A common criticism of target-date funds is that they group investors by a single factor, usually age or its counterpart, time remaining to the participant’s projected retirement date. A fund’s glidepath is then designed using some underlying theory, such as the tradeoffs between human capital and financial capital or the life-cycle model designed to minimize abrupt changes in participants’ consumption patterns.

Some TDF critics maintain that while a glidepath might have the right allocation for an average participant in an age cohort, there really is no average participant. Incomes, retirement asset balances, risk tolerance and access to other retirement income sources like pensions vary among participants and suggest that a more personalized glidepath would be optimal.

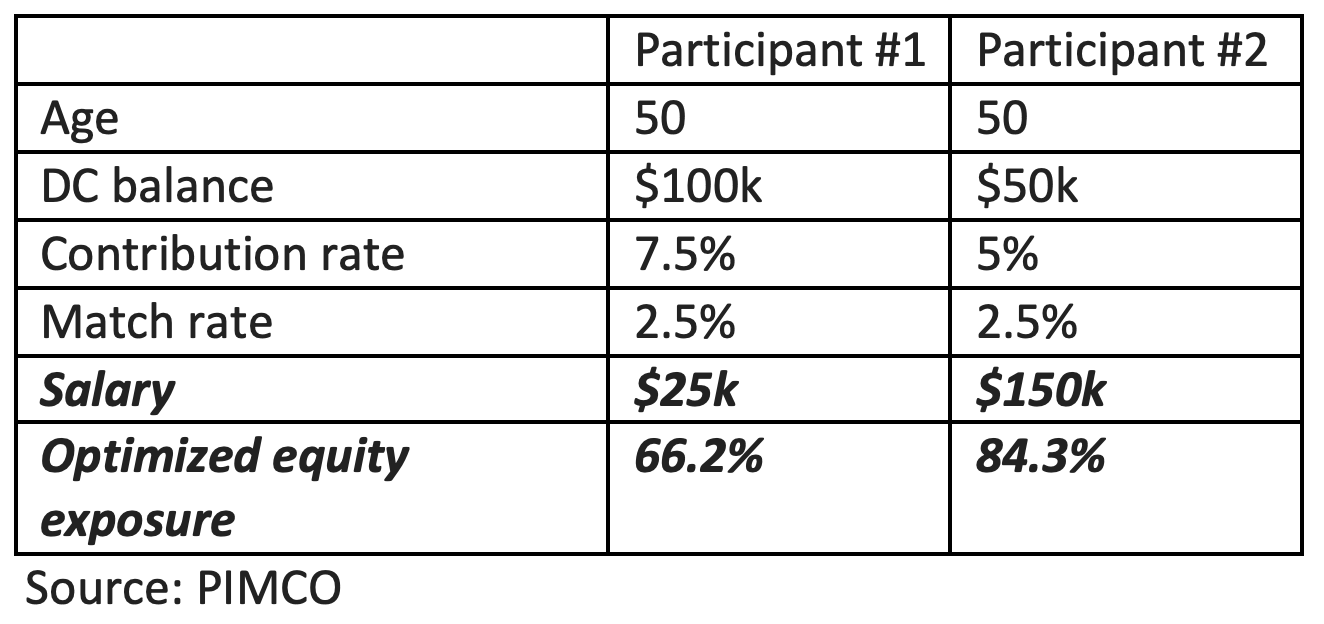

Here’s a hypothetical example that PIMCO provided of a 50 year old with two scenarios that bookend the standard age based allocation. For reference, an age-only based approach would suggest 73.8% equity exposure, which falls between the two illustrated values. (PIMCO has published an interesting white paper on its glide path construction method that’s available online.)

The arguments against TDFs that rely solely on age add credence to the case for managed accounts in defined contribution plans. Managed accounts allow an advisor to create a customized portfolio for the participant that considers age and additional financial information to create a customized DC portfolio. A March 2021 report from Cerulli Associates concluded that the “professional advice and investment management offered through a managed account can be instrumental to improving retirement readiness.”

Nonetheless, managed accounts have been slow to catch on with DC plan participants. Cerulli Associates estimated that managed accounts comprised only 3% to 4% of total DC assets as of year end 2019. Vanguard’s How America Saves 2021 (20th ed.) survey found that 39% of Vanguard’s DC plans offered managed account advice with 71% of participants having access to the accounts as of year-end 2020. But only 10% of participants who were offered managed account advice were accessing that option; that number is 7% when the total number of participants is considered.

