Dave Haviland

Most Americans invest in mutual funds because they are seeking to grow their money. However, most investors also believe that an active manager will sell stocks to protect their investment when markets enter periods of failure. Unfortunately, this is often the furthest thing from the truth.

To start, let’s establish that all markets undergo periods of failure often called bear markets. Looking at the chart below, it’s clear that these failures can be devastating to a portfolio. The mathematical reality of returns supports this: the larger a loss a portfolio sustains, the harder the remaining capital has to work just to break even.

So, what about the typical actively managed fund? Most managers' objective is to beat their index each year. Most managers fail. Worse yet, most active managers don’t, or are not allowed to, act like their investors want them to. So what does a typical investor want? The dual mandate of growth in normal times with a solid effort to reduce losses in times of market failure. What does the investor typically get? Growth in the normal times but little to no loss mitigation during bear markets. Why?

One reason is that fund managers can not stray too far from their benchmark or they will lose their institutional mandate(s). This is an important distinction: individuals and institutions have different expectations. Neither are right or wrong, but institutions typically judge managers in relative terms versus the benchmark. In other words, institutions expect managers to follow their index closely even if it means going over the proverbial lemming cliff. Managers then often claim how great their performance was because they “outperformed.” Meanwhile, as an example, they could have beaten their benchmark’s performance by 1 percent and still lost 37 percent in 2008. To institutions, this is outperformance. To an individual who just lost 37 percent, it is a disaster.

Another reason active management can let investors down can be found in the fund’s offering prospectus. Even though many prospectuses have been modified after the 2007-2009 bear market, many active funds effectively prohibit selling a large percentage of the portfolio. The fund’s managers are required to stay fully or mostly invested because this is what their prospectuses say or what management dictates. Therefore, these managers are prohibited from doing what their individual investors expect them to do: limit the large losses found in bear markets.

Let’s not forget that index funds, by design, will follow their index closely even if it is plummeting like most stock indexes did in 2000-2002 and 2007-2009. Passive investing, seemingly all the rage, is great until human emotion overwhelms the typical investor during a significant drawdown. In other words, most active and passive management still forces the buy/sell decision back onto the client or, if the client is lucky, their advisors.

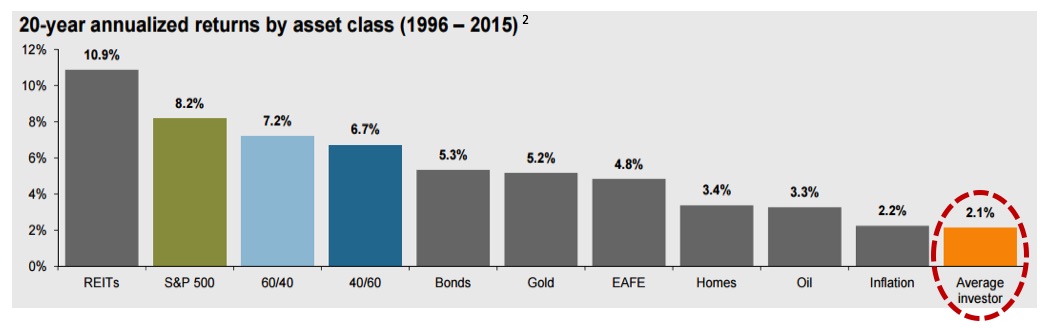

As the chart below illustrates, investors have a history of selling low and buying high relative to the benchmark performance. We let emotions overtake our decision-making process and the results are clear: Investors, as a group, cannot handle the volatility and devastating large losses. They actually want their money to be managed in all market conditions and do not want to, and should not have to, make the buy/sell decisions.

Tactical management was created to meet the typical investor’s needs and expectations. While still considered active, tactical management is quite different. Tactical management seeks growth during “normal” times but is engineered to avoid the majority of the losses found in a bear market. Put simply, tactical managers, most often following rule-based systems, do the buying AND selling for you.

No strategy can avoid all the losses, but as the data above illustrates, the losses found in bear markets typically take years to unfold. It is time to recognize that our industry needs to provide investors options that remove emotion, smooth the ride, and provide investors the opportunity to stay invested throughout the full market cycle by not subjecting them to large, devastating losses. It really is simple: Deliver what investors expect.

Dave Haviland is Managing Partner and Porfolio Manager of Beaumont Capital Managemnt (BCM).