There’s no better way to improve the odds of achieving a secure retirement than working longer. Research shows that most of your clients plan to implement that strategy - many through a “phased retirement” involving continued work with reduced hours. Just one problem: many employers aren’t on board.

Two-thirds of baby boomer workers envision a phased transition into retirement, shifting to a reduced schedule or doing less demanding work, according to a survey of employers and workers released late last year by the Transamerica Center for Retirement Studies. Just 21 percent said they expect to immediately stop working when they retire.

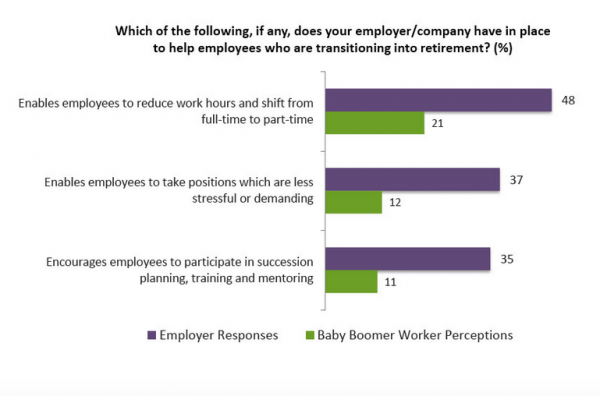

But only 48 percent of employers offer phased retirement options, the study found, and only 37 percent make it possible for workers to shift to positions that are less stressful or demanding (see chart).

Research by Kevin E. Cahill, a research economist at Boston College's Sloan Center on Aging and Work, confirms employer disinterest in phased retirement, which he defines as either reduction in hours with a current employer, a “bridge” job with a new employer following career employment, or re-entry to the workforce by a retiree. And the Society for Human Resource Management says just 11 percent of employers provide some version of phased retirement, with only 4 percent having formal programs.

One version of phased retirement could get a boost from a new program that the federal government is kicking off. Participants will be able to work half-time while collecting half their pensions after they become eligible to retire. One thousand workers are expected to take advantage of the program annually, according to the Congressional Budget Office, saving the government $427 million in pension costs.

The federal government often pioneers practices that ultimately find their way into the private sector. And phased retirement could be a game-changer for your clients. It can boost Social Security benefits through delayed retirement credits and by adding more high-earning years to the formulas that drive benefit calculations. Even one year of additional work improves the probability of a successful retirement by 18 percent, according to research by David Blanchett and Gregory Kasten; two years boost the odds by 37 percent and a three- year delay improves the outlook by a whopping 55 percent (the authors defined success as achieving the income goal for the target retirement period).

If you have clients contemplating phased retirement, recommend that they at least ask their employers about the option. The TCRS study hints that some workers may not be aware that a phased retirement option even exists: only 21 percent of workers believe their employer will enable phased retirement, compared with the 48 percent of employers who said they offer the feature.

Beyond that, encourage them to develop strategies for continuing work through bridge employment, self-employment or starting a business.

Mark Miller is a journalist and author who writes about trends in retirement and aging. He is a columnist for Reuters and also contributes to Morningstar and the AARP magazine. Mark is the author of The Hard Times Guide to Retirement Security: Practical Strategies for Money, Work and Living. He edits RetirementRevised.com.