Many lead advisors were exasperated with next gen advisors preference for digital communication over a human connection with clients. “Developing and deepening relationships cannot solely be done through email and social media”, said one advisor. Another frustrated advisor stated that the skill gap is almost entirely about communication and human relations noting “screen time is destroying the interpersonal fabric of our culture”.

Not surprisingly, the challenge that the next generation of advisors face regarding new client acquisition was the next most prominent item on advisor’s lists. Lead Advisors, who often expect a next-gen advisor to instantly contribute to the practice’s bottom line, often express frustration at the pace at which new advisors develop new-client acquisition skills.

Technical knowledge of financial planning concepts ranked third on the list. Many advisors noted that while the acquisition of estate planning, tax planning, and risk management knowledge is important, many young advisors had difficulty applying those teachings to actual client scenarios. Younger team members, said one advisor, have difficulty “understanding the difference between academic planning and practical planning.” Another advisor lamented that many young advisors know more about “school-book solutions” than “real-life financial events.”

Once younger advisors are brought onboard, more-senior advisors naturally want to know when they’ll be productive team members. Some firms address this concern by involving the next generation of advisors in meaningful projects as soon as possible. Doing so may not only boost these younger advisors’ levels of engagement, but also may get them thinking more strategically about the firm’s operations and how they can contribute in a meaningful way.

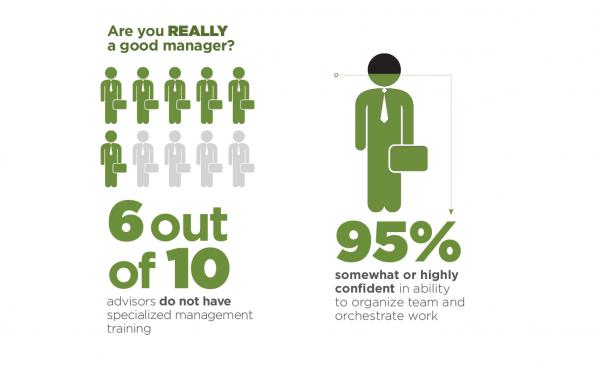

Breakthrough for Growth research revealed more than 60% of the 350-plus advisors do not have specialized management training, such as a college or graduate degree in the subject. What’s more, nearly half have never received any kind of formal training in how to manage colleagues. But it’s clear that many advisors believe that their management experience has given them the skills necessary to effectively train and oversee their teams of younger advisors.

Indeed, regardless of how much training they’ve received, Breakthrough for Growth’s research found that advisors are extremely confident in their ability to organize their team and orchestrate their work. Roughly 95% of advisors surveyed said they were somewhat or highly confident in their abilities to effectively organize their team and orchestrate the team’s work. Just 5% of advisors admitted to a lack of confidence in creating a team where everyone is put to their highest and best use.

Lack of Confidence

But while most advisors thought highly of their broad aptitude as managers, the reality is that many weren’t very confident about their skills on specific managerial tasks. For instance, advisors agreed that creating a highly engaged team and developing clear roles and responsibilities among team members were the top two leadership skills. But they also agreed that their ability to put those skills into action didn’t match the tasks’ importance. And when we asked advisors to talk about their biggest challenges, many advisors admitted they struggled to craft roles and responsibilities for younger team members, and to ensure next-gen advisors were put to their highest and best use.

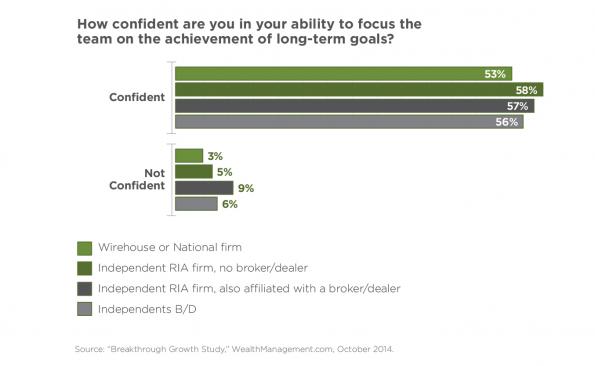

Indeed, it appears that long-term strategic planning may pose the greatest challenge to advisors. While 42% of advisors surveyed were highly confident in their abilities to focus their teams on long-term goals, more than half—53%—said they were only somewhat confident in setting a clear vision and driving the team toward these goals.

Despite the difficulties of long-range planning, advisors agree that creating clear long-term goals for their teams is one of the most important tasks for someone in a leadership role. In order to achieve engagement, younger employees need to be able to see where their path leads, and where the firm is going. Developing plans helps to clarify expectations and identify the steps needed to achieve them.

Meanwhile, the study also found that advisors generally believe that creating clear short-term goals—both for individuals and for the team as a whole—is less important than long-range planning. Short-term goals are important, but if they are not connected to the achievement of a long-term vision, their efficacy is often diminished.. If a younger employee gets feedback that says what they need to do this week, or next month or even within a year, it doesn’t answer the question of their long term career path and opportunities for advancement, learning and engagement. Next gen advisors need help connecting the dots as to how their daily activities contribute to their long term success and that of the firm.

About WealthManagement.com

WealthManagement.com is the digital resource of REP. and Trusts & Estates. It provides the latest news, industry trends and investment ideas for more 800,000 centers of influence in wealth management—from financial advisors and planners to estate-planning attorneys and CPAs.

We deliver unbiased insights through websites, mobile devices, magazines, newsletters, email, white papers, videos, webinars, events and social media channels.

To learn more, visit wealthmanagement.com

About

BreakthroughGrowth

Breakthrough Growth, LLC is a joint venture between The Collaborative and Purpose Consulting Group. Established by two industry veterans to meet the need for effective hands-on resources to accelerate productivity of the next generation of advisors and their leaders.

Christine Gaze is president of Purpose Consulting Group, a practice management consulting firm that works with financial services leaders to develop strategies and thought leadership programs that engage and advance financial advisors. In the last 20 years, she has held a variety of leadership roles in practice management and human capital at firms such as Merrill Lynch, Morgan Stanley, AllianceBernstein and TD Ameritrade. She is a frequent speaker, avid researcher, and writer.

Christine Gaze is president of Purpose Consulting Group, a practice management consulting firm that works with financial services leaders to develop strategies and thought leadership programs that engage and advance financial advisors. In the last 20 years, she has held a variety of leadership roles in practice management and human capital at firms such as Merrill Lynch, Morgan Stanley, AllianceBernstein and TD Ameritrade. She is a frequent speaker, avid researcher, and writer.

Beverly D. Flaxington (The Human Behavior Coach™) has spent more than 25 years in the investment industry as a sales and marketing expert, corporate consultant, college professor and Gold-award winning author She has been quoted in hundreds of media outlets, including the Wall Street Journal, MSNBC.com and USA Today. Her latest bestselling book is titled Understanding Other People: The Five Secrets to Human Behavior.

Beverly D. Flaxington (The Human Behavior Coach™) has spent more than 25 years in the investment industry as a sales and marketing expert, corporate consultant, college professor and Gold-award winning author She has been quoted in hundreds of media outlets, including the Wall Street Journal, MSNBC.com and USA Today. Her latest bestselling book is titled Understanding Other People: The Five Secrets to Human Behavior.

Next: The Advisor's Role