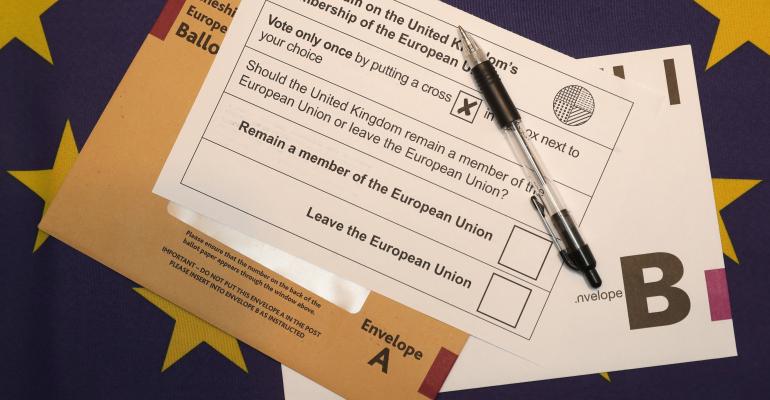

As we approach Thursday’s vote for Brexit, many investors have speculated what a potential exit from the EU will mean for the UK. However, the outcome of the EU referendum possesses both short- and long-term ramifications that will affect markets around the world — not just the UK.

There are of course negative ways of viewing the Brexit’s impact on the U.S. economy, but also opportunistic ways to view any major global financial change. As always, it’s best to keep in mind risk, potential upside and who you choose to invest in and with.

The Negative Impacts

For private and corporate investors, businesses and individuals, it is understandable that they are looking for guidance in order to make financial decisions both now and in the immediate short term without negative impact, and to minimize losses.

In the U.S. — as evidenced by Monday's market being up over 200 points due to rumors the Brexit would not occur — the global market is nervous about the event moving forward. As we all know, markets do not like uncertainty and lack of confidence, which, of course, will stop countries, companies and investors from investing capital.

The International Monetary Fund (IMF) issued a warning that leaving the EU will cause the UK to fall into recession as soon as next year. In a report published last week, the IMF shared its view that should the Brexit take place, the result would be reduced trade and financial flows with other EU members and lower investments, accompanied by higher financial market volatility. The Los Angeles Times recently shared figures from the International Monetary Fund estimated in a report published this weekend in Washington that a “Brexit” could knock up to half a percentage point off the combined output of all advanced economies by 2019, including the United States.

U.S.-based companies often collaborate with manufacturing and strategic partners in the UK and Europe. Financial institutions, car manufacturers and others have offices in the country, especially in London, whose bottom line and the financial health of their employees should be considered. Keep an eye on U.S. companies and investment options that have significant exposure to British investors and markets.

And as for the remaining EU countries, should the Brexit receive a Yes from the British voters and Britain leaves the EU, this will undoubtedly set a precedent for the remaining members and we could see a collapse of the EU. This would have an impact on the main global economies.

I think all of the above will see a rocky time for U.S. exports and companies as all major trade partners trade with Europe and of course Europe is one of the main U.S. trading partners. The global markets are so heavily linked now that whatever happens with the Brexit, the U.S. will be affected.

The Opportunistic Impact

In any economic environment, there are always opportunities to invest and grow. Diversity is the key to securing an individual’s financial future, and while their economy may slow down, the British (and in fact the Europeans) will look for ample opportunities to invest and generate income outside of domestic investments.

With a stable and growing economy, albeit slowly, U.S. real estate will continue to emerge as an option for international investors, especially as a long-term approach. Thus, U.S. property investment professionals and the service providers in that industry should ready themselves for an infusion of investors from across the pond. However, it is difficult for these investors to identify these opportunities alone from across the Atlantic, let alone understand the local economy or worse still the laws on taxation and banking. These areas for foreign investors into the U.S. can be an absolute minefield. The key for European residents to keep in mind when considering U.S. investment opportunities is to identify the right strategic partners to invest with.

In addition, smart investors can also utilize the foreign currency fluctuations to their advantage. For instance, overseas investors investing in U.S. dollar funds that are short-term (2–4 years) will provide a tremendous opportunity to generate 25 to 75 percent on returns over the investment term — great news. If an individual’s currency is already USD, it would be wise to stick to these U.S. investments to protect yourself against the upcoming currency uncertainties.

Conclusion

It is more than likely that an exit from Europe will not happen for Britain. However, if it does, the world will survive the economic disruption and live to fight the next economic catastrophe. Whatever happens to an economy, just know that it is only temporary. The key to a smooth transition from any economic downturn is confidence. Consumer confidence is the key to a growing market and once a country masters this, they can propel from that particular downturn more quickly and smoothly.

Simon Calton is founder and CEO at Rycal Investment Group, a U.S. and UK-based property advisory firm.