Sponsored by Lincoln Financial

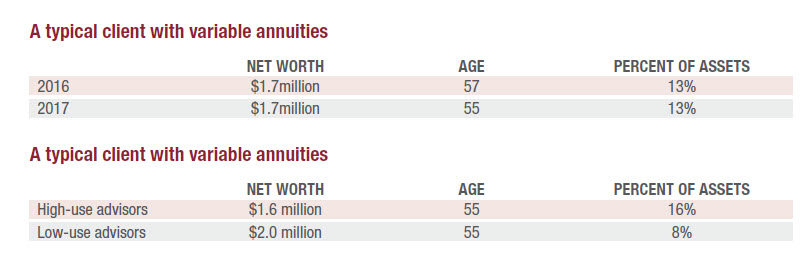

This profile is virtually identical to the typical client reported in last year’s results, although the age has dropped slightly from the 2016 results. There are some differences among advisor channels, however, as well as between high-use and low-use advisors.

For instance, advisors from large firms report a slightly higher net worth ($1.9M) for their typical client than do advisors from independent firms ($1.7M). Meanwhile, advisors from insurance firms are recommending these products to clients at a much younger age (49 years) than are advisors from large firms (age 56). Advisors from independent firms are in the middle with their recommended age of age 53.

Perhaps the largest difference in these factors among advisor groups is between high-use and low-use advisors. Lower-use advisors tend to describe a typical client with a much higher net worth than do higher-use advisors. Interestingly, lower-use advisors also tend to recommend variable annuities to clients at a slightly younger

age (52) than their higher-use peers (53).