Several trends rose to the surface as Wealth Management’s annual advisor technology survey results were being analyzed. Prominent among these was how advisors feel about the increasing client demand for improved digital services and the race for firms to catch up with industry leaders. We predict that over the next 12 months, advisors will face an unrelenting demand from their clients for high-touch, personalized and ever more sophisticated (yet simple to use) digital solutions. At the same time, advisors will continue to struggle to find the necessary understanding and support needed internally, from a return on investment and business perspective, to justify investment in solutions to meet these needs.

Top Four Trends

- The Myth of the Non-Digital Boomer

- RIAs Slow to Implement Digital but Rapidly Catching Up

- Not all of your problems are your vendors. It could be hidden in the rollout.

- Social client engagement is more than just marketing.

In case you hadn’t noticed, the days when competition was limited to other wealth firms is gone. Advisors now compete against expectations set by players outside our industry. Called “liquid expectations,” clients expect their wealth management experience to be as predictive, digital and effortless as that provided to the consumer mass market by Facebook, Amazon, Apple, Netflix and Google, or FAANG by Wall Street. This year’s report, in partnership with F2 Strategy—a boutique wealth management tech and marketing firm—dives into the top four trends we found in the data that advisors should consider addressing as priorities if they’re not already doing so.

A Taste of What’s to Come

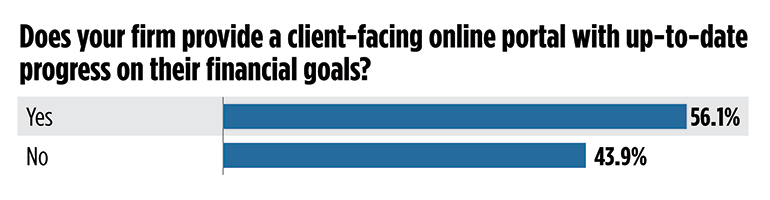

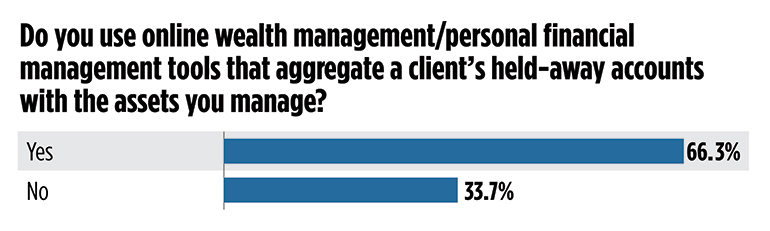

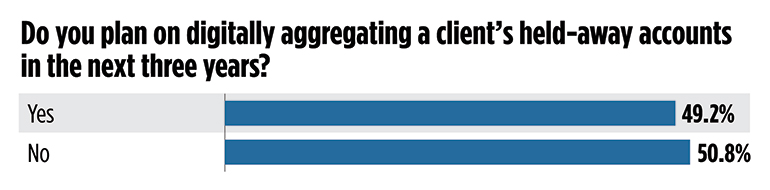

We found that 88 percent of clients have access to an online portal that has up-to-date portfolio performance, holdings and transactions. However, only 56 percent of firms are providing up-to-date data on progress toward their clients’ goals—a full 44 percent of firms are not doing so. In addition, while 66 percent of advisors reported that they were using tools that aggregate their clients’ held away account assets, a third of advisors were not. Among the remaining third of advisors not aggregating client data, only 49 percent plan to add this to their practice in the next 3 years; 51 percent do not plan to add account aggregation. How can advisors provide truly holistic financial advice if they’re only getting data on part of a client’s holdings?

Also, consider that over half of those firms are relying on client portals provided by their custodian or broker/dealer. Only 42 percent of advisors are using a third-party client portal offering, only a handful of which roll out improvements and features at what could be described as on a steady clip.

These results, considered in isolation, are probably not that surprising. Consider them in light of developments among business-to-consumer digital investment services like Wealthfront, Personal Capital, and upstart CinchFinancial, all of which are baking real-time tracking of progress toward financial goals and account aggregation into their core digital offerings—and this lack becomes more troubling.

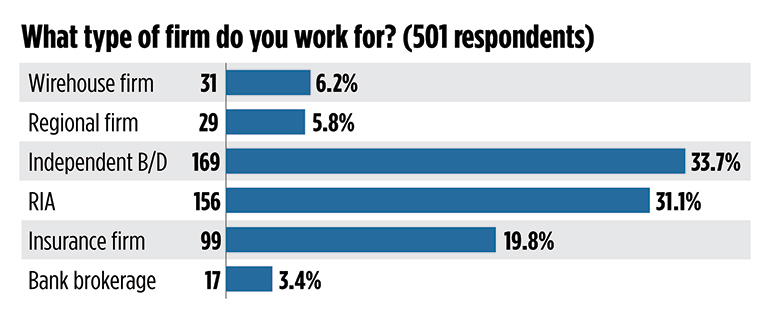

In our survey, which had 500 respondents, we took a deep dive asking advisors 217 questions about their technology and levels of satisfaction with it. A third of respondents worked with independent b/ds, a third were registered investment advisors, 20 percent worked with an insurance firm and 12 percent were wirehouse or regional brokers.

In our first installment. we will break down the Myth of the Non-Digital Boomer and how we may be totally wrong when it comes to the digital expectations and technology desires of our aging client segments.

Doug Fritz, CEO of F2 Strategy, will share his extensive tech expertise over the coming months, interpreting these survey results in a series of guest columns on wealthmanagement.com. In these pieces he will debunk common myths in the RIA, wealth management and family office space and share the data-backed reality of what clients actually want—and tangible ways to get your firm’s digital strategy on track.