High-net-worth taxpayers have used individual retirement accounts and qualified retirement benefits effectively over the last several decades. While these deferred benefits have been subject to income and estate taxation, the ability to stretch payments to beneficiaries over decades was a very powerful planning benefit. But the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 eliminated the lifetime stretch provision for inherited qualified plans by non-spousal beneficiaries. Life insurance will allow plan participants to preserve and relocate plan assets in a tax-efficient manner for future generations.

SECURE Act

The SECURE Act was signed into law on Dec. 20, 2019 by President Donald Trump. The bill includes significant provisions aimed at increasing access to tax-advantaged accounts and preventing older Americans from outliving their assets. The SECURE Act brings significant changes to retirement planning, with heightened concern by individuals surrounding the removal of the stretch provision. Specifically, the SECURE Act instituted a 10-year payout requirement for qualified retirement plans (for example, traditional IRAs, Roth IRAs, and Internal Revenue Code Section 401(k) and 403(b) plans) inherited by a non-spouse beneficiary.

What does this really mean? Previously, if an individual held a qualified retirement plan like an IRA and died, and this IRA went to a beneficiary that wasn’t his spouse, like his adult children, the IRA distributions could be stretched over the lifetime of that beneficiary. There was an opportunity for growth of the assets within a tax-deferred vehicle, and there wasn’t an immediate payout that would result in a large tax liability for the beneficiary. The new law states that for all non-spouse beneficiaries, distributions are required to be paid out over 10 years (not their lifetime). Additionally, there is no mandate in the SECURE Act that withdrawals are required to be taken every year over the 10 years, but it must be fully withdrawn by the 10th year. This results in a large tax liability, especially if the plan held a significant amount of savings. It also takes away the opportunity for growth of the assets over their lifetime. If the beneficiaries are minor children, the required IRA distributions can be stretched to the age of majority, and then a 10-year payout is required.

Replacing Lost Deferral Benefits

The below case study discusses the use of life insurance to replace lost deferral benefits as a result of the SECURE Act. This demonstrates how life insurance can allow plan participants to preserve and relocate plan assets in a tax efficient manner for future generations.

Background. Mary is a 60-year-old senior partner at a national CPA firm. She’s a widow and has one adult 30-year-old son, Chris. Chris is a photographer and has a limited income. He’s married with four children, all under the age of 10. Mary, Chris and his family are residents of Texas. Mary has $5 million in an IRA account that she inherited from her deceased husband. She also has a non-qualified plan valued at $4 million, and she has $6 million in outside investments. Mary feels secure with the combination of her assets and believes that she has more than enough assets to retire comfortably.

Goals and Issues. During a review of her financial situation and her retirement plans with her financial advisor, John, Mary told John she wouldn’t need access to the qualified plan assets before her death. She wants her IRA to go to Chris at her death. John informed Mary about the SECURE Act and how a change in the law could adversely impact Chris and his family. Mary is concerned about the Act’s removal of the IRA stretch provisions, which will require a 10-year payout requirement for her son. John explains the loss of income Chris would have earned if the assets in the IRA could have continued to grow and compound after Mary’s death.

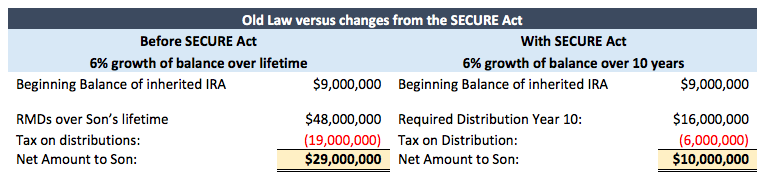

Before the implementation of the SECURE Act, Chris could have had 30+ years of payments spread over his life expectancy with the investment returns on the funds that remain in the IRA protected from income taxes. This is a substantial loss in the amount of income he could have taken from the IRA if the lifetime stretch wasn’t eliminated. In addition, depending on Chris’ state of residence, the IRA assets may not be protected from creditors because it’s an inherited IRA. John illustrated the impact of the new act to Mary with the below chart, with a projected loss of growth of over $19 million due to the new Act:

Recommendation. Mary wants a more efficient way to handle the IRA assets, and John suggests she review options using life insurance as a way of preserving the lost value of the earnings for Chris at the time of her death. Life insurance proceeds are paid income tax free to the beneficiary, and Mary could also keep the proceeds out of her estate for transfer tax purposes. Chris would receive the death benefit, which doesn’t result in an income tax liability.

John recommends Mary obtain a life insurance policy for $12 million and pay premiums over 10 years. That will provide a guaranteed death benefit to Chris. John recommends Mary take distributions from her qualified plans to pay the premiums for the policy. To protect the life insurance assets from estate taxation, Mary purchases the life insurance in an irrevocable life insurance trust. She uses her annual exclusion plus her unified credit to avoid gift taxes when she pays the premium for the policy held by the trust. Although Mary would pay income taxes on the distributions to pay the premium payments, because Mary is over 59 1/2, she wouldn’t be subject to the 10% penalty on distributions from her qualified plans. If she were to die, Chris would receive the death benefit, which doesn’t result in a tax obligation. This also allows financial flexibility for Chris.

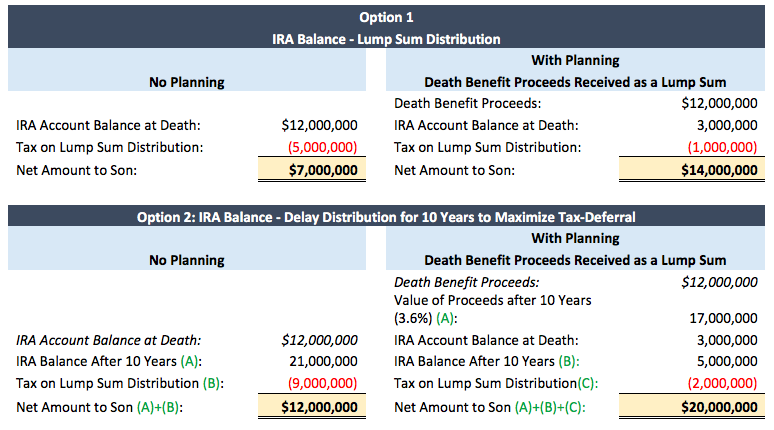

Example 1: After 10 Years, Mary passes away. What options does Chris have?

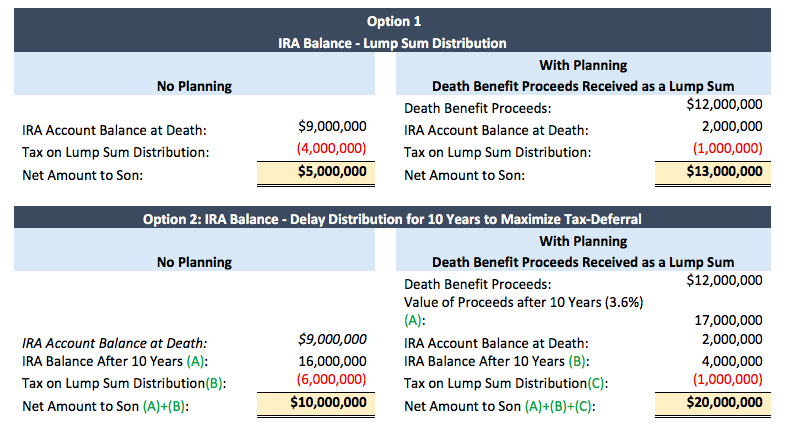

Example 2: After 25 Years, Mary passes away. What options does Chris have?