One of the effects of the pandemic is that it has driven an already wide gap between the value of late-stage, pre-IPO (initial public offering) tech companies and their post-IPO valuations to a level that’s becoming hard to fathom. The magnitude of the gap suggests that either private investors are valuing these pre-IPO unicorn companies far too low, or that public investors, in their exuberance for new economy stocks, are piling into them with such abandon that it is reminiscent of past market bubbles. But one thing is certain: Private market investors are reaping the greatest rewards, while public investors are taking on more risk with less potential upside.

Today’s IPOs – More Mature with Higher Valuations

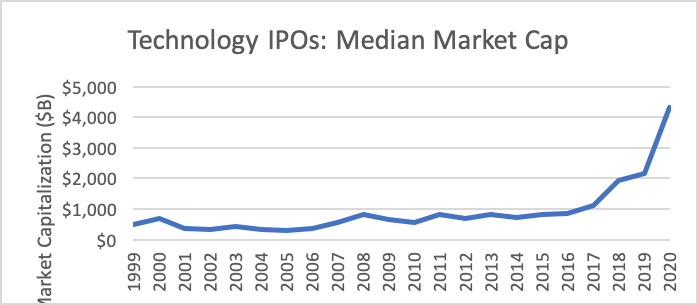

The average unicorn that went public last year – excluding the outliers in the top and bottom deciles – was valued at just over $3.1 billion in its last round of private financing, according to Crunchbase and CNBC. This average unicorn came to the public markets in 2020 with an IPO market capitalization of approximately $7.5 billion (about 10 times Microsoft and 20 times Amazon’s market caps at their IPOs), and public market investors bid up these stocks another 50% in their first day of trading.

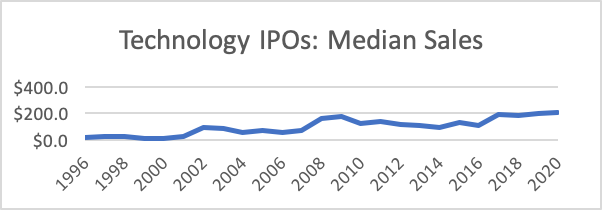

Most of these companies are well past their hyper-growth phase. In fact, the average age of a tech company at the time of IPO in 2020 was a record high of 13 years. These unicorns have used their dozen or so years marinating in the private markets to build their businesses, with the median tech company generating revenue of over $200 million over the 12 months prior to its IPO. Companies coming public in during the dot-com era had average annual revenues of just $12 million and were much younger, according to Jay Ritter, Cordell Professor of Finance at the University of Florida. Future tech giants like Amazon, eBay, Salesforce, and Google went public when they were between 3 and 6 years old with enormous growth left ahead for public shareholders.

Jay Ritter, Cordell Professor of Finance, University of Florida

The median initial market value of 2020’s technology IPOs reached $4.3 billion. By comparison, it took Microsoft and Amazon multiple years as public companies to reach a similar size. In short, even though the tech IPO class of 2020, on average, comprises more mature and larger companies than in prior years, the public markets are rewarding them with valuation multiples that were once reserved for much younger businesses in their hyper growth phase.

Jay Ritter, Cordell Professor of Finance, University of Florida

The Pandemic Fuels a Tech Boom … and Perhaps a Bubble

The resurgence of tech IPOs is attributable, in large part, to the pandemic, which has pulled the use of technology forward by years, accelerating the shift from the old to the new economy. There is also tremendous pent-up demand by individual investors to own well-known unicorns with which they have had personal experiences but haven’t been able to own because they were private. As a result, many public investors seem willing to pay almost any price to include these New Economy companies in their portfolios, once they become available.

Over the past 20 years, private equity and venture capital firms have created a virtuous circle that has made them the preferred choice of capital for the talented entrepreneurs behind these innovative companies. Most individual investors must wait for these companies to come public at often breathtaking valuations and thus take on greater risk with less upside, compared with institutional investors and the very wealthy, who can access these companies at more favorable entry points. Consequently, today’s public investors are less likely to capture an amazing tech company at its hyper growth phase at a reasonable multiple.

However, this is slowly changing as feeder funds and certain ‘40 Act funds are providing qualified purchasers and accredited investors, respectively, with access to private growth investments. In addition, the Department of Labor issued an information letter in 2020 giving the green light to defined contribution plans to use private equity within asset allocation funds, such as target date funds. This leveling of the playing field will provide a long overdue opportunity for many individual investors to participate on a limited basis in the growth of tomorrow’s market leaders, and perhaps help limit some of the excess exuberance when these companies come to the public markets.

Nick is Co-Founder and one of the Managing Partners of iCapital Network, where he is Head of Portfolio Management. Aref Jessani is a Senior Vice President of Research and Due Diligence at iCapital Network.