The Department of Labor allows plan sponsors to use balanced funds, managed accounts and target-date funds (TDFs) for their plans’ qualified default investment alternative (QDIA). TDFs are overwhelmingly the preferred option, however. The Willis Towers Watson 2017 U.S. Defined Contribution Plan Sponsor Survey found 93% of plans were using TDFs for the QDIA. Results from Vanguard’s How America Saves 2018 survey found similar results for 2017, with 96% of plans that designated a QDIA using a target date fund.

Balanced funds and managed accounts trailed far behind. Vanguard reports that just 4% of participants used a single risk-based, balanced fund. Only 3% of participants used managed accounts—although 30% of plans offered them and 55% of participants had access to them.

TDFs are particularly well-suited for younger plan participants. The funds’ low costs and typical focus on long-term growth works well for a younger cohort with long time horizons. In contrast, older participants often have more-complex finances and can benefit from more-personalized managed portfolios and advice. For older participants, managed accounts’ added value can justify their higher fees.

TDF to Managed

But might it be possible to combine the best elements of the QDIA alternatives in a hybrid approach, such as a TDF for younger participants that transitions seamlessly to a managed account as retirement approaches? A recent white paper from Jason Shapiro, CFA, director, investments with Willis Towers Watson, QDIA Evolutions—Moving Defined Contribution Plans Into the Future, makes the case that hybrid QDIAs merit consideration in the search for sustainable retirement income.

Shapiro observes the most commonly cited hybrid model uses this transition model with sponsors determining the criteria for the TDF-to-managed transition. “We’re starting to see not only sponsors think about this, but recordkeepers and administrators are starting to acknowledge and tout their capabilities to administer something like this,” he says. “You are seeing some of the large institutional recordkeepers say yes, we can support a hybrid QDIA option for a sponsor that would want to consider it.”

