Publicly-traded REITs have been swept up in the financial fallout stemming from Russia’s invasion of Ukraine that has sent global equities prices downward. In February, the total returns for the FTSE Nareit All Equity REITs index were down 3.89 percent as of the end of the month and down 11.52 percent year-to-date. That compares with an 8.01 percent decline for the S&P 500 and a 6.43 percent drop for the Dow Jones Industrial Average during the same timeframe.

The stock prices don’t tell the whole story within the sector, however. February wrapped up a very strong annual earnings season for publicly-traded REITs.

Funds from operations (FFO) for all equity REITs rose 24.6 percent from 2020 to 2021 to $64.8 billion. Net acquisitions in the fourth quarter totaled $26.7 billion, the second-highest amount on record. Net acquisitions for the year were also a record $67.8 billion.

WMRE sat down with Nareit Executive Vice President and Economist John Worth to discuss the 2021 results and February returns.

This interview has been edited for length, style and clarity.

WMRE: Let’s start with February’s numbers. Total returns were down for the second straight month to start the year.

John Worth: So far, year-to-date through the end of February there’s been an 11.5 percent decline in the all-equity REIT index. In February, we saw a drop of 3.9 percent on total returns for the index. It’s a continuation of some of the earlier trends from January. Infrastructure was one of the worst performers. Data centers lagged. Those two sectors are down 21.5 percent and 17.5 percent respectively year-to-date.

On the other end, office REITs are down only 2.8 percent, which is better than the all-equity figure, and retail REITs are also a bit better, even though they are down 9.3 percent for the year. And residential REITs were down 9.35 percent.

A strong performer of note is lodging/resorts, which are up 1.5 percent for the year after gaining 3.6 percent for the month.

Altogether, that spells out a bit of a transition from the tech-oriented real estate stocks to the more traditional sectors. Perhaps investors are looking for value and also working in a continued reopening play.

In addition, a lot of those topline results started the first week of March with positive returns. REITs finished the week up and month-to-date up 3.4 percent. Also, a lot of this reflects Russia/Ukraine-related volatility that is going to take some time to work its way out of the system.

Cumulatively, as of last Friday, REITs were down 8.55 percent and the S&P was down 8.9 percent on a year-to-date basis. My take is that what we are seeing is mostly about geopolitical volatility. Until we get clear of that, we won’t get a good read of the broader stock market views of real estate.

WMRE: February marked the end of the fourth quarter earnings season for REITs. What were some of the big takeaways?

John Worth: The headline is that REIT earnings rose nearly 25 percent from 2020 and also exceeded pre-pandemic levels from 2019. It signals that we’ve seen a meaningful recovery from the COVID performance and nearly every sector improved on an annual basis from 2020.

Along with strong growth in earnings for 2021, we saw net acquisitions in the fourth quarter equal to $26.7 billion. That’s the second highest quarter on record. The full year landed at $67.8 billion. That is a record for REIT annual acquisitions.

As we’ve seen share prices recover, they’ve been raising capital and 2021 was also a banner year on that front. REITs raised more than $126 billion in debt and equity offerings, which is also a record. A lot of that capital-raising went into acquisitions. That is what you need as a recipe for future growth. Acquisitions will be accretive to earnings and we will see that flow over the coming quarters and years.

Another thing to note in the T-Tracker is that we continue to see the balance sheets of REITs to be quite strong. The leverage ratio declined in the fourth quarter. The debt-to-total-book-assets ratio stood at 48.1 percent. And the debt-to-market-assets ratio is down to 25.7 percent. Weighted-average terms to maturity also lengthened to 89.4 months, or about 7.5 years. For context, the average maturities were less than five years in 2008.

WMRE: The level of capital raising seems notable given that investors have other options, including private markets, for investing in real estate. So, the fact that REITs continue to be able to tap markets seems like a good indicator of the strength of the industry.

John Worth: It is a competitive market for capital raising and competitive in terms of acquiring. The fact that REITs are able to go out and effectively bring in high-quality properties speaks to their operating platforms. They are permanent entities, they are in the markets where they know the players and they know the geographies. They are able to go out and do deals. Some of them are able to do their own development and do the site selection, planning, processing and construction to put new properties onto the market.

WMRE: Can you drill down a bit more on the FFO numbers for the year and the quarter?

John Worth: FFO was up dramatically over the prior year, at 24.6 percent, and was also up 1.4 percent from the pre-pandemic year of 2019. That signals a full recovery. On a quarterly basis FFO ticked down a bit. There was a very strong recovery through the second and third quarters of 2021 and then a slight downtick from $17.3 billion in the third quarter to $16.8 billion in the fourth quarter. But when you look at the fourth quarter of 2021 compared to the same quarter in 2020, FFO was up quite dramatically at 22 percent. So with all of that, I don’t read too much into the quarter-on-quarter decline. The bigger picture is really an upward trend.

WMRE: Any other takeaways from the full-year reports?

John Worth: We had a very active 2021 in terms of M&A and we are going to see what 2022 brings. So far, we’ve already had a few deals. Blackstone REIT has been active and announced some big acquisitions. And there were two other big announced listed-to-listed acquisitions. Most important, Healthcare Trust of America announced a merger with Healthcare Realty Trust.

