Republicans are throwing ideas around for how to pay for the Trump administration’s sweeping tax plan; one idea is to cap pre-tax 401(k) employee contributions at $2,400 a year. Any contributions above $2,400 would have to be made on a Roth (after-tax) basis.

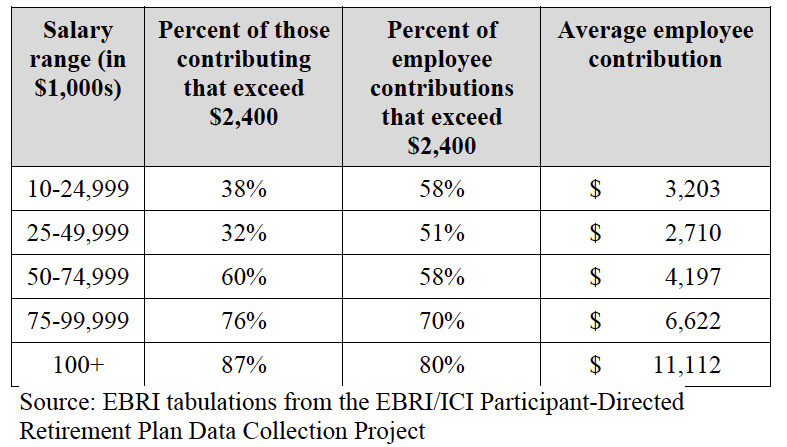

And although President Trump recently tweeted that he would not make any such change, a $2,400 threshold would impact 87 percent of employees who make $100,000 or more and make 401(k) contributions, according to a new study by the Employee Benefit Research Institute.

In light of the possibility of rothification, EBRI released some of its data, part of a larger EBRI study coming out next month. The data is based on 2015 contributions.

At the lowest wage levels ($10,000 to $25,000), 38 percent of 401(k) participants would be impacted by the cap. The impact drops slightly for those making $25,000 to $49,999, but it then increases as a person’s wages go higher.

The study also looked at the percent of employee contributions that exceed $2,400, which follows a similar pattern. For those making $10,000 to $24,999, 58 percent of contributions exceed $2,400. For the highest wage earners ($100,000 or more), 80 percent of contributions would be subject to rothification.

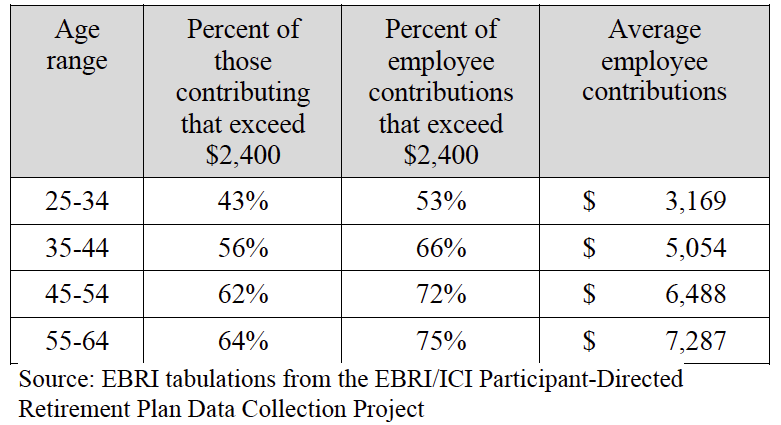

EBRI also provided a breakdown by age of the plan participant, and the impact is greater for older contributors. Forty-three percent of the youngest segment (ages 25-34) would be impacted by the threshold, versus 64 percent of those aged 55 to 64. For the youngest segment, 53 percent of their contributions would exceed $2,400 versus 75 percent of contributions for those participants aged 55 to 64.