Former wirehouse rep David Boling joined regional broker/dealer Morgan Keegan in late October from Wachovia. The turning point: “When we were told on a Friday that Citigroup was going to buy the bank and we'd be spun off. That same weekend, Wells Fargo jumped in and wanted all of Wachovia's units and the FDIC backed out on Citi. I realized the FDIC was at the helm of this decision and I put my team up for bid.”

Boling met with five b/ds — wirehouses, regionals and independents — before choosing Morgan Keegan. “I have always been biased against regional firms. When people would talk about leaving a wirehouse and joining a regional, I'd say, ‘Why would I jump out of a Cadillac and into a Chevrolet?’ Well, turns out, the Cadillac I was in was on fire and I ended up leaping out of it into a souped up Saab. It's a little smaller, but it's better engineered,” he laughs.

Perhaps more than anything else, Boling was impressed with the firm's product offerings. “They had almost everything I needed, and made commitments to get the things they didn't,” he says. Boling got confirmation that he'd made the right decision about moving when clients who previously refused to open new accounts with him at Wachovia were now willing to do business with him. He had also watched about $5 million of existing client assets walk out the door as a result of his association with Wachovia — one of those clients was Boling's own uncle. Since moving to Morgan Keegan, he's won his uncle's business back.

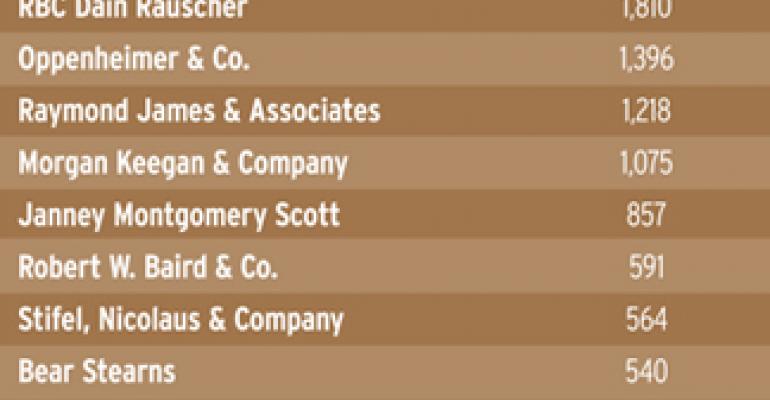

Boling is one of a growing number of former wirehouse advisors who have joined regional broker/dealers like Morgan Keegan, RBC Wealth Management (formerly RBC Dain Rauscher), and Janney Montgomery Scott in the past eight or so months. Like Boling, many of them would not have considered such a move just a year or two ago. Major upgrades in technology and platform offerings in recent years at the regional firms, coupled with a desire among many wirehouse advisors for stability, security and a conservative investment philosophy, has made this collective change of heart possible. While he could not offer an exact figure, Christopher Yeomans, research analyst at the Financial Research Corporation in Boston, predicts that recruiting in the channel will continue to grow in the next couple of years. Today, there are about 39,791 financial advisors at regional b/ds, up 11 percent versus the end of 2006 when there were 35,853 reps, according to FRC and Discovery Database data. And regionals have been the largest recipients of wirehouse reps switching channels since November 2008, according to Shrewsbury, NJ-based Discovery. (See table on next page.)

All of this recruiting success is very good news for regionals, which had been consolidating and losing reps for years. “In 2004, you had about 150 regional b/ds. Now you see there are about 50 left and only a handful with a significant number of advisors. We expect that to change,” says Yeoman. Firms lost reps as they merged, he says, because, in their bid to cut costs and increase profit margins, the newly combined firms often drove out lower tier advisors. But they lost out on the upper end too, as top producing advisors were lured away by enormous compensation packages that firms in other channels were offering, he says. With higher producing reps headed back in the regionals' direction, some of them are raising their production minimums, which is, in turn, making them more profitable. A channel that some thought was on its death bed is evolving into one with a small but strong group of firms.

Reeling It In

Janney Montgomery Scott, a regional firm based in Philadelphia with 865 reps, is cleaning up with departing wirehouse brokers so far this year. In 2008, the firm hired 53 financial consultants with annual production of around $500,000, which, if you try to average it, breaks down to around 4 advisors a month. About 75 percent of those reps came from wirehouses. In January 2009 alone, the firm hired 18 wirehouse advisors with average annual production of around $800,000. If the firm continues at this pace, it will hire more than 200 wirehouse advisors this year. And, as is apparent in the numbers, the new recruits' typically produce at least 50 percent more than prior years' recruits did. Many of them are million dollar producers, the sweet spot where many brokerage firms are concerned. In fact, Janney hired more million dollar producers in the last four months than they typically hire in the course of one year.

“What are we doing to attract these advisors? Simple. We're just answering the phone,” says Jerry Lombard, president of the Janney's private client group. “They're the ones doing the calling. They're calling us saying, ‘We're tired of making excuses for the firm we work for.’ They want to get away from conversations explaining the troubles their firms are in and actually help clients in this market,” he adds.

Janney is doing so well with larger producers, in fact, that as of last month the firm raised its production minimum for new recruits to $500,000 from $350,000. It's not stopping there. Existing advisors must now meet a $250,000 production minimum, up from $175,000. “We want a more successful advisor,” Lombard says. So even if the firm hires another 100 advisors from wirehouses, Lombard says he expects the firm's 2009 FA headcount to level off at just over 900, as lower producing advisors are trimmed away.

