Sponsored by Raymond James

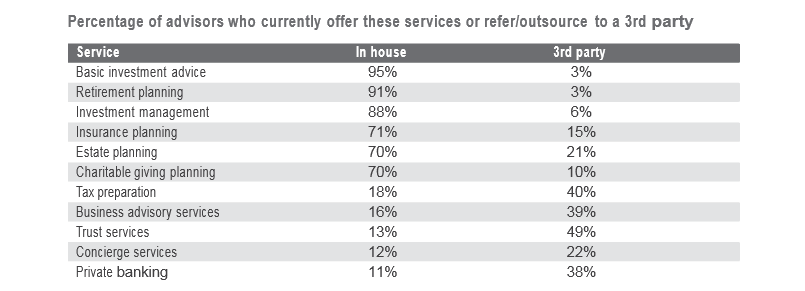

RIAs typically offer a baseline set of services to their clients, including basic investment advice (95%), retirement planning (91%) and investment management (88%). Those services aren’t enough to differentiate an advisor from his or her peers. Instead, advisors can offer other services that help deliver a more holistic level of support to clients. Among the most popular: charitable planning, insurance planning services and estate planning, which are offered by more than two-thirds of advisors. Meanwhile, fewer advisors—just one in 10—currently offer their clients trust services, concierge services or private banking.

Independent advisors can still offer clients access to services that they do not wish to provide themselves. That may mean outsourcing services to other professionals or simply referring clients to a third party. Just under half of advisors refer clients to third parties for specialized services such as tax preparation, trust services and business advisory services. The key for most advisors is to make sure their clients have access to the services they need, regardless of who is delivering those services.