Fee-for-service payments platform AdvicePay is improving its workflow support for enterprise clients in a move that continues to blur the lines between payments provider and compliance support.

The cash-flow-positive startup (according to founders Alan Moore and Michael Kitces) is adding an “Engagements” feature to its enterprise platform, according to a press release and a preview offered to WealthManagement.com. The feature is designed to make it easier to standardize custom workflows at enterprises, as they track deliverables and offer support for advisors who have fee-for-service offerings, such as financial planning.

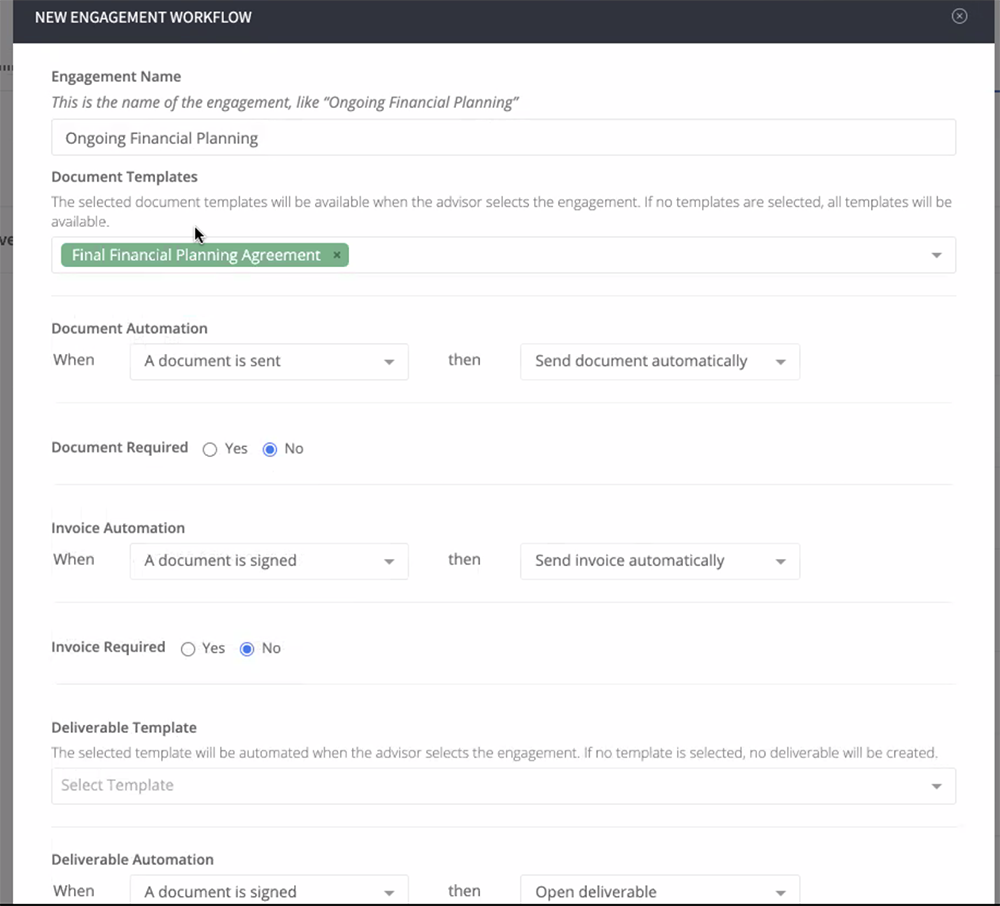

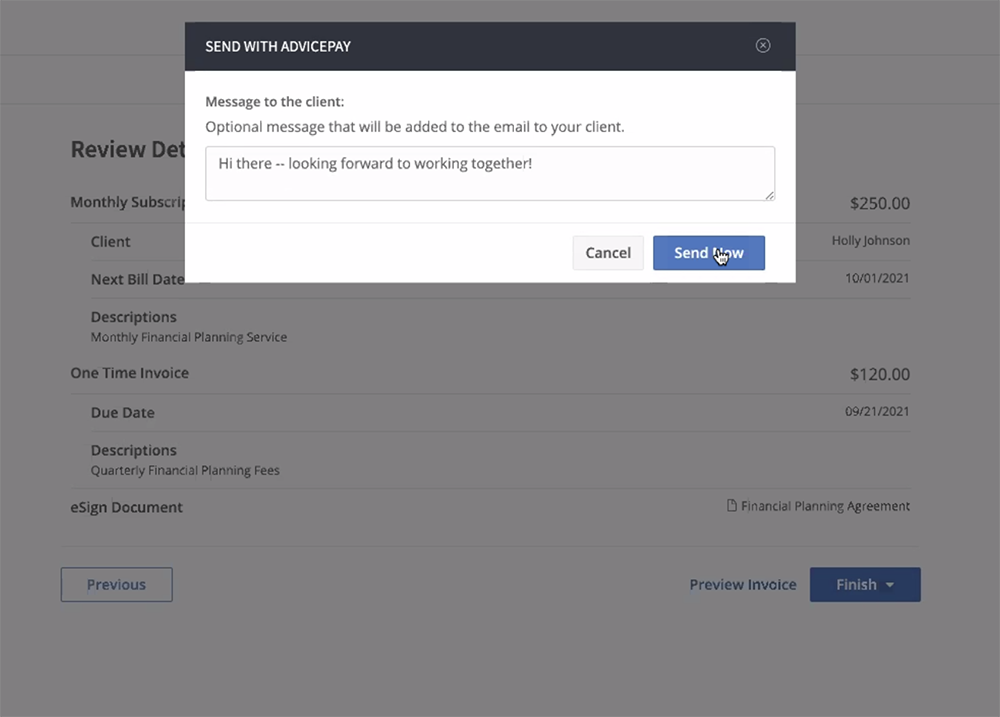

The new Engagements feature allows enterprises to add document templates, such as financial planning agreements, and set up workflows so advisors using the service can automate their invoicing. For their part, home offices can ensure that services billed by advisors are services delivered. For example, by tracking deliverables provided to clients, or that a necessary client signature has been obtained by the advisor and, in turn, results in compensation held by the home office being released to an advisor.

One of the new Engagements features on AdvicePay.

Enterprises can customize workflows to reflect their own billing practices, automating when an advisor receives compensation for services rendered.

As simple as standardizing workflows may seem, the features offered by AdvicePay are often replacing time-consuming manual processes, such as filling out dreaded spreadsheets, said Kitces. As one-off or recurring fees have grown in popularity among advisors associated with enterprise firms, those organizations have seen an increase in the need to scale their workflows. Engagements is designed to meet those demands for the 62 enterprises and more than 4,500 advisors now using the service. Early adopters of the new feature include Cetera Financial Group, Financial Services Network and Thrivent Advisor Network. Cetera is AdvicePay’s first enterprise client.

In fact, AdvicePay has seen the sometimes unenthusiastic reception of fee-for-service offerings from the past evolve into something more positive among some larger firms, said Kitces.

