China’s GDP growth rate has long been a focus for many investors. But a closer look suggests that this headline number is not always a reliable barometer of potential opportunities in China’s corporate debt market.

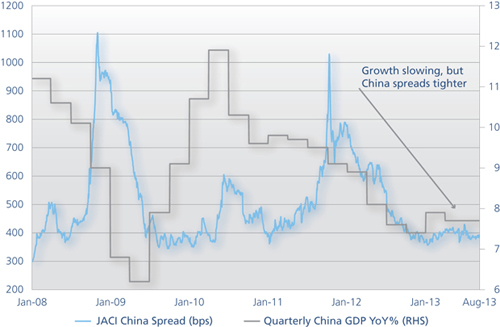

As the display below indicates, there is generally not a strong or intuitive correlation between Chinese growth and Chinese corporate credit spreads. From 2011 to early 2013, these credit spreads continued tightening as the country’s GDP growth slowed—essentially the opposite of what you might expect in a deteriorating growth environment.

In the past two years, strong technical forces and a search for yield have been additional key influences. Another is the evolving mix/drivers of the Chinese economy. Indeed, our team believes that the underlying drivers of growth are more important to our investment decisions than the headline GDP growth number alone.

Consider the Chinese property sector, which represents 33% of the country’s USD corporate debt market. Despite slowing growth and media attention on concerns about a property bubble and restrictive policies, property sales have and continue to be resilient. In fact, Chinese property has been one of the best-performing sectors in Asian corporate debt over the past year...

But even as property sales have been strong, this has not translated into equally robust construction demand as property developers have looked to clear their inventory as well as adopt a more conservative growth strategy.

The implications are mixed for Chinese corporates. On the one hand, a conservative growth strategy has led to an improving credit profile for property developers, but weaker construction demand has contributed to disappointing earnings for other companies reliant on demand for construction materials such as steel and cement.

In analyzing the Chinese market, we make a few additional observations:

- Despite slower GDP headline growth, housing demand has been strong given a high household savings rate, selective policy easing and rising wages.

- High level policy rhetoric does not always translate into uniform implementation across the board. On-the-ground implementation of policies can vary regionally, and has been reactive to local economic and social conditions. For instance, in Beijing and Shanghai, real estate purchase restriction measures are much more tightly enforced than in many other cities due to more speculative demand from non-locals.

- Demand in the Chinese property market can vary across different regions and market segments, and we simply cannot generalize or extrapolate from past trends. For example, in 2010, property sales volume in Shanghai dropped 39% while nationally it grew 10%. Year-to-date through July, sales in Shanghai are up 32% versus 26% nationally.

Taking a broader view, Asian growth is moderating, largely driven by higher global interest rates, weaker investment and commodity demand. More positively, household balance sheets remain strong and the outlook for exports is improving. We see opportunities in sectors that benefit from a developed-market upswing or household demand. But we are more selective on sectors that are leveraged to the capital investment cycle.

In our view, investing in Emerging Markets Debt requires both a solid understanding of the macro economy and an appreciation of the granularity and dynamism of the underlying drivers which contribute to growth. Having individuals on the ground who speak local languages and can observe developments first hand is key in seeking success in this important and growing marketplace.

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees and advisory clients may hold positions of companies within any sectors discussed. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. Neuberger Berman products and services may not be available in all jurisdictions or to all client types. This material may include estimates, outlooks, projections and other "forward-looking statements." Due to a variety of factors, actual events may differ significantly from those presented. Investing entails risks, including possible loss of principal. Indexes are unmanaged and are not available for direct investment. Past performance is no guarantee of future results.

This material has been issued for use by the following entities; in the U.S. and Canada by Neuberger Berman LLC, a U.S. registered investment advisor and broker-dealer and member FINRA/SIPC; in Europe, Latin America and the Middle East by Neuberger Berman Europe Limited, which is authorised and regulated by the UK Financial Conduct Authority and is registered in England and Wales, Lansdowne House, 57 Berkeley Square, London, W1J 6ER; in Australia by Neuberger Berman Australia Pty Ltd (ACN 146 033 801, AFS Licence No. 391401), which is licensed and regulated by the Australian Securities and Investments Commission to deal in, and to provide financial product advice for, certain financial products to wholesale clients; in Hong Kong by Neuberger Berman Asia Limited, which is licensed and regulated by the Hong Kong Securities and Futures Commission; in Singapore by Neuberger Berman Singapore Pte. Limited (Company No. 200821844K), which currently operates under an exemption from licensing under the Financial Advisers Act (Chapter 110) of Singapore for marketing of collective investment schemes to institutional investors; in Taiwan by Neuberger Berman Taiwan Limited, which is licensed and regulated by the Financial Services Commission ("FSC") to deal with specific professional investors or financial institutions for internal use only, and which is a separate entity and independently operated business, with SFB operating licence no.:(101) FSC SICE no.008, and address at: 11F, No. 1, Songzhi Road, Taipei, Telephone number: (02) 87292308; and in Japan and Korea by Neuberger Berman East Asia Limited, which is authorized and regulated by the Financial Services Agency of Japan and the Financial Services Commission of Republic of Korea, respectively (please visit https://www.nb.com/Japan/risk.html for additional disclosure items required under the Financial Instruments and Exchange Act of Japan). Except for the foregoing, this material is not intended for use or distribution within or aimed at the residents of any other country or jurisdiction. This document is not an advertisement and is not intended for public use or additional distribution in the following jurisdictions: Brunei, Thailand, Malaysia and China.

The "Neuberger Berman" name and logo are registered service marks of Neuberger Berman Group LLC.

© 2013 Neuberger Berman LLC. All rights reserved.