Although retail banks, private banks, discount brokers, insurance companies and fintech outfits have spent a great deal of time and money developing a wide range of offerings, the affluent segment remains poorly served. This shortcoming represents an opportunity for savvy wealth advisors.

In its annual Global Wealth report, released Thursday, Boston Consulting Group highlights the affluent segment (defined as those with personal wealth of between $250,000 and $1 million) as an area of financial advisory market inefficiency that is ripe to be capitalized on.

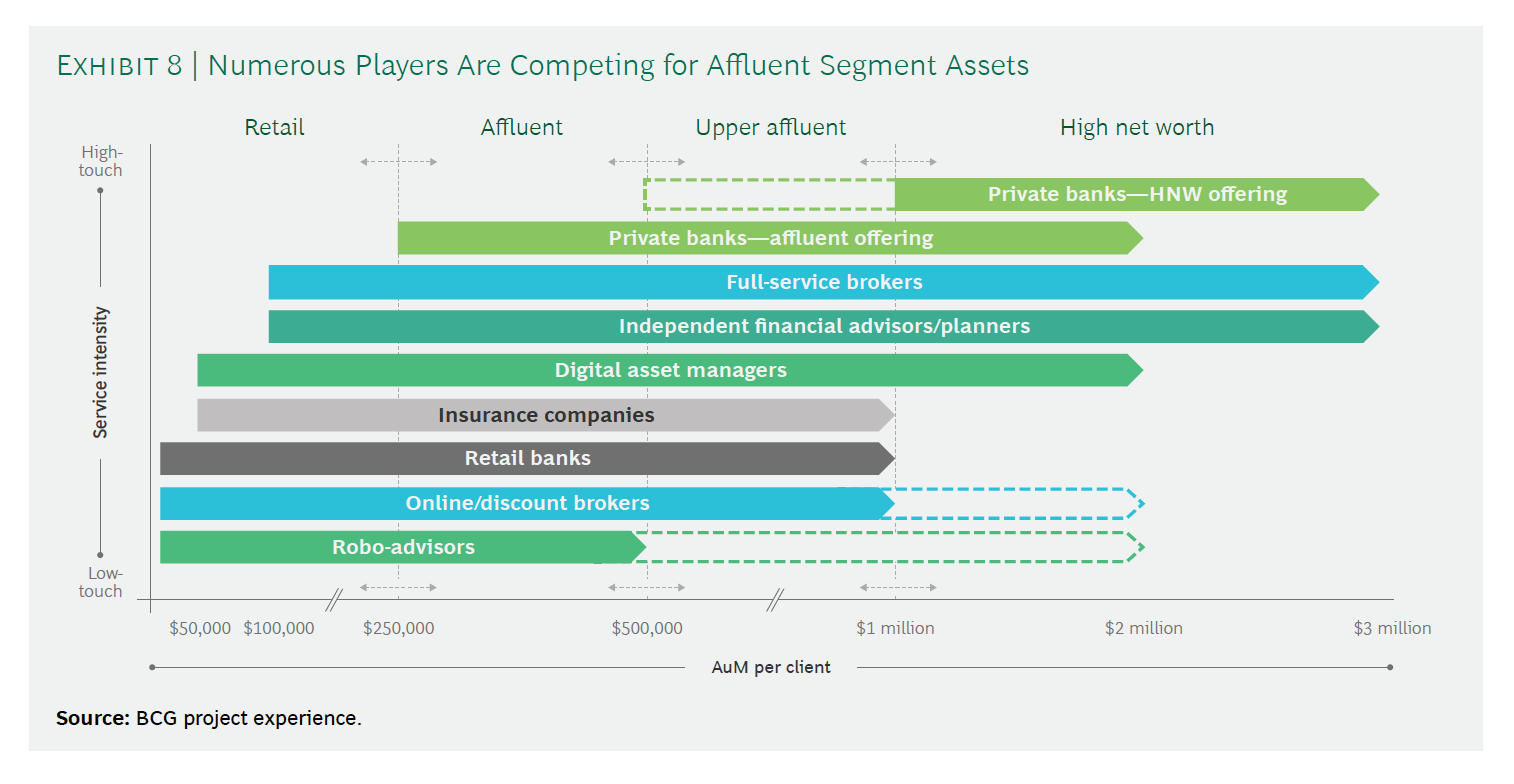

The report estimates that this segment represents 76 million individuals globally who control roughly 16% of global wealth—the second-largest concentration by percentage. Further, the report indicates that this segment’s investable assets are projected to grow at an above-average compound annual growth rate of 6.2% over the next five years. This combination of strong projected growth (particularly in light of the overall downward global economic trends of 2018) and sheer size present an attractive target. Unsurprisingly, there’s already a great deal of competition for their attention across the financial advice spectrum.

However, current offerings simply aren’t properly meeting this group’s needs. According to the report, Shortcomings include: “cookie-cutter and overly simplistic offers from retail banks, overpriced services from brand-name firms and ill-fitting product recommendations from various wealth management providers.” Trust is also an issue, as regulators around the globe have instituted numerous consumer protection measures in recent years to safeguard investors, but the response to these efforts from wealth managers has been largely self-defeating. The report notes that, “Rather than aligning their business models with the needs of customers and digitizing processes to embed new protections, many firms take a tick-the-box approach to compliance and rely on manual input and paperwork-heavy steps that add time, cost, and error to their processes without meaningfully improving their handling of the underlying governance issues.”

According to Anna Zakrzewski, one of the authors of the report, partner and managing director at BCG and leader of the firm’s global wealth management segment, “Hardly any one of these providers really meet the rising expectations of these clients. With digitization, data analytics and personalization, you can actually develop a really efficient crystalized model that meets these clients’ expectations and provides fast, go-to-market product innovation.”

Ultimately, the report lays out three factors that could be key in finding success in the affluent market:

