After a weak start to 2014, the U.S. dollar has muscled its way higher this summer and the long-term gains may not be over.

The U.S. dollar index, which contains a basket of currencies including the euro, the Japanese yen and the British pound, is coming close to levels not seen in over a year and some currency analysts said the longer-term trend for the dollar is slated to go higher.

In part that’s because of an improving U.S. economy and an evolving monetary policy from the major central banks. The Federal Reserve is unwinding its asset-purchase program and is expected to be done by October. Meanwhile, the European Central Bank (ECB) and the Bank of Japan (BOJ) are adding stimulus measures to boost their economy, which pressures their currencies.

There are a few ways investors can take advantage of this structural currency divergence using mutual funds, but advisers warn these should be treated as speculative investments and not part of a core holding.

Since 2010 the BOJ has used some sort of asset-purchase program to force the yen down as part of “Abenomics,” the economic policies program of Prime Minister Shinzo Abe. Meanwhile, the ECB finally embraced a looser monetary policy, with ECB President Mario Draghi saying in early September the central bank would purchase asset-back securities, in addition to lowering interest rates.

The weakening economies there, combined with ideas the U.S. economy is growing well enough for the Fed to end its quantitative easing program and perhaps raise interest rates next year, has helped the dollar index rise. As of mid-September it was at a 14-month high of around 84.50 and was up 4% year-to-date. Specifically against the yen, it is at a six-year high and also at a 14-month high against the euro.

Currency analysts at BNP Paribas raised in September their dollar index forecast to 84.86 for 2014 and to 91.16 for 2015, while lowering their 2014 and 2015 forecasts for the euro and yen.

In fact, longer-term U.S. dollar strength is becoming “a popular view among currency managers,” said A.J. D’Asaro, alternative fund strategist at Morningstar. D’Asaro noted U.S. investors do have dollar-exposure simply by investing in U.S. markets.

John Person, president of NationalFutures.com, said he hesitates chasing the greenback rally at this point because, as the dollar index has steamrolled its way higher this summer, a short-term pullback is likely. He wants to see if it can get “substantially” above recent levels. “I’ll suspect the rally in the U.S. dollar is for real when we break above the two-year highs around 85.60,” he said. “Is the dollar up because of anticipation of stronger fundamentals and higher interest rates, or is flight-to-quality because there is a lot of European weakness amid Russia-Ukraine concerns?”

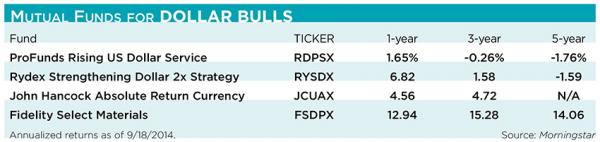

For portfolio managers who wish to speculate on further dollar strength using mutual funds, there are a few options available. ProFunds offers the Rising U.S. Dollar ProFund (RDPSX), which seeks to track the U.S. dollar index. It is up 2.65 % on the year as of Sept. 12 and has $39.4 million under assets.

Guggenheim Investments offers the Rydex Strengthening Dollar 2x Strategy (RYSDX), a leveraged fund, which has a return of 8.07% as of Sept. 12, with $68.3 million under management. Being a leveraged fund, it seeks 200% of the performance of the U.S. Dollar Index by investing in derivative instruments such as index swaps, futures contracts and options on securities and future contracts.

Person again reiterated he would not get into a fund until he sees the dollar break above the two-year highs. But he said “if one needs to invest in a fund, then the Rydex is an investment product worth diversifying a small portion of their portfolio.”

D’Asaro suggested portfolio managers may want to look into some absolute return currency funds.

The biggest is the John Hancock Absolute Return Currency, (JCUAX) with $1.9 billion under management, and a 6.26% return as of Sept. 12. The fund has a mix of currencies at any one time. D’Asaro said as of June 30, the fund was long the U.S. dollar and short the euro. It was also long the yen at the time, he said.

He cautioned, though, that by using the currency funds, investors are “basically depending on (the portfolio managers) to make the call. There’s no guarantee they’ll be long the dollar and short the euro,” D’Asaro said.

For instance, he noted that as of June 30, 11 out of 14 largest currency funds were short the U.S. dollar.

D’Asaro said portfolio managers should look at holding currency funds not unlike holding cash.

“When people think about this bet, they may think of it as a great opportunity, a speculative bet. But you’re going short cash and going long cash … it’s not a huge returning investment,” he said.

Person said thinking outside of currency, he might play the rising dollar with a commodity fund. “If the economy is improving you could buy industrial commodities, but stay away from commodities like gold,” he said.

In that vein, he said the Fidelity Select Materials, (FSDPX) would be worth a look. A $2.3 billion fund, is up 5.37% on the year. Its top holdings include Monsanto (MON) and Freeport McMoRan (FCX).