Technology companies like Betterment and Wealthfront tend to dominate the media narrative around robo-advising, but tech startups represent just 15.9% of the direct-to-consumer digital investment market in terms of AUM, according to a report released this week by the research and advisory firm Aite Group. The report’s authors predict that this market share will drop to 6.6% by 2023 as discount/online brokerage and full-service wealth management firms invest more in their digital offerings.

"We don't see the startups growing nearly as fast as some of the other segments,” said Eric Sandrib, research associate at Aite Group and one of the authors of the report. “Over the next five years we see the startups growing 15% per year compared to a 64% compound annual growth for the full-service wealth management firms."

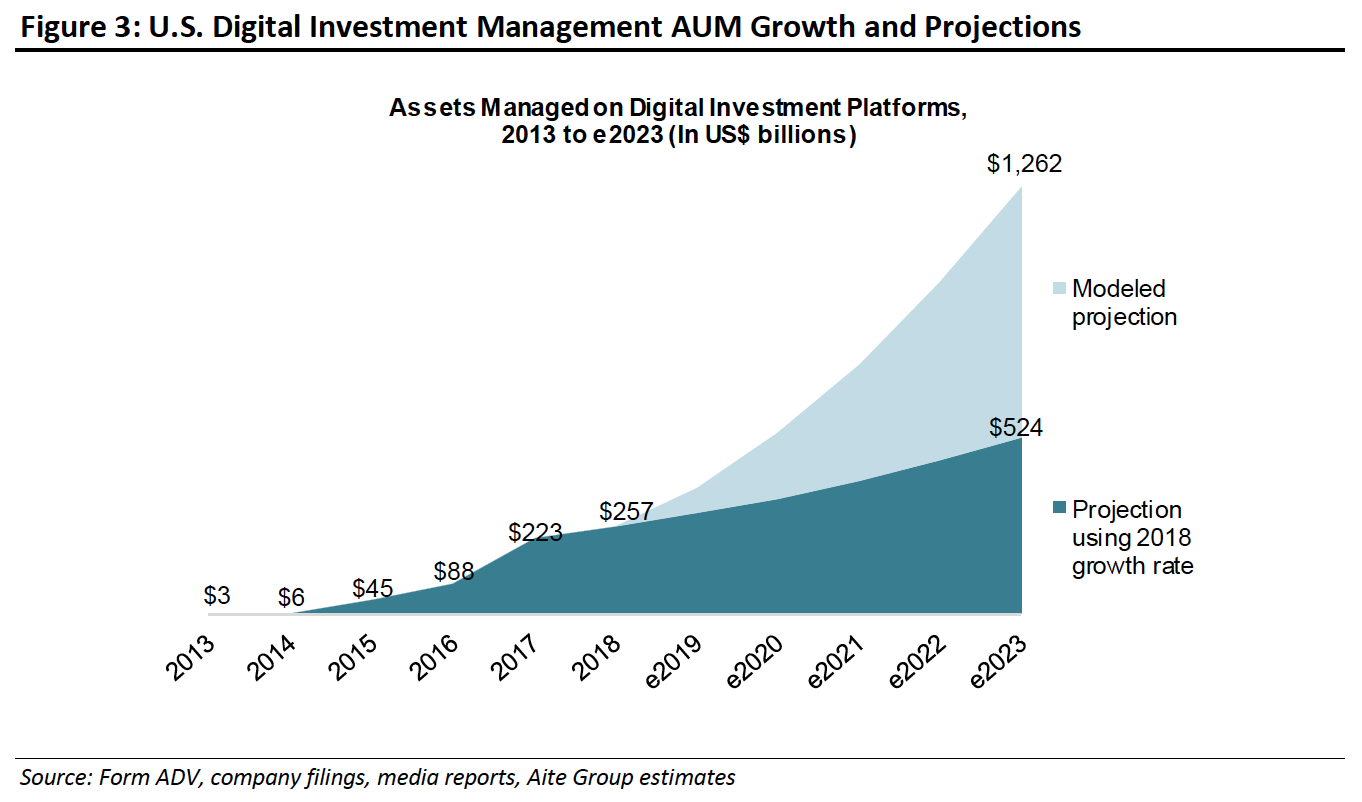

In its least conservative modeled estimate, Aite Group projects that direct-to-consumer digital investment assets under management could reach $1.26 trillion in 2023, up from $257 billion in 2018. The research firm expects large financial institutions like J.P. Morgan Chase and discount/online brokerages like Charles Schwab to capture much of the growing market as they tap into their existing client bases and expand their digital offerings to service customers with lower asset levels who trust a brand name firm over a new entrant. A more conservative estimate using the 2018 growth rate for future projections puts the market at $524 billion.

With its higher-estimate scenario Aite sees full-service wealth management firms using robo-advising to shift poor profitability, low asset clients from direct advisor relationships into lower cost digital solutions, improving the efficiency of their businesses. Having a robust digital investment offering could also help with future regulatory requirements.

"If the SEC or some other regulatory body comes out with changes or future rules, then that again could cause these full service firms to say, 'we need to change our business models for some of the low investors where it doesn't make sense for them to be paying over 100 basis point for a traditional advisor,'” Sandrib said.

Incumbents like UBS or Fidelity don’t need to profit right away from digital products because they have large diversified businesses that would offset near-term losses, said Sandrib. “They don't have the pressure that a startup has to be profitable and go to an IPO or show tremendous growth to get more venture money,” he said.