(Bloomberg)—Digital Realty Trust Inc., a data center owner and operator, is considering an initial public offering of a trust in Singapore that could raise $300 million to $400 million, according to people familiar with the matter.

The U.S. firm is working with advisers on the listing, which could come as soon as the end of the year, the people said. The potential investment vehicle’s portfolio is valued at around $1 billion, they said, asking not to be identified as the process is confidential.

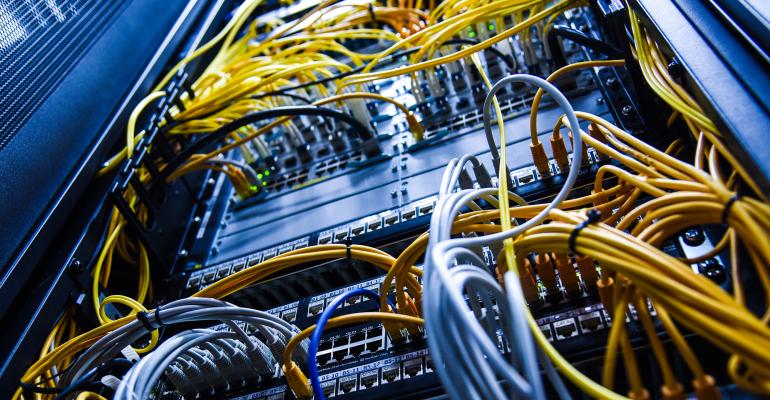

The listed entity will own about 10 data centers from around the world, one of the people said. It could be structured as a real estate investment trust or a business trust.

Deliberations are ongoing and details such as size and timing could change, the people said. A representative for Digital Realty Trust declined to comment.

The share sale would tap growing investor interest in data centers, with the coronavirus pandemic accelerating a shift to remote work and e-commerce adoption, both of which depend on cloud computing resources. Digital Realty Trust’s offering would be the second tech-related listing in Singapore this year, following electronics maker Aztech Global Ltd.’s S$297 million ($224 million) IPO in March.

Digital Realty Trust caters to several industries ranging from cloud and information technology services to banks, manufacturing, energy and health care. The Austin, Texas-based company’s portfolio consists of 290 data centers globally as of March 31, its latest earnings release showed.

Its customers include International Business Machines Corp., AT&T Inc. and National Australia Bank Ltd., according to the website. Digital Realty Trust completed the acquisition of Dutch data center firm Interxion Holding NV for about $7.2 billion last year. The U.S. company in 2019 agreed to sell a portfolio of data centers to Singapore’s Mapletree Investments Pte and Mapletree Industrial Trust in a two-part deal valuing the assets at about $1.4 billion. The transaction completed in early 2020.

--With assistance from Faris Mokhtar.

© 2021 Bloomberg L.P.