There is still some controversy over whether or not Albert Einstein can be credited with saying, “Compound interest is the most powerful force in the universe.” But there is much less controversy surrounding the actual benefit that compound interest has on a portfolio over time.

Your clients are likely aware of another force that can have a powerful impact on a portfolio in a less desirable way: taxes. Have you considered the impact that taxes can have on a portfolio’s ability to compound returns?

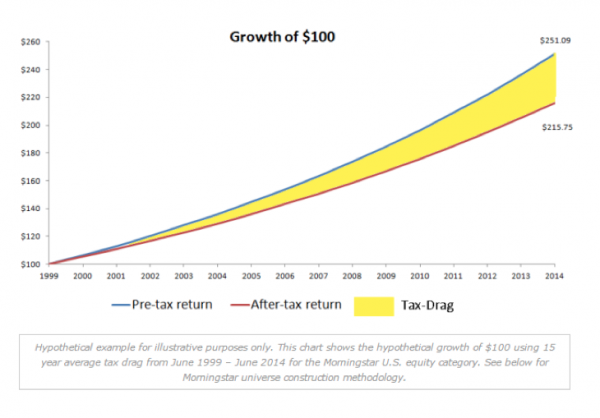

It’s fairly simple: by reducing the tax drag (the amount of wealth lost to taxes) on a portfolio, the portfolio is left with a larger asset base, which benefits over time from the compounding of returns. Coupled with a long investment horizon, this reduction in tax drag can create significant improvements in total wealth.

For the 15 years ending June 2014, the average fund in the Morningstar U.S. equity category* gave up 1.03% of its return to taxes annually. The compounding effect of 1.03% average annual tax drag over 15 years represents a 16.4% return degradation.

The good news is that a portfolio’s tax drag can be reduced using various active management techniques – such as tax lot swapping, tax loss harvesting and managing holding period. You may already be employing such strategies for many of your high net worth clients or those who request tax-managed strategies. But have you considered how much value compounding could contribute if you proactively identified clients for whom tax-aware investment strategies may be appropriate early? The earlier you can discern their suitability and place their taxable assets into tax-managed products, if that is an appropriate course of action, the greater the impact of a reduction in tax drag can have. What might these clients look like? Often they are already well-funded or headed towards being well-funded for retirement having maxed out their qualified contributions.

Of course, avoiding taxes or even minimizing taxes shouldn’t be an investment goal unto itself. In the end, it all goes back to helping maximize your clients’ after-tax wealth. But what’s good for your clients may also be good for your business. A client with higher after-tax wealth can potentially mean higher revenue for you over the lifetime of that relationship.

The reduction of tax drag on a portfolio can potentially have a meaningful impact on your clients’ total after-tax wealth thanks to the power of compounding over time.

Start today by identifying clients for whom a tax-aware investing solution may be suitable. Then have the conversation with them about the importance of tax management and the difference that acting now versus delaying the decision may have on their wealth in the long run.

Todd LaFountaine is program director, capital market insights at Russell Investments. To see this post in its original form, with more information and full disclosures, visit Russell's Helping Advisors blog.