Singapore-based robo-advisor architect Bambu and automated investment back-end technology provider DriveWealth are looking to make a splash in the U.S. advisory market.

Today, the two firms announced a partnership and introduced a white-label advisory software product designed to automate financial planning, saving and investing for the U.S. wealth management market, one flexible enough to essentially give advisors and asset managers the means to implement their own portfolios and strategies in a bespoke robo platform.

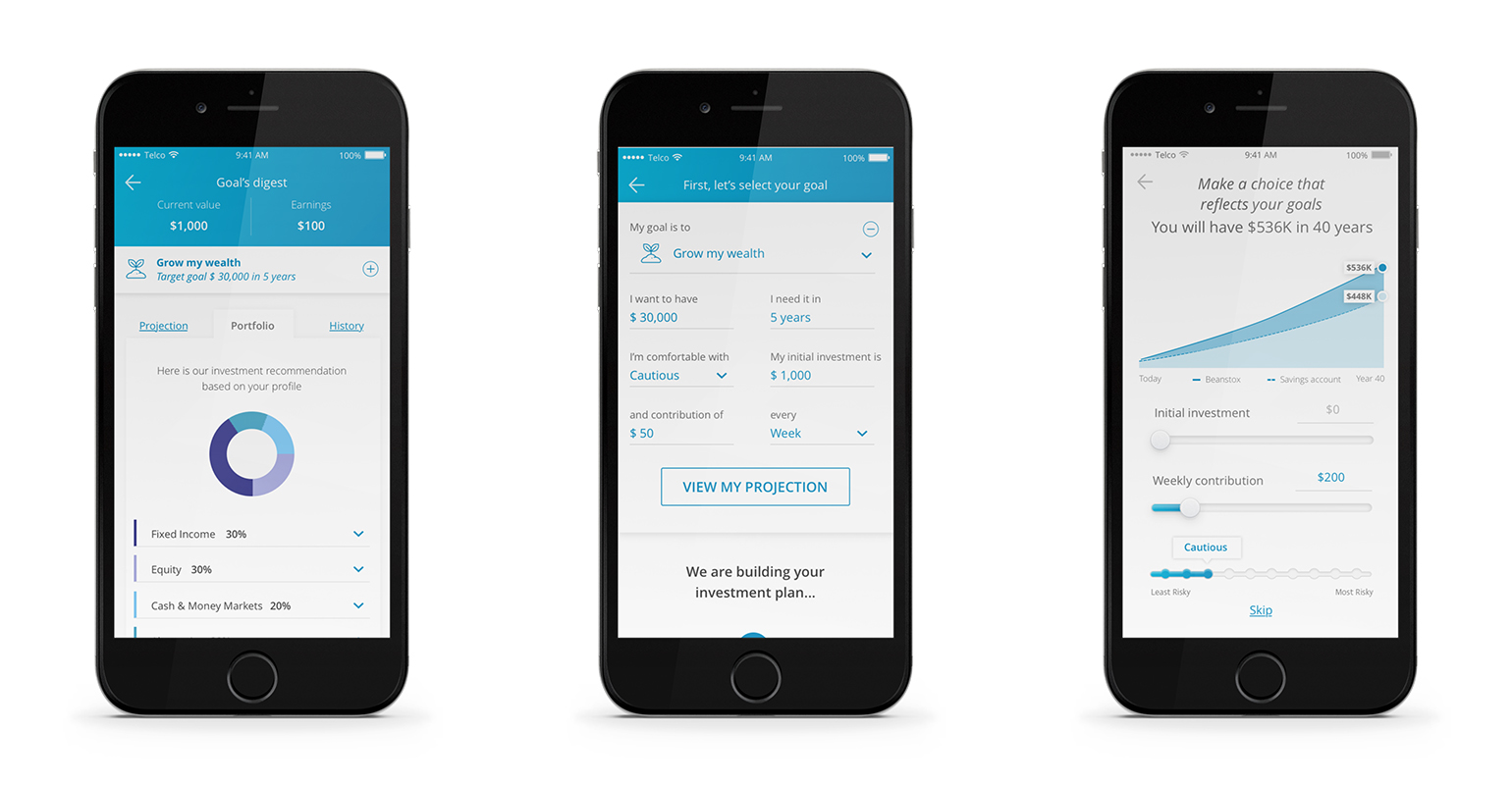

According to materials reviewed by WealthManagement.com, Bambu will provide the front end of the platform, including asset modelling, portfolio allocation, model simulations and order management, while DriveWealth will provide and run the inner workings of the tool, including account and goal funding, rebalancing and reporting.

The two companies have been in communication about a U.S.-focused partnership for 3 years, according to DriveWealth CEO Robert Cortright, having previously worked together on projects for foreign markets.

“Both of us are really B2B businesses who are supporting B2C customers or partners,” said Cortright. “We just provide, obviously, the technology to build a unique customizable product … to match their existing product.”

