Here’s a discomforting stat. John Faustino, head of Broadridge Financial Solutions’ fiduciary certification and training solutions, reports that about 10%-15% of the firms with whom Broadridge raised the topic of PTE 2020-02 compliance were unaware of the regulation. Many of these firms were small, wealth management-focused shops that likely lacked compliance resources on retirement plans, but nonetheless, that’s a lot of advisors in the dark.

Why It Matters

PTE 2020-02 matters this year because of two effective dates. On Feb. 1, compliance with most of its provisions became mandatory. Starting July 1, advisors must disclose and deliver to clients the specific supporting reasons behind rollover recommendations. Advisors could attempt to provide only education on rollovers but given rollovers’ prominence in growing firms’ assets, the education-only option looks to have limited applicability.

A recent webinar from attorneys at Faegre Drinker, PTE 2020-02 Obituaries: Mistakes and Misunderstandings (Part 1), presented a 5-step process for developing a best interest rollover recommendation:

- Gather information about retirement investor;

- Gather information about plan investments, services and expenses;

- Gather information about IRA investments, services and expenses

- Provide objective analysis to determine option that is in the investor’s best interest;

- Provide the retirement investor with specific reasons why the rollover is in the investor’s best interest (as of July 1, 2022).

Assuming your firm must implement a process like this that includes information-gathering, analysis and documentation, you’ll need to address multiple compliance points while ideally developing a repeatable approach with each case. Otherwise, every rollover could take a large amount of time and increase the risk you’ll overlook an important element.

Consider the plan documentation requirement, which is just one aspect of the rules. On the plan side, it can be difficult for advisors to acquire some of the needed documentation and data to do the comparison against the IRA, said Dave Palascak, vice-president, product management at Broadridge Fi360 Solutions. Ideally, the advisor will have two sets of data available, one for the current plan and one for the potential IRA. For the current plan, the collected documents should include up to four of the participant’s most recent statements; the current version of the summary plan description; and the most recent 404(a)(5) participant fee disclosures.

Add the analytic and documentation requirements and compliance with this provision can be a challenge. A recent joint presentation from attorney Jason Roberts with Pension Resource Institute (PRI) and Broadridge highlighted several key steps that must be considered before recommending a rollover (from plan to IRA in this example):

The retirement investor’s alternatives to a rollover, including staying in the employer’s plan;

- Selecting different investment options available with the employer’s plan;

- Fees and expenses with both accounts;

- Whether the employer pays for some or all of the plan’s administrative expenses;

- The different levels of services and investments available through the plan and the IRA.

It’s a multi-step process and in response, Broadridge Fi360 Solutions has partnered with the PRI on modifications to Fi360’s Decision Optimizer tool to enhance PTE 2020-02 compliance. Decision Optimizer, a software as a service (SaaS) product, addresses several important concerns for working with rollovers:

- Advisor workflow and discussions with clients on whether a rollover, or other covered transaction, is in the client’s best interest.

- Associated documentation to support recommendations.

- Home office surveillance of each advisor utilization of the tool and data to support required retrospective reviews.

- Alternative benchmarking data when a plan’s 404(a) or other fee documents aren’t provided by the plan participant.

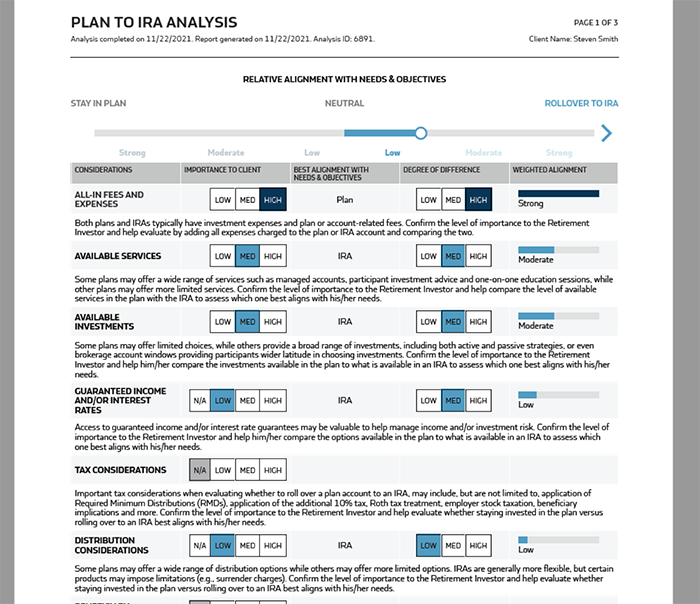

Another useful feature, developed in conjunction with Pension Research Institute, is the ability to compare the features and benefits available in the participant’s 401(k) with those in an IRA, with a weight attached to measure each factor’s importance to the client. That review helps document the required analysis for PTE 2020-02. (See Figure 1.)

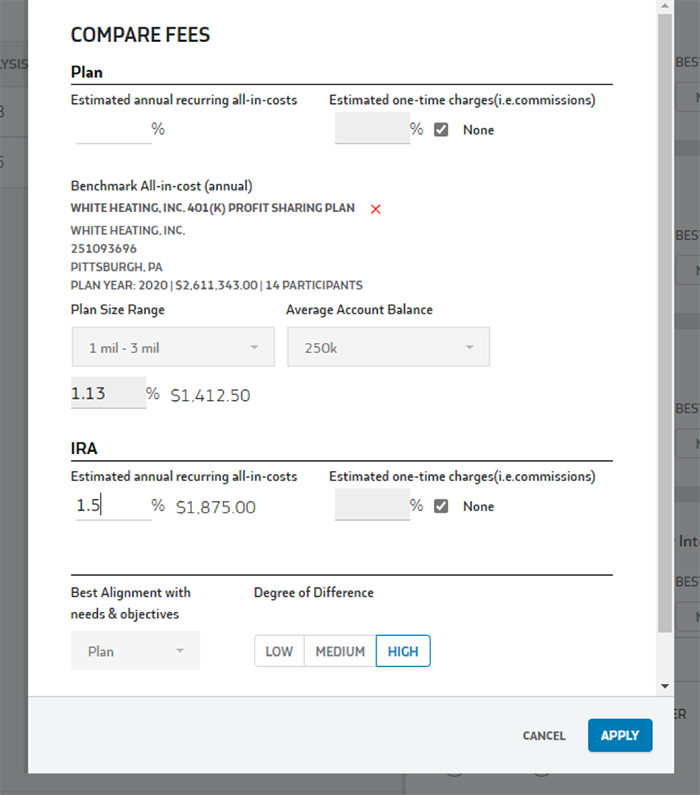

Plan versus IRA fee comparisons are another important analysis that Plan Optimizer includes (See Figure 2):

So far registered investment advisors, midsize broker-dealers and bank trust departments have been among the software’s primary initial adopters, said Faustino, and he describes the software as the “solution with the broadest demand that we have ever created.” The license costs $995 per year for individual advisors, with a range of pricing models and discounts available to volume-users.