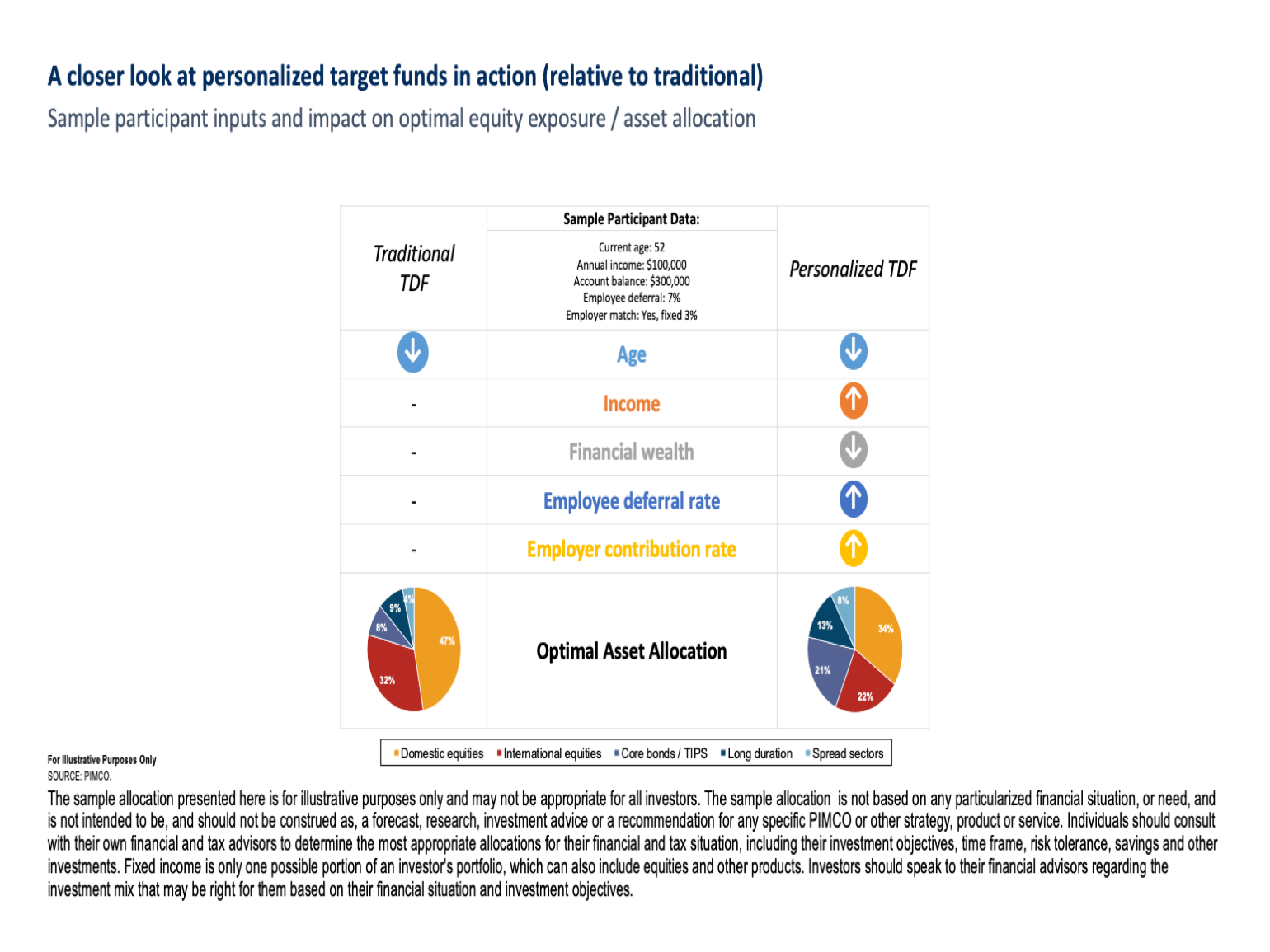

Late last October PIMCO and Morningstar Investment Management LLC announced a collaboration with the myTDF program. According to the press release, myTDF will incorporate factors such as an individual’s age, salary, assets, savings rate, and company match rate to assign more personalized investment allocations for individuals by using Morningstar Investment Management’s user interface and network of data integrations with recordkeepers.

Rene Martel, managing director and head of retirement with PIMCO, said the DC market was being underserved with a wide gap between off-the-shelf TDFs and managed accounts. PIMCO’s goal was to develop an approach that would be based on more personalization than just a participant’s age but to do it in a way that didn’t increase complexity or the need for greater engagement from participants. Additionally, the solution would have to be “offered at a cost that looks more like traditional target date funds than managed accounts,” Martel added. The firm ultimately decided to do that by leveraging its existing target date complex.

Increased personalization requires more participant data from the recordkeepers. Bransby Whitton, executive vice-president and product strategist with PIMCO, explained that obtaining the data directly from each recordkeeper would have required significant infrastructure work. That realization led to the collaboration with Morningstar Investment Management, which already had over two dozen recordkeepers on its platform.

Dan Bruns, head of product management with Morningstar Investment Management LLC, explained the myTDF program’s mechanics. “Periodically, the PIMCO myTDF platform will receive data about the participant from the plan’s record keeper and use that data, in collaboration with PIMCO’s methodologies, to determine how to blend multiple target-date funds into a portfolio of target date vintages, personalized for the individual,” Bruns said. “myTDF then passes that allocation strategy back to the record keeper and will implement it. The personal data used includes age, account balance, salary, and total contribution rate. By expanding the data set beyond just age, myTDF can deliver a more personalized investment strategy than a standard target-date fund. myTDF then will periodically receive updated personal data from the record keeper to help ensure investors are allocated correctly over time.”

PIMCO’s RealPath Blend TDF funds are the foundation of the program so participation in myTDF is limited to plans using those funds. “When we implement myTDF, we actually use the same algorithm and optimization (as the RealPath Blend fund),” said Martel. “The only difference is instead of feeding market average data for those different data points we pull from the record keeper and in the optimization feed in actual participant data. We didn't have to create a whole new process and a whole new optimization or algorithm for this—we’re leveraging what we have, just making it more personalized to each participant.” So, in many aspects, it will feel a lot like the current way plan sponsors and their participants are set up now, Martel added.

I was unable to obtain information about myTDF’s adoption rates or the level of interest from consultants and advisors by this article’s deadline. But it’s an interesting approach that could catch on with plan sponsors and other TDF-fund managers.