through the “explore, connect and partner” phases of relationship building with prospects and clients.

“In preparation for building these tools we took a deep dive and mapped out the client journey in detail, speaking to thousands of clients and through feedback of advisors at hundreds of our branches,” said Ilan Davidovici, a principal leading the client experience program and CX Lab at Edward Jones. He emphasized that both the client and advisor side, or perspective, of the journey were critical to the process.

“We have some data on what phase the prospects are in,” he said referring to data collected from social media networks and other sources, “buckets if you will; data that helps in assessing where the clients are in their lives and their needs.”

The four applications include Starting Point (which is already available), Edward Jones Match, My Priorities and Webinar Hub. The latter three are starting to be rolled out this month, but it will be the end of 2021 before all 19,100 Edward Jones financial advisors will have access.

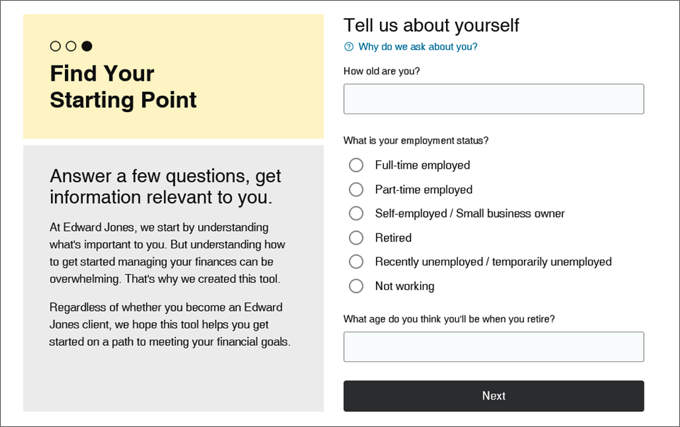

Starting Point is a self-guided digital questionnaire used to collect some basic information from prospects and, in return, provides personalized feedback to the potential client that can help them understand how a relationship with an advisor could benefit them.

“This application is where we ask the client to ‘tell us about yourself’ and where we can elicit the clients hopes and fears—not yet goals—and help the prospect in evaluating what a relationship with an advisor would be like,” he said.

Edward Jones Match takes input from the prospect and finds three advisors within the Edward Jones system that best mesh with the person’s needs based on data they provide.

“For example, a prospect can point out that they would like to work with somebody that has experience advising teachers or somebody that goes hunting or on a geographic basis,” Davidovici said. Data is then fed into an advisor matching system, which then sends the prospect information on three advisors. Those advisors in turn receive these "warm" leads and have 12 hours to a day and a half to respond, whether by email, phone or face-to-face.

“This is based on what we heard from clients and prospects in the research phase, basically ‘please reach out to me in the first day,’” Davidovici said, because it demonstrates the interest and sincerity of the advisor.

Davidovici admitted that while the Branch Webinar Hub app lacks the sexiest of names, it has nonetheless been welcomed by branches and their advisors. The tool makes available prerecorded and firm-compliant content to advisors who can in turn send it out to their prospects and clients selectively or en masse. One example provided is entitled “The CARES Act and Your Retirement Savings.”

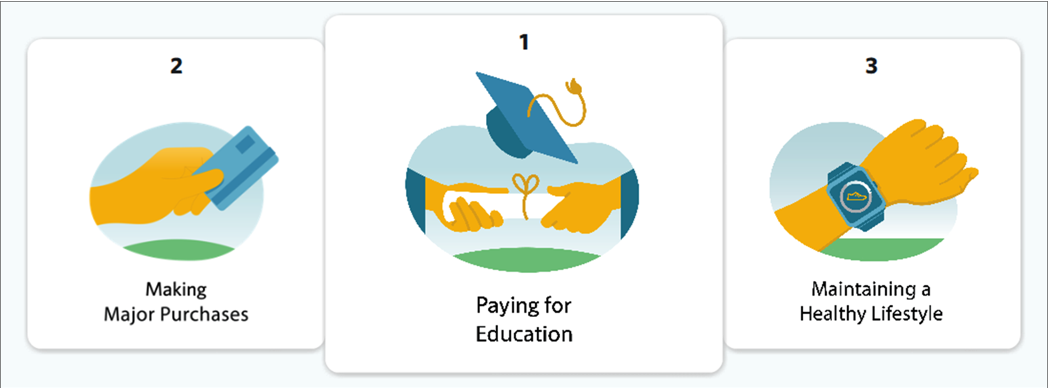

The final application is My Priorities, which is meant for new clients. It is, like the Starting Point tool, a mix of multiple choice questions and answers with the ability for clients to tailor their answers and responses. With it, clients will begin to work through their values and translate those to goals and actions.

For example, clients go through the exercise of prioritizing between “making major purchases,” “paying for education” or “maintaining a healthy lifestyle” as choices. And the intent is that the data and responses collected will help foster a useful conversation with the advisor, making the process of building a financial plan easier.

Davidovici said that the best story to come so far over the past six weeks of testing the Priorities tool was from a high-net-worth client who had never fully realized the importance of charitable giving as a part of their legacy.

“This came out in responding and prioritizing in the questionnaire—the client had never shared that with the advisor and now 25% of their portfolio has been changed into a charitable trust,” he said.

“We have already had a $4-million-relationship come in [to the firm] as a result of a client using My Priorities,” during the pilot phase, he said.

Sure, Davidovici said, these tools are about client experience and digital transformation, but really it is about helping advisors to better connect with clients.

“The closer we get to helping advisors truly understand client goals, the more likely they are to have deep and meaningful relationships with everyone in their book of business,” he said.