Betterment is adding funds by Dimensional Fund Advisors to Betterment for Advisors, the first mutual fund family to be added to the platform.

Registered investment advisors that use the robo allocator will be able to create and manage portfolios of DFA funds on behalf of clients and, unlike at most other custodians, will be able to do so with no transaction costs, potentially saving clients some hundreds of dollars each year.

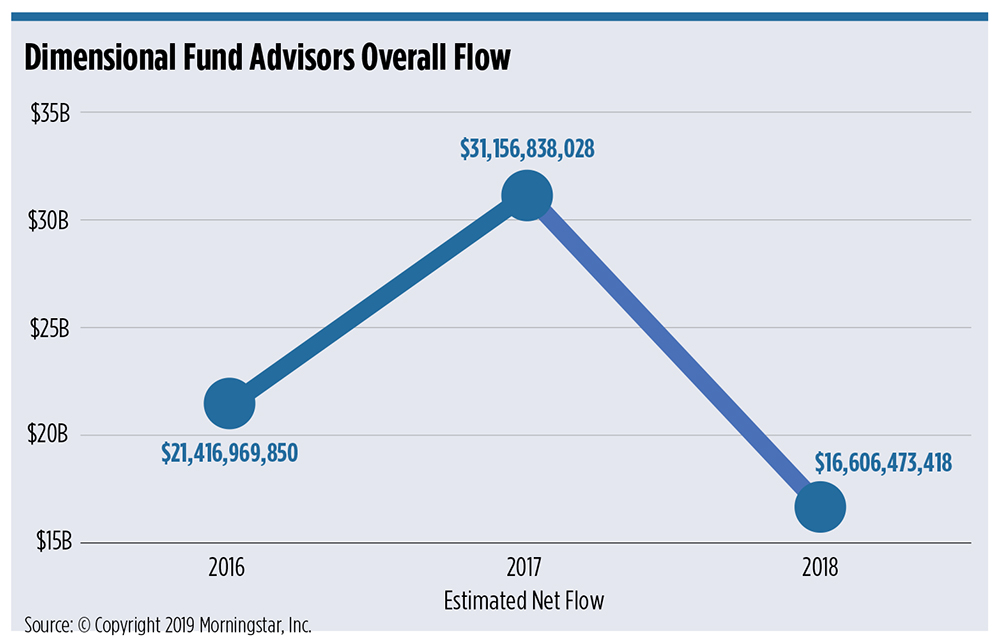

DFA funds are sold only through advisors and institutional channels. They manage $517 billion. The fund company took in $16.6 billion in net flows in 2018, down from $31.2 billion in 2017, according to data gathered by Morningstar.

Betterment and DFA have explored working together for most of the past decade, Betterment founder and CEO Jon Stein told WealthManagement.com. But the advisor platform only recently gained the ability to manage and trade portfolios of DFA funds, he said.

RIAs use Betterment for Advisors to outsource investment management using one of five strategies built by either Betterment itselt, Vanguard, Goldman Sachs or BlackRock. Portfolios of DFA mutual funds will be the sixth and are expected to be available this fall. The company does not know which specific DFA funds will be available.

Like the retail clients it serves directly, Betterment charges investors with accounts through advisors 25 basis points for assets up to $2 million and 15 basis points for assets over $2 million. Advisors can choose to tack on an additional fee of up to 1.25%.

Advisory firms pay a one-time implementation fee of $250 to use the platform, but there is no cost thereafter. Advisors can adjust clients’ allocations with no additional trading fees.

Custody and clearing firms charge RIAs to trade most mutual funds. TD Ameritrade Institutional and DFA formed a relationship in 2017 and lowered the cost to trade the asset manager’s fund to $9.99 per transaction, a spokesperson said. Schwab Advisor Services offers a reduced transaction fee for DFA funds of $25, a spokesperson said, and Fidelity Clearing & Custody Solutions charges $30 per transaction for most mutual funds, according to a fee schedule online.

Even the cost of $10 per transaction can add up quickly. At $10 per trade, a basket of four DFA mutual funds, in an account rebalanced four times, could cost a maximum of $160 per year. At $25, that same scenario might cost an advisor $400 in transaction costs. Add to that more transactions per year related to any tactical changes or tax loss harvesting activity, then multiply that cost per account by the number of clients with similar accounts and trading costs start to balloon.

Stein said that advisors, including some managing large client portfolios, have expressed interest in taking advantage of the cost savings alongside Betterment for Advisors’ account opening, automated trading and tax management.

“We have a lower cost platform, we have newer technology, better services and operations, we’re just able to service advisors more efficiently, and they are able to serve their clients more efficiently,” Stein said. “It’s actually not that much to trade. I think [transaction fees] are just an easy way to make money off advisors and advisors’ clients.”

He declined to comment specifically about how much advisors could potentially save on transaction costs.

Nevertheless, transaction fees are not the primary source of revenue for custodians, and the number of low or zero cost investment options is growing, said Russell Norwood, the founder of Austin, Texas-based Venturi Wealth Management, which manages approximately $1.1 billion.

Regulatory filings in February revealed that Social Finance Inc., the online lender better known as SoFi, is helping start two new ETFs that won’t charge management fees. Fidelity Investments launched two more zero-fee mutual funds after its first two amassed more than $1 billion in less than one month after their debut.

Trading costs are only one component of an investment decision and a small part of most firms’ expenses, Norwood said. At Venturi, he said maybe 2 basis points of the firm’s fee goes to cover trading costs. “It’s nothing. It’s really not material.”

“They make such a great point about the story of their success and the relationship with advisors and clients, and the ability to manage behavior through the ups and downs,” Stein said about DFA. “We’re not breaking with that tradition.”

Although, while there are no current plans in place, Betterment did not rule out someday offering DFA funds directly to retail investors.

“Advisors and Institutional clients have been and will continue to be our focus. We have worked with advisors for 30 years and we believe strongly in the role an independent advisor plays in working with individual investors to help them have a good investment experience. We have no plans to change this model now or in the future. Betterment for Advisors, like the other platforms we work with, will provide restrictions so only advisors who work with Dimensional will be able to access our funds on their platform,” DFA said in a statement.