I started covering guaranteed income options for defined contribution (DC) plan participants about 12 years ago. The articles’ sources then and over the subsequent years frequently cited several common themes. First, participant and sponsor interest in guaranteed retirement income was growing. Second, uncertainty around interplan portability and sponsors’ fiduciary obligations in choosing income solution providers was slowing adoption.

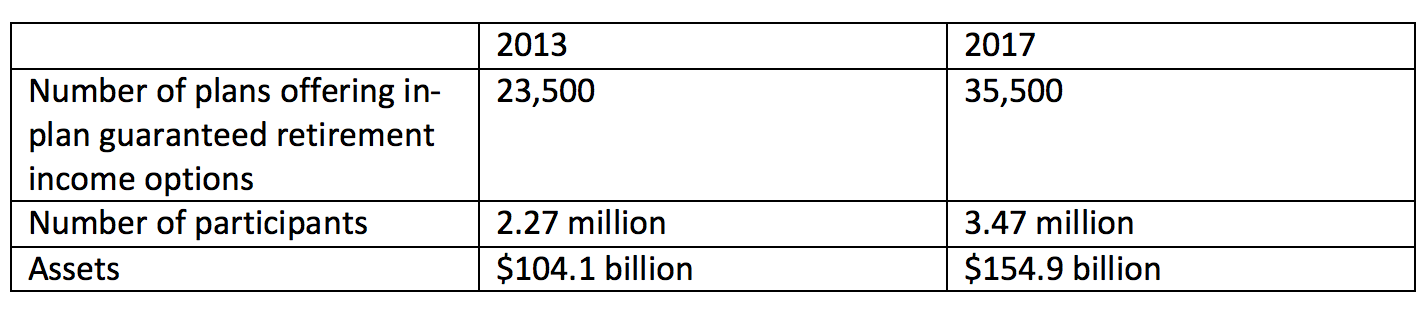

Although plans’ adoption of retirement income solutions has often seemed glacial, there has been substantial progress. Consider these statistics generated by LIMRA and provided by Bob Melia, executive director of the Institutional Retirement Income Council (IRIC):

The number of plans and amount of assets leveled off from 2015 to 2017, but nonetheless, the data indicate a solid growth trend. Sponsors’ changing views of DC plans’ role suggest the growth will continue. Melia cites a recent Defined Contribution Institutional Investment Association survey finding that 85% of plan sponsors believed a DC plan’s primary purpose was to provide retirement income. That’s an impressive result, considering that only 9% of respondents held that belief just seven years ago.

Promising Legislation Stalled

Earlier this year, the U.S. House of Representatives passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act. Another retirement bill, the Retirement Savings and Security Act (RESA), was introduced in the Senate in May. The bills contained several key retirement-income provisions, which Melia outlined via email:

- In addition to showing participants their accrued and vested balances, DC plan statements would also estimate the guaranteed income that the participant’s balance would provide. Given the common tendency to overestimate the sustainable retirement income a lump sum can generate, that information could spur participants’ interest in additional savings and guaranteed retirement-income solutions.

- The legislation provides “a very prescriptive and defined fiduciary safe harbor when sponsors select an insurer to guarantee income products and solutions,” Melia notes. Provided an insurer can demonstrate, document and maintain compliance with the applicable state regulations, the plan sponsor receives a fiduciary safe harbor. That will satisfy the prudence requirement regarding an insurer’s claims-paying ability for a guaranteed retirement income contract, he explains.

In other words, the sponsor is not liable if the insurer cannot satisfy its contractual financial obligations in the future. “By removing the fiduciary uncertainty around the claims-paying capabilities of an insurance company, this legislation will remove the number one barrier to adoption of guaranteed retirement income,” he adds.

- The portability challenge is also addressed. Participants can make a direct trustee-to-trustee transfer to another employer-sponsored retirement plan or IRA of lifetime income investments or distributions of a lifetime income investment in the form of a qualified plan distribution annuity, if a lifetime income investment is no longer authorized to be held as an investment option under their current plan. Melia cites a hypothetical case to illustrate that provision’s importance:

Suppose a participant had purchased a deferred fixed annuity (DFA) within the plan and had been contributing to the DFA over the past 10 years at a variety of interest rates that were in effect at the time of the purchase. In essence, the participant was dollar-cost averaging but with interest rates instead of stock prices.

The plan sponsor decides to drop the DFA option at a time when rates are lower than they were over the prior 10 years, leaving the participant in a bind. She must accept the current market value that the plan assigns to the DFA. Also, if she decides to purchase a new DFA or an immediate annuity at retirement and rates remain low, the income she will receive will be lower than she would have received under the previous rate-averaging arrangement. The ability to purchase institutionally priced deferred income with dollar-cost averaging can be beneficial to near-retirees and helps mitigate the ”point in time” interest rate risk that retirees face when making annuity purchases at retirement with a lump sum, says Melia.

The changes likely would spur adoption of retirement-income options, but unfortunately, the reforms’ legislative progress has stalled in the Senate. According to published reports, the retirement-income provisions are not causing the delay, but the result is still the same. The bad news is that Congress recessed for the month of August, and interparty hostility seems to increase with each news cycle. There is speculation that the SECURE Act’s chances could improve if it is added to the budget legislation, but at this point it’s hard to predict whether that will happen.