In Minneapolis, RBC Wealth Management is doing the same. John Taft, head of U.S. Wealth Management for RBC Wealth Management, says the turmoil on Wall Street has created “unprecedented attraction” to the regional model among wirehouse advisors who wouldn't have looked twice at them in the past. “Now, these same advisors have put our firms at the top of the list of places they want to run their business,” he says. That, he adds, gives the firm an opportunity to “upgrade the advisor force by dropping off advisors at the low end and bringing on advisors who are of the quality and caliber that we want.” Taft acknowledges such mass migration wouldn't have been possible if the wirehouse advisors' deferred compensation packages (heavily invested in their company stock) hadn't imploded as the value of their employers' stock collapsed in the past year or so. The so-called golden handcuffs have come undone.

When she joined RBC Wealth Management's Dallas office in January, 10-year Smith Barney veteran Kelly Rigas left behind a “worthless” deferred compensation package, she says. “I had about nine years of savings in the [capital appreciation plan]. It used to be worth hundreds of thousands of dollars, but it was all gone. That's how most of the people there retired with millions, but that's not an option anymore,” she says.

For RBC, that means more calls from wirehouse reps. In 2008 and through first quarter 2009, RBC WM says it received more inquiries from financial advisors than ever before. In fiscal year 2008 (which ended October 31, 2008), the firm hired 157 financial advisors, up from 96 the previous year. Between November 2008 and February 2009, RBC hired 88 financial advisors — 90 percent of them from wirehouse firms. Taft says new financial advisors generate double the production of advisors who are leaving the firm.

Over at Baird, the year is off to a great start. In 2008, Baird hired 49 financial advisors. The firm will have exceeded last year's new hire count by April 15. Mike Schroeder, director of Baird Private Wealth Management, says he's looking to attract and bring on the best advisors in the country: ones with a distinctive focus on an advisory wealth management practice, with more than half their business in fees. The target recruit for Baird has at least $100 million in assets under management and at least $500,000 in production. In January and February, the firm brought on 26 advisors — all but one came from wirehouses. An additional 24 advisors will join the firm by mid April. Each year, Schroeder budgets to take on between $65 to $70 million in revenue via new advisors. “I think we'll perform well beyond our expectations. We are saying ‘No’ to advisors as often as we're saying ‘Yes,’” he says.

Moving On Up

Executives say the advisor recruits darkening their doors are looking for stable b/ds with strong product offerings, cohesive office culture and full-service back-office support. Unlike the many advisors who have switched to independent b/ds and RIA firms in recent months, these advisors like the full-service model and don't want to play entrepreneur. But they're sick of the drama on Wall Street.

Jim Parrish, president of Morgan Keegan Private Client Group in Memphis, Tenn., says that most wirehouse advisors are dealing with too much stress right now to be trying to figure out whether or not they can be entrepreneurs. “Lots of these advisors don't feel comfortable running a business. Those that aren't sure if they're entrepreneurial are saying they don't want to find out,” he says.

“Regionals are mini wirehouses. They offer big branch offices, an employee model, a bit of investment banking and decent technology,” says Bing Waldert, associate director of Cerulli Associates. “A lot more wirehouse advisors who have to answer to their clients about their firms' problems are looking to regional b/ds for their conservative business models.” Unlike wirehouses, many regional firms steered clear of mortgage-backed securities, sub-prime loans and asset-backed securities, tending to stick with straight forward mutual funds and ETFs.

Rigas, who joined RBC in January, says before settling on RBC, she spent some time checking out the biggest independent b/ds. But she believed her clients would feel more confident about the backing of a firm like the Royal Bank of Canada than they would about an independent b/d. “Going independent is just off the table. Because if you can't trust something as large as a Citigroup or Bernie Madoff, the former chairman of the NASDAQ, how can you trust your sweet broker, Kelly, down in Dallas?” she says.

For Rigas, the actual move from Smith Barney to RBC Wealth Management was easy. Her new office is located just 6 floors above her former Smith Barney digs in the same building. But the two offices couldn't be more different. Rigas explains, “I'm not sitting on conference calls each day about how to talk to clients about capital problems and stability. There are no e-mails listing talking points on how to defend the firm to clients. Here, they didn't participate in any of the problems facing the big firms. We just focus on going forward and serving clients.”

Another reason for the regional firms' increasing appeal among wirehouse recruits is that the firms that survived the recent wave of consolidation in the regional landscape have re-invested heavily in the business. Most firms have put that money towards upgrades in technology, products and platforms — according to critics, all areas that are inferior in quality compared to the wirehouses. “We saw the firms left standing after the regional acquisition spree gearing up for long-term survival,” Waldert says. “Both Dain and Baird, for example, were putting up resources around their advisors to help them grow. A good number of firms were building some scale and re-establishing themselves for the long-haul.”

Parrish says the idea that regional firms are behind on technology and product upgrades is a wide misperception, anyway. Baird's Schroeder concurs. “It's nonsense. We have every capability in technology that any other organization has. Technology is no longer a novelty,” he says.

The numbers of wirehouse advisors joining the regional firms suggests they're right. “There's no question the relative attractiveness of the regional firms has been significantly improved as the result of the Wall Street mess,” says Taft. “This is a once in lifetime opportunity to attract the best advisors in the business. In our business, the way you get better is to attract better financial consultants. Of course, you have to support them so they can do the best possible job for their clients, but it all starts with the quality of the advisor.” In that respect, regional b/ds seem to be headed in the right direction.