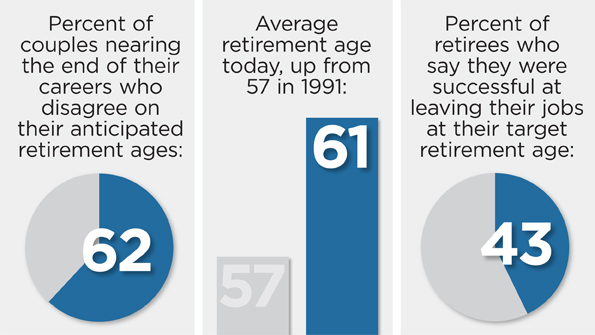

Percent of couples nearing the end of their careers who disagree on their anticipated retirement ages: 62

Average retirement age today, up from 57 in 1991: 61

Percent of retirees who say they were successful at leaving their jobs at their target retirement age: 43

Maximum annual Social Security benefits for those retiring at age 66: $30,396

Average annual Social Security payment received by retired individuals and married couples, respectively: $14,748; $23,928

The poverty threshold set by the U.S. Census Bureau for individuals and married couples over 65 years, respectively: $10,788; $13,610

Amount (matched by employer) the average earner will pay into Social Security this year: $2,522

The taxable maximum the Social Security Act of 1935 set as the income subject to Social Security taxes: $3,000

The taxable maximum for 2013 earnings: $113,700

Factor by which the inflation-adjusted “wage threshold” has been increased between 1950 and 2012: 3.8

Percent of an average wage earner’s post-retirement income represented by Social Security payments: 40

Percent of elderly married Social Security beneficiaries in 2011 whose payments represented 90 percent or more of their income: 23

The income Social Security was to receive from every dollar it spent as predicted by the 2008 Trustees Report: $1.31

The actual figure it received from every dollar spent: $1.09

Average period life expectancy (the number of post-retirement years collecting benefits) for a 65-year-old male in 1940: 11.9

Ratio of workers to retirees in 1935: 40 to 1

The ratio today: 2.9 to 1

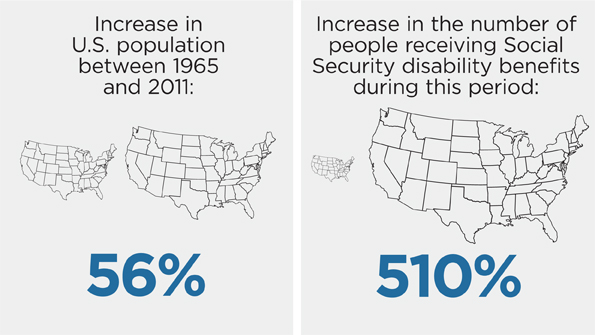

Increase in U.S. population between 1965 and 2011: 56 percent

Increase in the number of people receiving Social Security disability benefits during this period: 510 percent

Percent of Social Security administrative costs relative to total benefits paid in 2011: 0.87 percent