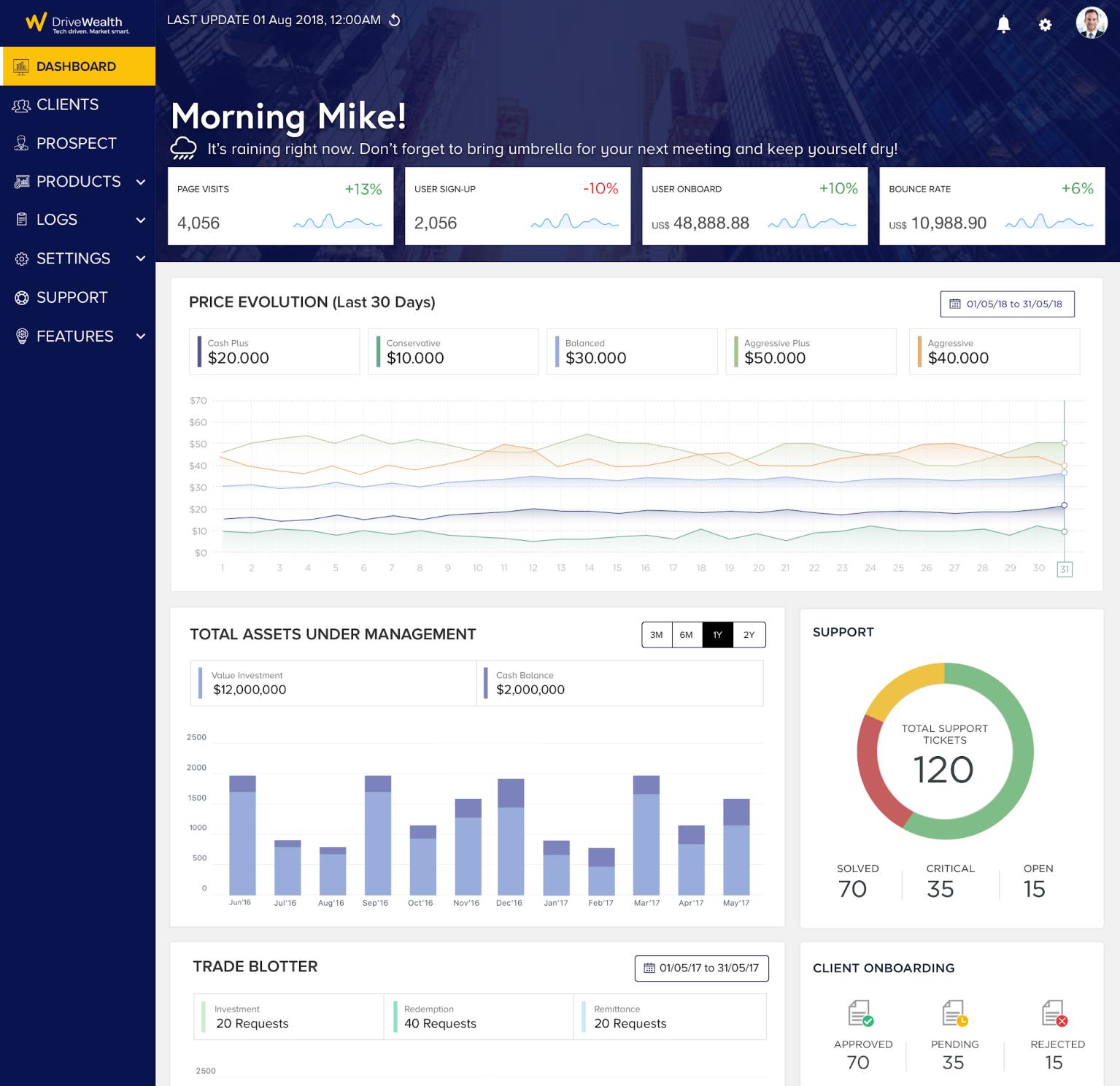

The new platform has a Bambu-provided advisor dashboard with the basics advisors have come to expect: a client overview, actionable alerts and investment tracking. There’s even a weather feature pinned to the user’s location, which reminds an advisor to bring an umbrella if it’s raining. The CIO Dashboard allows advisors to build model portfolios and simulations to implement a rebalancing routine. Clients, meanwhile, will see their investment goals and have access to live performance analysis. The platform is mobile responsive.

As a broker/dealer and technology provider, DriveWealth not only powers fractional share capabilities, allowing advisors to keep their clients fully invested, but it provides both advisors and client with market data and account funding connectivity. In fact, DriveWealth’s product is a harbinger of the future of robo-advice: its technology is built so front-end user interfaces can be swapped with DriveWealth’s back-end technology, allowing sophisticated advisors to essentially build their own robo.

“We have a lot of large fund managers that are very, very proud of the proprietary nature of their portfolios—and some are quite large. They manage 100, 250, 350 securities within their portfolio,” Cortright explained. “Now how do you get that to a client that only has a couple hundred dollars or a thousand dollars to invest?”

DriveWealth says their tool can do just that, through factional shares and technology, giving access to those managers from investors who may not have previously been able to meet minimums. “These are people that are looking more towards the younger investor, the newer generation of investors on a digital device,” said Cortright. “The old legacy clearers don’t really give that type of uniqueness to a product.”

The fintech engine also has a partnership with mobile finance platform MoneyLion, which launched a managed investment account through its Plus product late last year.