Sponsored by Brighthouse Financial

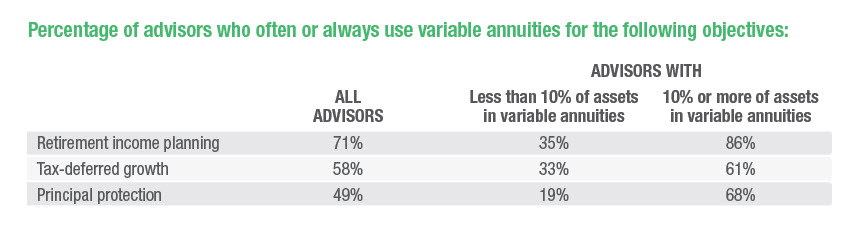

Retirement income planning was the most commonly cited objective (71%, including often and always) for the use of variable annuities in client portfolios. Among all advisors, the second and third most commonly cited objectives were generating tax-deferred growth (58%) and protecting a client’s principal (49%). As expected, advisors who use these products less often were less likely to cite any of the objectives, but the relative order (retirement income, tax-deferred growth and principal protection) was consistent across all advisors.

Advisors who use these annuities more frequently, however, were more likely to cite principal protection than the tax-deferred growth benefits. This finding suggests that advisors who actually use these products do so primarily for retirement income planning and principal protection.