Allianz Life Ventures, a subsidiary of Allianz Life, has invested in Halo Investing, a platform that provides access to structured notes, during its most recent Series B funding round. The startup, used by Dynasty Financial Partners, has raised $11 million from venture capital arms of investment managers, including an affiliate of Piton Investment Management and an affiliate of William Blair.

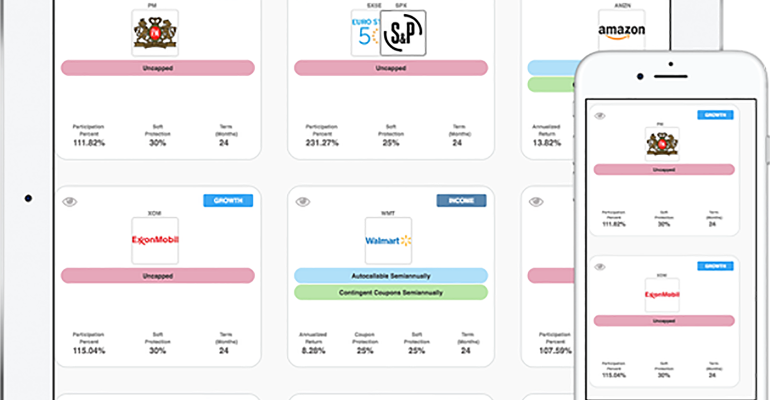

The Halo platform allows advisors to monitor structured notes for their clients, analyze trends and sell for access to secondary liquidity.

“Our goal with Halo is to bring transparency, price competition and independent liquidity to the structured note market,” said Biju Kulathakal, Halo CEO and co-founder, in a statement. “Built with the financial professional in mind, the Halo platform allows them to access products that can help protect their client’s assets and meet their financial goals.”

The company will use the latest funds to expand its operations globally and work toward changing the way structured products are manufactured, purchased and traded.

Stocks and bonds might not be enough to meet client expectations of their portfolios right now. That’s the worry on the minds of advisors—and it’s leaving room for designers and distributors of complex financial products to strike while the iron is hot.

Structured products, alternative investments and private placements are gaining traction today in a way they weren’t even a few years ago, with several structured product platforms taking off, such as SIMON Markets, a unit that Goldman Sachs recently spun off.