Wealth management and data aggregation platform provider Addepar today announced the launch of its Investor Sentiment Index.

Addepar CEO Eric Poirier said this was the first of what he expected to be many new data-related offshoots to be derived from the firm’s anonymized client data.

“Our intention with this first data analytics project we are launching is to provide a broad brush view using data driven insights, this time strictly using equity data and we think it is the first index of its type being generated from portfolio data,” said Poirier, noting most such indexes are created from survey data.

“We have captured some super interesting data from our clients that we have normalized and validated and preserved the sensitivity of," Poirier said. "It has provided us a unique view, in aggregate, of what these large portfolios are doing."

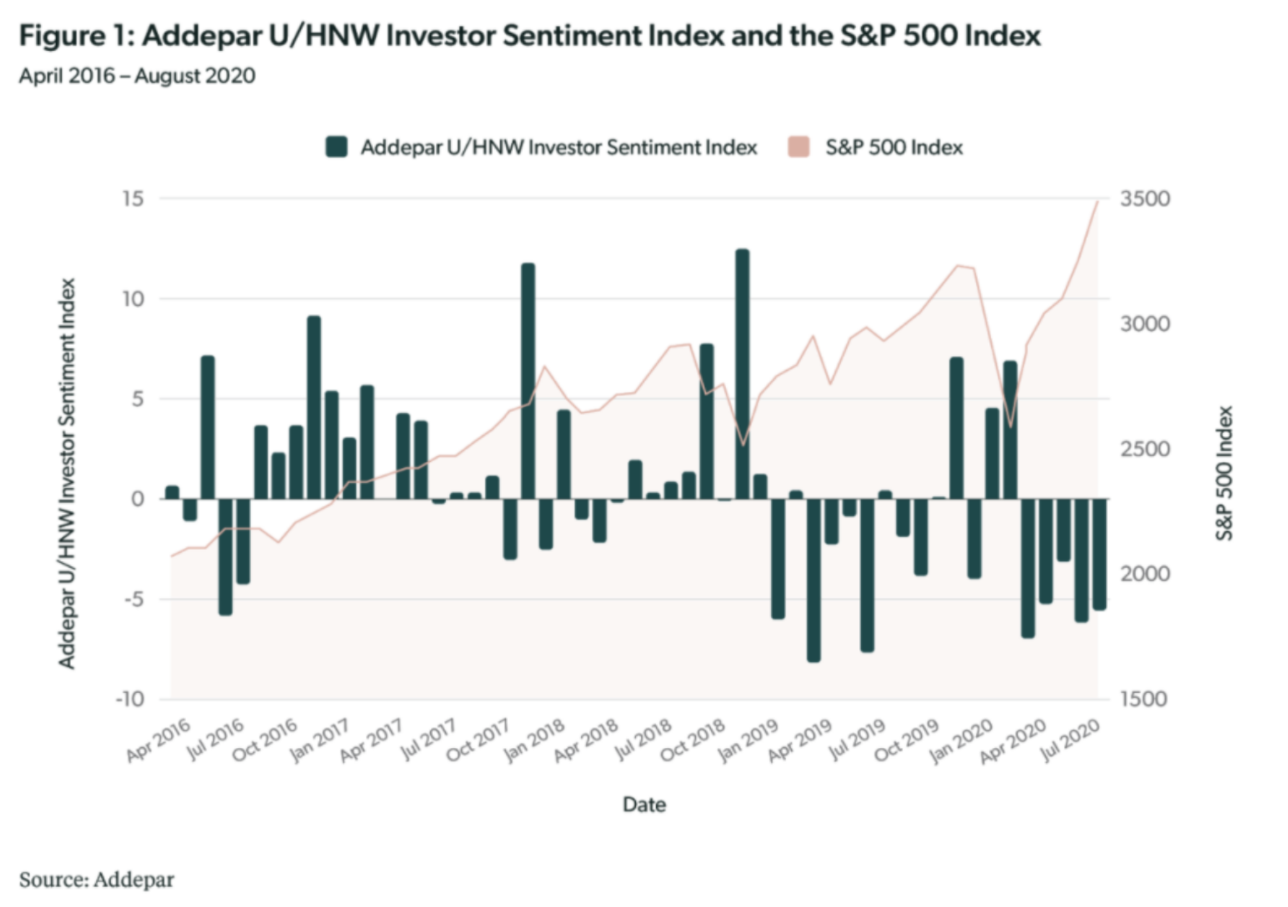

Data being shared in the Investor Sentiment Index shows a comparison of Addepar client activity with the S&P 500 index between April 2016 and July 2020.

In a nutshell, the data indicates that Addepar’s “sophisticated investors” are contrarian—since April of this year the firm’s cohort of indexed clients have been “consistent net sellers of U.S. equities, while markets have continued to rally.”

The index has been created using anonymized transaction data from the firm’s ultra- and high-net-worth investor clients captured on its platform. Specifically, the index is calculated from data recorded during the buying and selling of U.S. equities as tracked across more than 10,000 portfolios on the Addepar platform. The single number is derived by taking the percentage of portfolios buying U.S. equities minus the percentage of portfolios selling U.S. equities. The owners of those portfolios each have more than $10 million in total assets.

Advisors not using the Addepar platform should understand that while the index is available on a daily basis to the firm’s clients, it will be shared to the general public only on a monthly basis via the company’s blog.

In August, Addepar hit $2 trillion in assets on its platform.