Build a deeper understanding of key affluent subsegments and their needs. Wealth managers that tailor value propositions to individual subsections within the affluent band—for example younger emerging affluents or those preparing for retirement—innovate new offerings and align them to key stages in the individual’s investment life cycle can get a leg up. However, deriving these insights is not a casual exercise. Wealth managers must gather data from multiple sources and leverage or create analytical algorithms that can discern client investment and lifestyle habits. They can then use those insights to map the typical investment journey for these different subsegments, end to end.

Zakrzewski cites smaller regional banks as a group that’s rapidly catching on to this opportunity, and making changes to capitalize on it:

“What we see is regional banks globally sitting on assets and a pool of clients.” She explains. “For instance, in Asia, most of the regional banks have thousands, even millions of clients, in retail banking. And in that pool, they have HNW and affluent clients, but they don’t really differentiate their offerings. What they’re now realizing is that wealth management and private banking are really attractive, relatively low on capital and you can grow and deliver a great service to clients. So, the local retail banks are building an affluent banking service model. There is a whole wave of regional local banks making this shift, because they have the clients already, it’s just a question of how they can serve them better.”

Use technology to personalize at scale. To extend the reach and quality of service, wealth managers must get over their fear of technology and adopt digitally augmented coverage models. Digital self-service capabilities can be mutually beneficial by enabling affluent clients to manage routine matters quickly and experiment with different portfolio options without having to take up an advisor’s time and energy or be stuck waiting for him to call them back. Allowing digital tools and interfaces to do the heavy lifting on basic tasks lets advisors serve more clients—and serve them better. However, developing capabilities and platforms like these requires significant investments in data architecture, software and analytical engines. Wealth managers tolerance/ability to afford such changes can vary wildly. That said, operating models must also evolve. The arm's-length relationship between advisors and the product and marketing organizations that is common now must be actively disrupted in order to accelerate the product development cycle.

Create incentive structures that promote the right behaviors. Misaligned incentive arrangements, such as product sales targets, put institutions and advisors alike are at risk. To protect client interests and safeguard their own, wealth managers should revisit their performance management practices to ensure that the right governance, protocols and metrics are in place. Compensation structures should reward client centricity and positive client feedback.

“This is an interesting disruptive phase.” Zakrzewski explains. “Everbody is kind of trying to play with it.” The question now becomes, “Who’s going to win the game?”