If you’re getting more client questions these days about Social Security and know you need to bone up, a comprehensive - and enjoyable - way to do it has just surfaced. Three top experts on Social Security teamed up to write a comprehensive guide to optimizing benefits, and they manage to pull it off with a sense of humor.

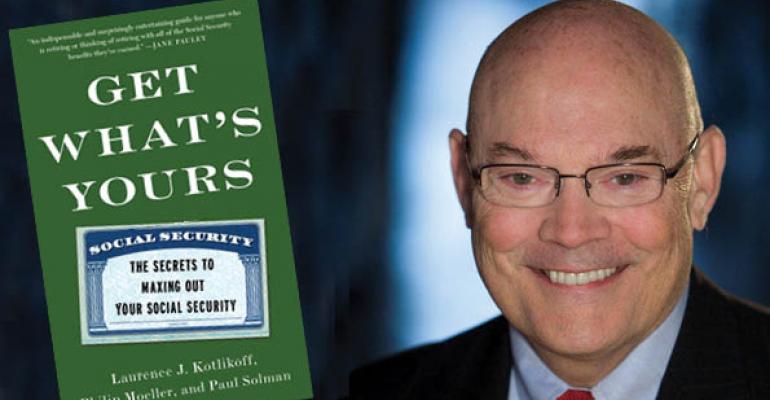

The braintrust behind Get What’s Yours: The Secrets to Maxing Out Your Social Security is comprised of Laurence J. Kotlikoff, Paul Solman and Philip Moeller. Kotlikoff is a professor of economics at Boston University and founder of Economic Security Planning, Inc, a financial software company that created MaximizeMySocialSecurity.com, one of a handful of premium online tools for optimizing benefits. Solman is the business and economics correspondent for The PBS Newshour (see: fedora hats). Moeller writes about retirement for Money magazine, the PBS website Making Sen$se and serves as a research fellow at the Sloan Center on Aging & Work at Boston College.

I asked Moeller recently what financial advisors can get out of the book as they seek to boost their Social Security I.Q.s.

Q: How should financial advisers be thinking about Social Security these days in the broader context of making a retirement plan?

Moeller: A friend retired more than 15 years ago at the age of 52 with an eight-figure fortune. He and I have had extensive discussions about the significance of Social Security in even his financial planning! Social Security should be a foundational component of nearly everyone’s retirement plan, and should be factored into risk and portfolio allocations. It is an immensely important piece of nearly everyone’s fixed-income portfolio and should be regarded as an inflation-indexed annuity whose payments are guaranteed by Uncle Sam. Plus, people who defer their benefits can watch them grow by eight percent a year plus the cost of living.

Q: In the book, you note that Social Security decisions can be tough even for financial experts. What’s your assessment of the Social Security “literacy” of today’s financial advisers?

A: We’re seeing a sustained effort by financial advisers to better understand Social Security and provide their clients with a more comprehensive suite of financial planning and retirement tools. At the same time, there is lots of room for improvement. Too many financial advisers still regard Social Security as a concern for less-affluent investors. And very few advisers are aware of the very complex claiming strategies available to individuals and couples. We’ve documented that optimizing Social Security claiming decisions can add hundreds of thousands of dollars to a household’s retirement income stream over time.

Q: What should financial planners be doing to improve their Social Security I.Q. - aside from reading your book?

A. Laurence Kotlikoff, a Boston University economics professor and a co-author of Get What’s Yours, has been answering Social Security claiming questions for years for the PBS NewsHour. There also are several solid Social Security advisory sites providing increasingly complete software tools that advisers can use to create detailed claiming scenarios for their clients. Larry’s Maximize My Social Security is, not surprisingly, my favorite.

Q: What are the three powerful takeaways from the book that financial planners should share with their clients?

A. First, longevity gains mean retirements are going to extend for 30 to 40 years, so be patient – consider deferring benefits until they reach their maximum amounts. Second, get all the benefits to which you’re entitled, meaning that you need to not only consider your own retirement benefits but also spousal benefits, ex-spousal benefits, survivor benefits (for current and former spouses), disability benefits, and even child and parent benefits. Third, get the timing right – claim too early and you can be hit with enormous lifetime penalties; wait too long and you can leave lots of money on the table.

Q: What do advisors’ high net worth clients need to know about Social Security?

A. A couple with high wage earnings soon will stand to receive upwards of $7,000 a month, or $84,000 a year, from Social Security if they defer benefits until age 70. If they had a private portfolio and were making 4 percent annual withdrawals, they would need upwards of $2 million to generate this annual income and preserve their principal. And Social Security payments are inflation-protected, guaranteed by the government, exempt from state income taxes in most states and enjoy federal income tax benefits as well. Social Security is a big deal!

Mark Miller is a journalist and author who writes about trends in retirement and aging. He is a columnist for Reuters and also contributes to Morningstar and the AARP magazine. Mark is the author of The Hard Times Guide to Retirement Security: Practical Strategies for Money, Work and Living. He edits RetirementRevised.com.