Sponsored by Brighthouse Financial

It appears that advisors who frequently use variable annuities are less likely to use cash holdings in their client portfolios. Almost half (45%) of low-use advisors always use cash or money market funds in client portfolios. By comparison, just 25% of high-use advisors do the same.

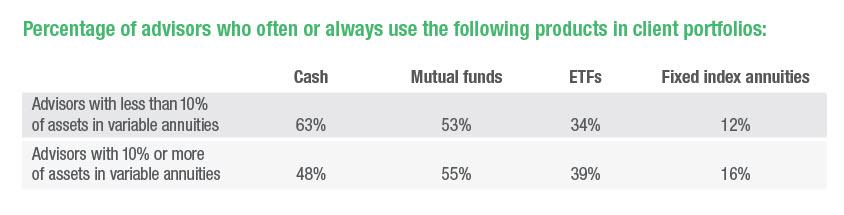

Low-use and high-use advisors tended to use mutual funds (53% vs 55%) and ETFs (34% vs 39%) at similar levels. (Percentages include both “often” and “always.”)

Neither group was particularly interested in fixed index annuities, however. More than half (56%) of low-use advisors said they never use fixed index annuities, compared to more than a third (39%) of high-use advisors.

0 comments

Hide comments