Percentage of U.S. retirees who are funding their retirement with cash savings: 56

Number of U.S. households in 2015 with a net worth of $1 million or more, not including primary residence (NIPR), an increase of 300,000 from a year earlier: 10.4 million

Number of mass affluent households (net worth between $100,000 and $5 million NIPR) in 2015: 29.8 million

Number of ultra-high-net-worth households (net worth between $5 million and $25 million, NIPR) in 2015, an increase of 42,000 from a year earlier: 1.21 million

Number of $25 million-plus households in 2015, an increase of 3,000 from a year earlier: 145,000

Number of jobs expected to be created in the U.S. economy from 2016 to 2021: 7.2 million

Percentage of U.S. jobs created since the recession that have gone to workers with post-secondary education: 99

Level of consumer debt accumulated in the fourth quarter of 2015, almost equivalent to the total debt added in all of 2014: $52.4 billion

Percentage of U.S. households that carry some sort of credit card debt: 38

Average household credit card debt in 2015: $7,879

Average credit card debt for balance-carrying households: $16,048

Average amount of credit card debt held by households with the lowest net worth (zero or negative): $10,308

Difference between average interest rates for new-car loans and used-car loans: 17 percent

Factor by which buyers with fair credit will pay more to finance a car than someone with excellent credit, equating to $6,671 in additional payments over the life of a $20,000, five-year loan: 6

Portion of U.S. workers who commute by themselves in a private automobile: three-quarters

Annual economic cost of traffic congestion in the U.S.: $160 billion

Monthly commuting cost for the average U.S. worker in 2015: $276

Median annual compensation among 300 of the largest public companies by revenue which filed their final proxy statements between May 1, 2015 and April 30, 2016: $3.5 million

Average life expectancy, in years, of a U.S. man in the top 1 percent of income: 87

In the bottom 1 percent: 73

Number of countries that offer citizenship in return for an investment commitment: 31

Number of countries that have issued travel advisories to their citizens traveling to the U.S. this year: 3

Chances that a cosigner in the U.S. will end up being responsible for some part of the loan: 2 in 5

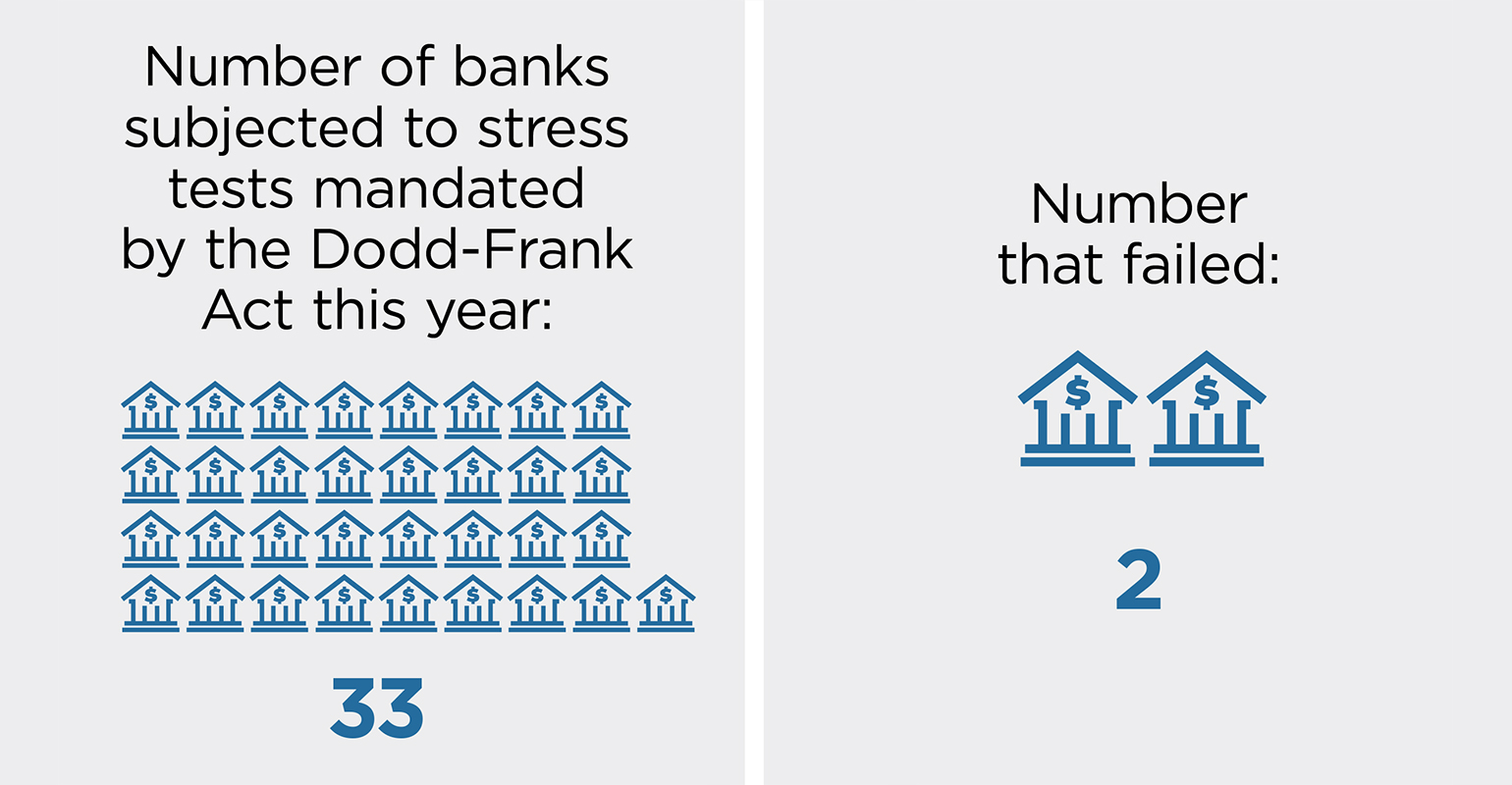

Number of hedge funds that began operating during the first quarter of 2016: 206

Number that shut down: 291