“Enterprises historically were an inhibitor to doing paid fee-for-service planning for consumers; not because of anything negative about financial planning, but just that they couldn't scale it enough to be profitable for the enterprise. They tended to limit their advisors from doing deep financial planning and trying to steer them toward other solutions that were available on the broker-dealers’ product shelf,” he said. “This rollout is primarily around solving the pain points enterprises have.”

“We're seeing enterprises make wholesale shifts,” he added, backed by the tech solutions offered by AdvicePay.

AdvicePay's invoicing automation feature.

Now that AdvicePay is facilitating workflows, it is also collecting data on what fees are charged, how they are charged and how enterprises are handling fee-for-service offerings. AdvicePay is beginning to turn that data into consulting opportunities, helping enterprises new to fee-for-service operations to better launch an offering, Kitces explained. “It’s actually just helping to train and teach [enterprises].”

In addition to establishing best practices for enterprise-level fee-for-service offerings, AdvicePay is able to harness data to provide advisors with better insights into how their peers are operating. Advisors doing fee-for-service advice, like providing financial planning, tend to be “some of the best advisors in the firm,” said Kitces. Enterprises want to train more of their advisors to replicate the success of those “planning-centric” advisors.

“We're now getting more inquiries from enterprises to work with them—not just consulting with the home office around how do you deploy and scale this—but actually doing advisor level training,” he said. AdvicePay can provide “hard data” on the average fees charged by advisors in the enterprise and compare that with other factors, like client retention.

By the end of the year, AdvicePay plans to make some of that anonymized data public, underscoring how fee-for-service has changed the wealth management industry, concluded Kitces. What began as a tool for individual advisors to automate billing and payment processing for hourly, subscription and retainer models has evolved as enterprises have increasingly turned to fee-for-service planning to complement the traditional services offered by their advisors.