The independent channel was expecting to win more financial advisors and client assets from the financial crisis than it did. It continues to grow, but not necessarily at the pace predicted in 2008. The trend toward independence has not been the surge some expected, but instead a more gradual migration.

And yet, despite slower-than-expected growth in the independent channel, it is perhaps the channel that has experienced the most change as a result of the crisis as the market turmoil and resulting financial pressures have forced some independent firms out of the business.

Other long-term trends continue, however. In the past, the distinction between independents and RIAs was clear. Independents were associated with commission-based business, while RIAs were associated with fee-based business. However, in recent years, independent firms have moved toward fee-based business along with the rest of the industry. The distinction could continue to blur; instead of requiring advisors to do fee-based business under the corporate RIA, some independent firms, including LPL, now allow their advisors to start their own RIAs.

CHANNEL SNAPSHOT

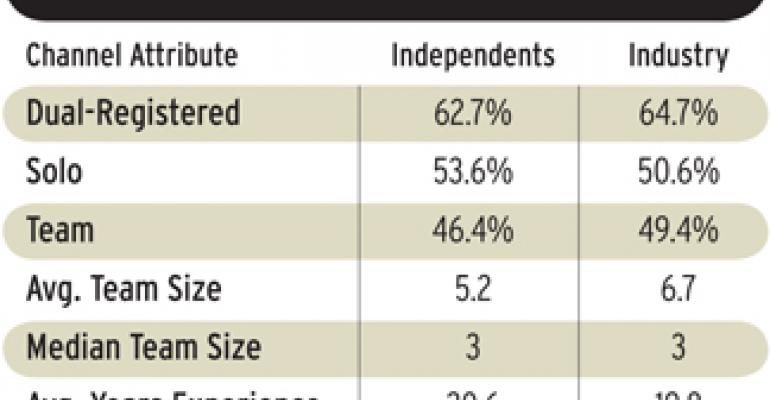

Dual-Registration — Independent advisors are nearly on par with the industry in terms of their progression toward dual-registration, or the hybrid model.

Some independent firms, like LPL, foster the hybrid model by helping advisors to overcome the challenges of dealing with multiple platforms. Dually registered independent advisors manage slightly more assets than their non-dually registered counterparts; 28 percent of the former manage $100 million or more, compared to 24 percent of the latter.

Solo Practitioner vs. Team — Most independent advisors still go it alone, with 54 percent identifying themselves as solo practitioners. Among the 46 percent who said they were part of a team, the median team size was three advisors, which is on par with the industry. Team members manage notably more assets; less than 19 percent of solo practitioners manage $100 million or more, compared to nearly 35 percent of team members.

Fee-Based Revenue — Independent advisors derive a slightly higher percentage of their revenue from fee-based business compared to the industry average, signaling that independent advisors (and their broker/dealers) have embraced their roles as fiduciaries and holistic planners in order to survive and grow. Currently, independent advisors derive an average of 35 percent of revenue from fee-based business, a figure they expect to grow to 45 percent by 2014.

PRODUCT USAGE

Product usage among independent advisors reflects the transition occurring in the channel. Though they exceed the industry average in their use of commission-based products like variable annuities, they also use more fee-based mutual fund wrap accounts than average.

Where independent advisors lag is in their use of sophisticated products generally geared toward high-net-worth investors, including hedge funds and structured notes. Only 30 percent recommend hedge funds, compared to the industry average of 36 percent, and only 40 percent recommend structured notes compared to the industry average of 46 percent.

Expected future product usage also reflects a dichotomy. While independent advisors expect a slight increase in their use of variable annuities, they also expect to use slightly more mutual fund wrap accounts and SMAs.

Independents also use more passive investments than the industry average, and are among the most likely to use passive investments as a core portfolio investment. Though fewer independent advisors currently use ETFs compared to the industry average, ETFs are the product most likely to experience incremental growth in the channel over the next 12 months.

ASSET ALLOCATION

On average, independent advisors have higher allocations to international equity (28 percent), and lower allocations to fixed income (23 percent) compared to the industry average. On the domestic equity front, they make slightly less use of large-, mid- and small-cap equity and slightly greater use of specialty equity than the average industry advisor. Independent advisors also have higher allocations to global equity, perhaps offsetting their lower-than-average domestic equity allocations.

Independent advisors were most likely to have made asset allocation adjustments over the past year due to changing risk/return expectations, followed by regular rebalancing. Though they don't anticipate making significant changes over the next 12 months, asset classes that could gain some assets from independent advisors include international equity and alternatives. These assets are likely to come from government fixed income and cash, the only two areas where independents plan to decrease their allocations.

Similar to other channels, American Funds and Franklin Templeton enjoy dominant positioning in the independent channel, but joining them in popularity is OppenheimerFunds, which is a preferred manager for domestic and international equity. Fidelity also received multiple mentions among independent advisors, which could be a reflection of the channel's higher-than-average use of specialty domestic equity asset classes.

Fees and expenses ranked as the top screening criterion among independent advisors, in contrast to its number 5 ranking among wirehouse and regional advisors. This ranking likely reflects the lack of preferred lists, and other types of prescreening that may be conducted at the home-office level in other channels. Among the other top screening criteria were reputation of manager, fixed-income statistics, and relative performance.

This article is excerpted from “Distribution Dynamics, Investment Selection 2010: A Guide to Advisor Views on Current and Future Product Usage, Asset Allocation, Preferred Asset Managers and Portfolio Construction.” The research report, the first in a series, was written in the third quarter of 2010 based on a survey of more than 1,000 advisors around the country in the various FA channels.

The research was conducted by Rep. ThinkTank, a consortium of industry experts — Registered Rep. magazine, The Oechsli Institute, FUSE Research Network, and Momentum Partners. The goal is to provide an integrated research and consulting approach that enables asset management clients to focus their product features and benefits, differentiate from each other, and gain appropriate distribution. The Rep. ThinkTank motto is: “We know what is on the mind of Advisors.”

The Oechsli Institute caters to FAs who want to attract and develop loyal affluent clients. Fuse Research is a research and consulting firm specializing in the asset management industry. And Momentum is a boutique advisory that helps fiancial firms develop brand strategy.

For more on RepThinkTank please visit, repthinktank.com. The complete 104-page study is available for purchase by calling Registered Rep.'s Vice President, Bill O'Conor on 212-204-4270.