Sponsored by Raymond James

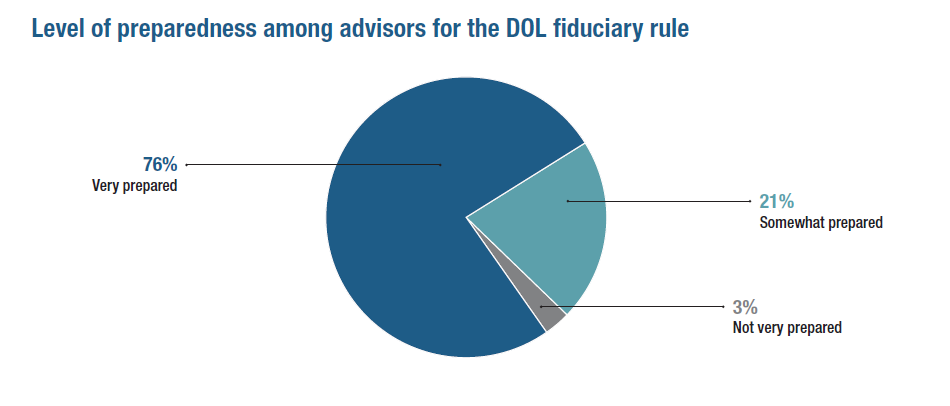

Just 3% say their firms are not very prepared. A majority of advisors expect the rule to lead to more paperwork (57%), while many also expect more complicated compliance (49%) and changes to policies and procedures (48%). As one RIA sees it, the rule “will increase costs for smaller clients and will cause more market volatility as clients see the fees they are paying and, when experiencing down markets, will withdraw money from their portfolios.”

Most RIAs (56%) do not expect to let go of their smaller clients due to the impacts of the fiduciary rule. That said, more than one in 10 (13%) do plan on dropping smaller clients, and a third (31%) remain unsure. In addition, advisors are less optimistic about new clients in the future. Wealth range is the most frequent (61%) selection criteria used by advisors when prospecting for new clients, and almost a third of RIAs (30%) say they will stop targeting smaller clients going forward. Less than half (45%) will continue to include smaller clients in their prospecting, while a quarter remain unsure.