Retirement plan providers—specifically, record-keepers, managed account providers and plan advisors—collect more detailed participant data than in years past. In many cases, providers gather participant-level information coming from the plan sponsor. In other cases, providers gather personal information, such as their individual retirement account balance(s) or information on their spouse or partner, directly from the participant.

Detailed, accurate participant data is a valuable strategic asset to many retirement plan providers, since providers can use this data to build out more complete participant profiles, which they can then use to deliver more effective in-plan advice and financial wellness experiences, and more germane participant communications and messaging, enhancing their value proposition as a plan provider.

Additionally, providers can use these more accurate, complete participant profiles to further integrate themselves into participants’ financial lives and establish more comprehensive financial service relationships with participants that may extend beyond simply record-keeping their 401(k) plans. This is particularly important for record-keepers and plan advisors that offer wealth management or other personal financial services.

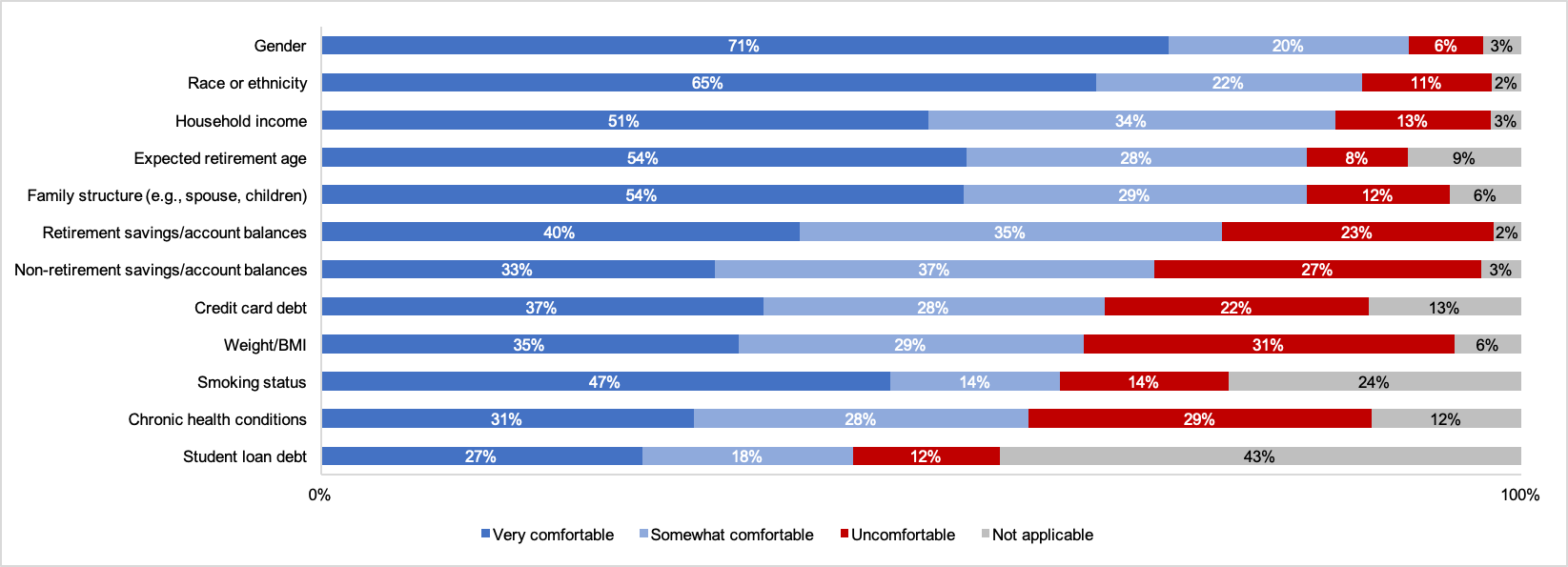

The good news for providers is participants generally seem comfortable offering their personal information to their DC plan provider. Recent survey data from Cerulli’s 2021 retirement investor survey suggests most 401(k) participants are either “very comfortable” or “somewhat comfortable” providing personal information such as their household income, family structure and nonretirement savings to their provider so long as the information is being used to personalize their investment advice or financial wellness experience and would not be distributed to their employer.

401(k) Participants' Willingness to Provide Personal Data, 2021

Respondents were asked to rate their willingness to provide personal data to their 401(k) provider(s). Respondents were also asked to assume that the data points would be used to personalize their investment advice and financial wellness experience AND that the information would NOT be distributed to their employer.

However, the concept of distributing nonplan services (e.g., wealth management, retail advisory, banking services) or accounts (e.g., IRAs, 529s) to DC participants often arouses concerns about inappropriate cross-selling activity, which has appeared in recent retirement litigation. For instance, in July 2021, the Securities and Exchange Commission fined TIAA $97 million for not properly disclosing conflicts of interest pertaining to rollover recommendations between 2013 and 2018. Alternatively, as part of a 2021 ERISA class action settlement, Columbia University agreed to instruct its record-keepers not to use participant data to cross-sell nonplan products and services to plan participants (unless the participant requests the nonplan product or service).

On the other hand, there are also cases in which providers were not found at fault for using participant data to market nonplan products and services. For example, in Harmon v. Shell Oil Co., a federal court judge ruled that by using participant data to market nonplan products and services, Fidelity, the plan’s record-keeper, was not acting in a fiduciary capacity under ERISA since the court did not consider participant data a plan asset. Therefore, Fidelity could not have breached ERISA fiduciary duties.

In short, the indication from regulators and the courts is not that retirement plan providers cannot market, or raise awareness of, nonplan accounts, products or services to DC participants. Rather, providers should determine whether their service agreement with the plan sponsor allows them to market such accounts, products or services in the first place and, if so, make sure they are marketing, or raising awareness of, these accounts, products or services in accordance with any applicable fiduciary responsibilities.

Shawn O’Brien leads the U.S. retirement research practice at Cerulli Associates, which focuses on the defined contribution and individual retirement account markets.