WMRE: Nareit also recently published a report on the state of REITs globally. What are some of the takeaways from that report?

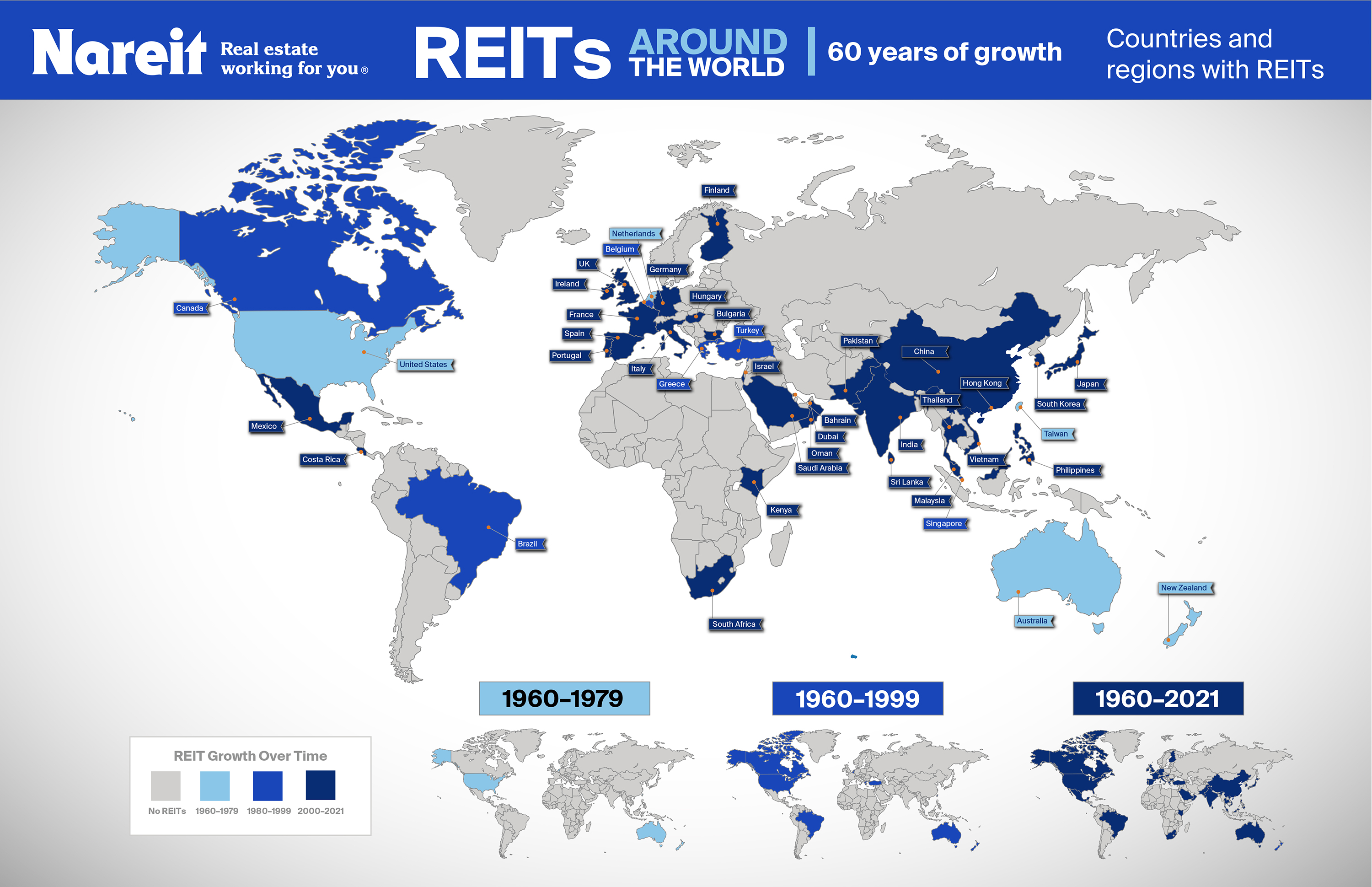

John Worth: This report takes a long view and how we have seen REITs grow over the last 60+ years. REITs were created in 1960 in the U.S., but not much happened over the first 30 years. It’s been much more dramatic in the last 30 years.

There are now 865 listed REITs around the world. What I find interesting is not the total or the $2.5 trillion market cap, but it’s the population of the countries that have REITs. Almost five billion people live in countries with REITs. Those countries account for 85 percent of global GDP. So about 65 percent of world population lives in country that has REITs.

WMRE: Are there any new countries that are adding REIT structures?

John Worth: The latest country to add REITs was China in 2021. There are always countries considering it, but right now I don’t know of any that are going to launch in 2022.

Long-term, demographic forecasts suggest the majority of the largest cities in the world are going to be in Africa, where right now only two countries have REIT structures. It’s the only continent where populations are growing at a meaningful pace and we are going to see more urbanization. As I think about the public policy challenges that will present, REITs can be an important contributor to solutions and bring capital to bear on those problems.