Firms using Envestnet | Yodlee, a leading data aggregation and data analytics platform for digital financial services, have a new tool to call upon when it comes to tracking their business metrics. Envestnet Intelligence for Financial Institutions, a new data intelligence tool, was announced Tuesday at FinovateFall 2018 in New York.

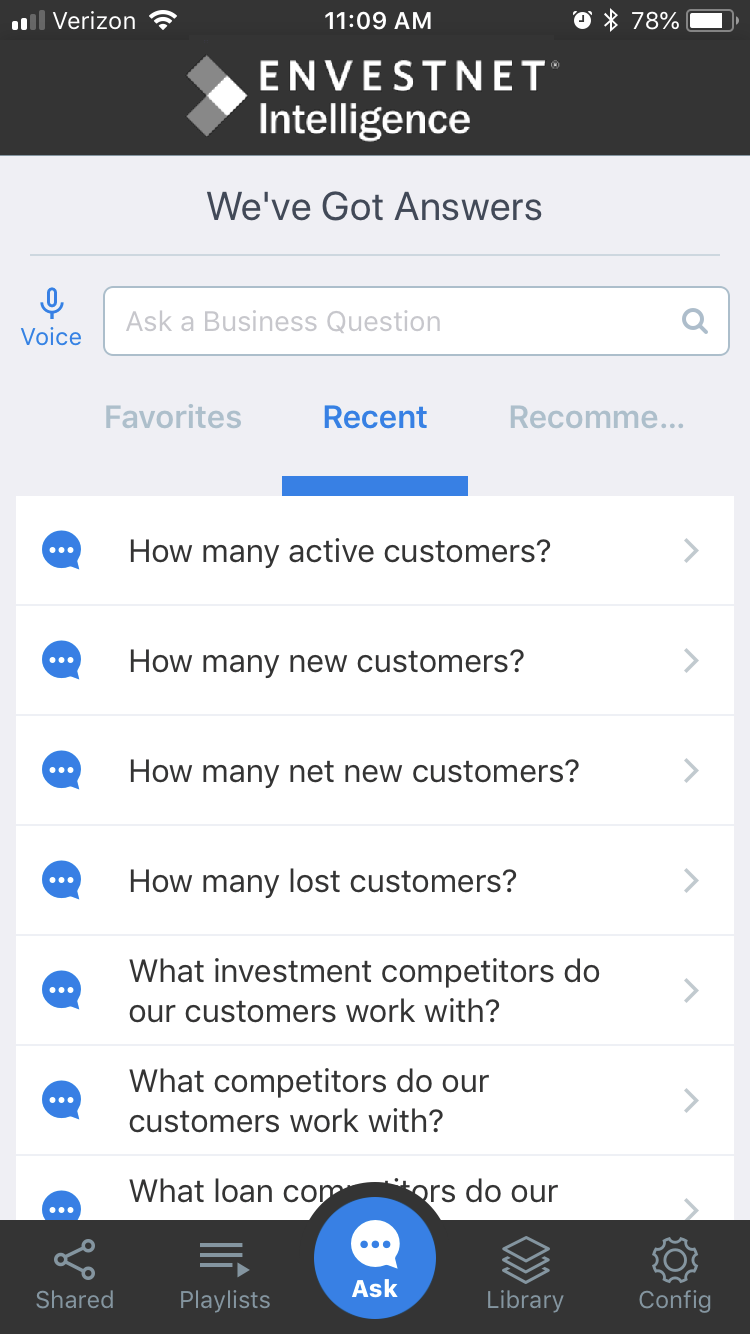

Machine learning and natural language processing—two of the most commonly employed technology subsets within the field of artificial intelligence—are being applied to the massive amounts of business data Envestnet collects from, and on behalf of, its institutional customers. A homegrown data analytics engine then powers the platform, which can be accessed from a user’s desktop, mobile and Amazon Alexa-enabled devices. It’s not the first time Envestnet has voice-enabled one of its products with Alexa; the firm added this feature to its Envision IQ product in May.

With the product, according to Envestnet, financial institutions can empower their employees to easily get answers, in real-time, to key business questions.

“We came to the realization that people just weren’t using available analytics packages enough,” said Frank Coates, executive managing director at Envestnet | Yodlee. “So we endeavored to make an application that is as easy to use as Pandora or Twitter,” he said.

Another challenge the firm faced was personalization, Coates said. Within a single organization Envestnet may be working with a dozen different groups, all of them possibly using the same data but in different ways or with different needs or within different contexts, such as core banking versus the credit department within a bank.

“We think early adopters will probably be wealth managers that meet with clients a lot or people that see customers and that are on the road a lot,” Coates said.

Three specific packages will be available under the “Intelligence” including Engagement, Advanced, and Custom.

Engagement is intended for firms to measure their customer adoption and the level of engagement when it comes to data aggregation-based offerings. Advanced will help firms to better understand their book of business, evaluate customer analytics and growth opportunities, and understand how to increase profitability and share of wallet. Finally, the Custom offering is meant to help a firm integrate both its aggregated data and proprietary data across the business (in many institutions such data has often been in silos) and provide far greater insights.

When asked about whether Intelligence would allow a financial advisor access to a clients accounts or holdings, Coates said the tool was restricted to a firm’s business data.

“Out of the box we are accessing business data; we of course use multi-factor authentication but many of our clients are not yet comfortable with providing access to customer data,” Coates said.

The offering is now available to select Envestnet | Yodlee clients and will be made generally available in the coming weeks.