Sponsored by Lincoln Financial

Nearly two thirds of advisors (62%) hold that opinion—down slightly from the 66% reported in the 2016 survey. Those who do expect an impact are far more likely to anticipate a decrease in usage (31%) than they are an increase (6%). Again, these results are similar to those we reported last year. When comparing 2016 to 2017, however, the slight reduction in “no impact” matches the slight rise in expectations for an increase, suggesting the industry is warming to these products.

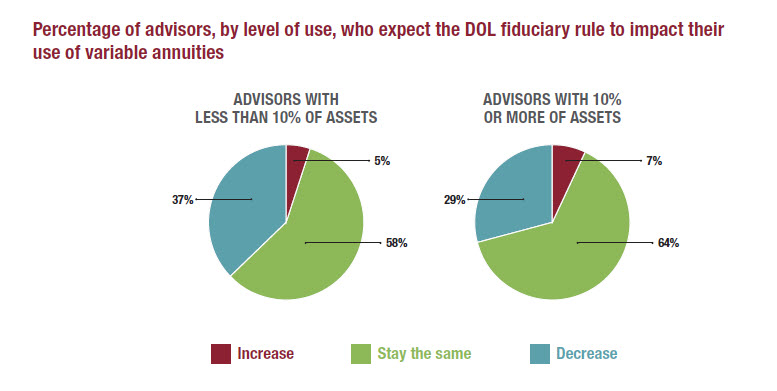

Advisors’ opinions are largely consistent across channels, but there are slight differences based on how much they are already using these products. For instance, both high-use advisors (10% or more of client assets) and low-use advisors (less than 10% of client assets) are most likely to expect their use to remain the same, at 64% and 58%, respectively. But the high-use advisors are less likely (29%) to expect a decrease than are the low-use advisors (37%).

Comments from advisors tend to bear this finding out. For instance, one high-use advisor from an independent RIA thinks the industry will simply adapt as necessary. “I believe that insurers will modify offerings to comply with whatever new regulations come along, including the final version of the DOL rule,” he says. “And advisors will use those products to simplify their lives and reduce fiduciary risks.” A low-use advisor, also from an independent RIA, holds a different opinion. He believes variable annuities are “too complex and difficult to use under the DOL rule.”