On Aug. 18 the Department of Labor’s (DOL) Employee Benefits Security Administration released an interim final rule (IFR) on the lifetime income illustrations defined contribution plans will be required to provide participants annually. The rule was a SECURE Act requirement and, following a 60-day comment period, the interim final rule will take effect 12 months after its publication.

Key Rules

Any retirement income model is based on a mix of hard data, assumptions and projections; the IFR spells out what sponsors need to cover in their illustrations:

Assumed account balance: Current balance, i.e., not adjusted for anticipated contributions or earnings.

Assumed commencement date: Regardless of the participant’s anticipated retirement date, the illustration must assume that the monthly income benefit will start on the last day of the benefit starting period.

Assumed age: The required assumption is that the participant will be age 67 on the benefit’s starting date. If the participant is older than 67, the illustrations will use actual age.

Assumed spousal and survivor benefits: The baseline assumption is that the participant will receive a fixed-amount, single life annuity with no survivor benefit. For married participants, the guidelines call for a fixed-amount, qualified joint and survivor annuity with a 100% lifetime survivor benefit. According to the DOL’s Fact Sheet, administrators must assume spouses are the same age, “regardless of a participant’s actual marital status or the actual age of any spouse.”

Assumed interest rate: Illustrated payments must be based on the 10-year constant maturity Treasury rate “as of the first business day of the last month of the statement period.” As of late August, that rate was just under 0.70%.

Assumed mortality: Life expectancy will be based on the IRS’s gender-neutral mortality table used to determine lump sum cash-outs from defined benefit plans.

The IFR also provides guidance for in-plan distribution annuities and deferred income annuities.

An Example

“Our goal is to help workers and retirees understand how savings translate to retirement income,” said Acting Assistant Secretary of Labor for the Employee Benefits Security Administration Jeanne Klinefelter Wilson in a press release. “Defined contribution plan savings are meant to stretch across the years of retirement. When workers are reminded of what their balances could mean in terms of an estimated monthly dollar amount, they can use this information to plan both savings and spending.”

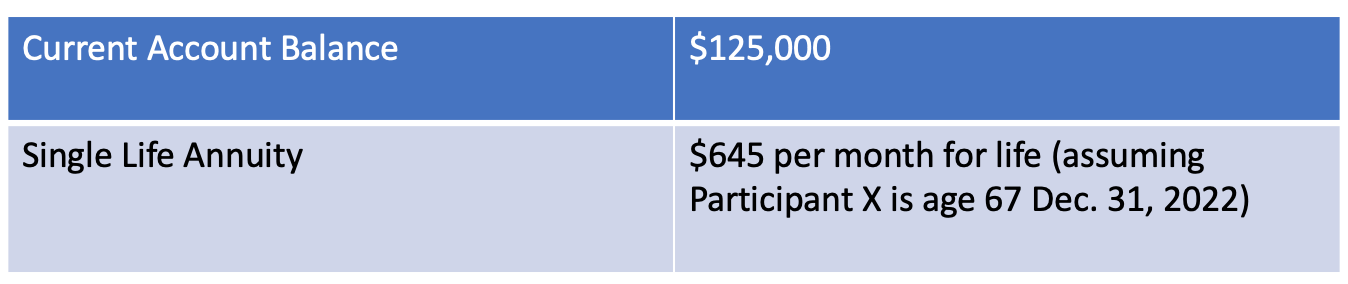

Here’s a hypothetical illustration from the DOL’s Fact Sheet:

Participant X is age 40 and single. Her account balance on December 31, 2022, is $125,000. The 10-year CMT rate is 1.83% per annum on the first business day of December 2022. The benefit statement of this participant would show:

The example illustrates the strengths and weaknesses of the IFR’s approach. For many participants, it will be a wake-up call that gives an easily interpreted snapshot of retirement income based on their plan balance.

That realization could motivate increased savings, but the illustration’s static nature is the most frequently criticized feature among sources. Steve Jenks, Empower Retirement’s chief marketing officer, points out in an email response that his company’s lifetime income projection model allows consideration of non-plan assets, including spousal savings. Projections include estimates of future plan contributions and earnings, and workers can interactively model key assumptions.

Jeff Cimini, senior vice president, retirement product and management with Voya Financial cites his company’s planning program, myOrangeMoney®, as including assumptions for future behavior. “Our perspective is it (the DOL illustration) gives a person a good indication of what they've earned so far and what they have today,” he says. “But I also think that showing supplemental information demonstrates the value of continued deposits, continued match, continued investment results, and what they could achieve in the future. I think both numbers (Voya’s projections and the DOL’s) together have the potential to be very strong in terms of positive behavioral actions by the participants.”

The good news for recordkeepers already providing more detailed income projections is that the DOL recognizes that those illustrations are superior to the IFR and “encourages the continuation of these practices.”

Model Language and ERISA Liability

The IFR requires that plans explain their assumptions and illustrations and clearly state that the illustrations are not guarantees. To that end, the document includes model language that sponsors can use to gain liability relief for their illustrations. Although some language flexibility is allowed, plans must derive the lifetime income equivalents (single and joint lives) “using the assumptions set forth in the IFR and must use the IFR’s model language, or language substantially similar to the model language, in participants’ benefit statements.”

A Starting Point

The IFR’s deterministic approach to retirement income modeling lags far behind the industry’s best practices. Consequently, it’s likely that companies with more advanced modeling capabilities will present both the DOL illustration as required plus their own more sophisticated version. “We're still obviously thinking through how we can incorporate this required illustration into what we do today and help supplement or increase the understanding of individuals,” says Lance Schoening, government relations director, retirement and income solutions with Principal Financial. “I think the most logical way that this will play out is that we can show this static (DOL) illustration and basically say, this is an illustration that demonstrates how important it is for you to continue to contribute to your plan, to minimize withdrawals and stay invested. By putting those two things together I think we can really improve upon what we have today.”