Unwrapping TDFs

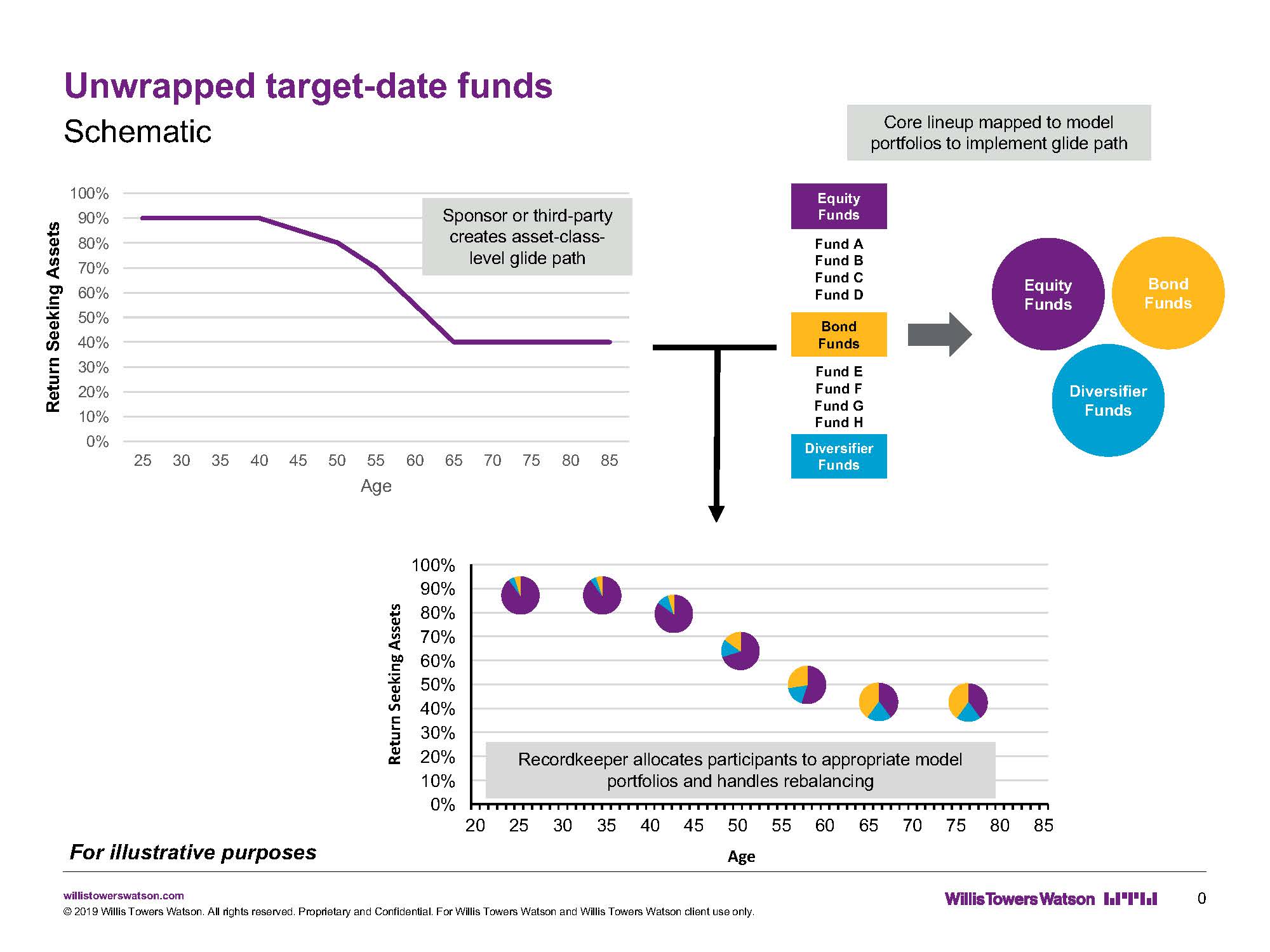

Another hybrid approach the paper discusses is unwrapped TDFs. Shapiro describes these vehicles as the marriage of traditional custom target date funds and model portfolio services. The sponsor or a third party creates a customized, asset-class-level glide path for the plan. This customization can account for factors unique to the plan and its participants, including the presence of a defined benefit plan, participant demographics and behaviors, and the sponsor’s investment beliefs.

At this stage, some larger plans develop and unitize custom TDFs, but that step’s costs can be prohibitive for midsized and smaller plans. In contrast, an unwrapped TDF is easier and less costly to create and administer because the plan directs the administrator on allocations and rebalancing within the core fund lineup. In other words, the core lineup is mapped to the model portfolios on the model glide path. (See the schematic for an example.)

“For example, let’s just say the plan offered two equity options, a growth option and a value option, and for simplicity you wanted your equity fund to be an even split, a 50/50 allocation to each,” says Shapiro. “Instead of creating a wraparound to create that equity fund, you can direct the administrator to say any equity allocation should allocate 50% to Fund A, 50% to Fund B and you could give direction on rebalancing. You could do the same thing for the fixed income side and any other exposures that are available within the plan, combine that all and apply it to the glide path that you’ve built.” The result is the same output as a custom target date fund but without unitization, Shapiro adds, so it becomes potentially implementable for plans of all sizes.

The Ultimate Goal

Considering hybrid QDIA structures’ evolution is more than just a thought exercise, though. The paper notes the DC plans have become the primary retirement plan for many American workers, and the plans’ role in generating sustainable retirement incomes has taken on added importance. Workable income solutions involve more than just offering participants annuities, Shapiro cautions, and the paper offers suggestions for integrating income sources while accommodating multiple components in hybrid arrangements.

“It’s thinking about everything that’s out there in the market and how those might play a role in combined contribution, in-plan, out-of-plan, guaranteed, nonguaranteed—all may have a place,” he explains. “In the paper, we gave illustrative components that were not meant to be prescriptive just to get sponsors thinking about how some of those might be aligned with their beliefs and what they might like to offer their participants. …The idea is to facilitate that conversation.”