Europe Bond Funds saw their longest run of inflows since the second quarter of 2016 come to an end during the second week of July and flows into Emerging Markets Bond Funds were the smallest since their current inflow streak began in late January as the prospect of further tightening by the U.S. Federal Reserve and an end to quantitative easing in the Eurozone prompted fixed income investors to reassess their current outlooks. Asia Pacific Bond Funds also experienced net redemptions – their 21th in the 28 weeks year-to-date – while Global Bond Funds attracted over $1 billion for the sixth week running and flows to U.S. Bond Fund edged up to a four-week high.

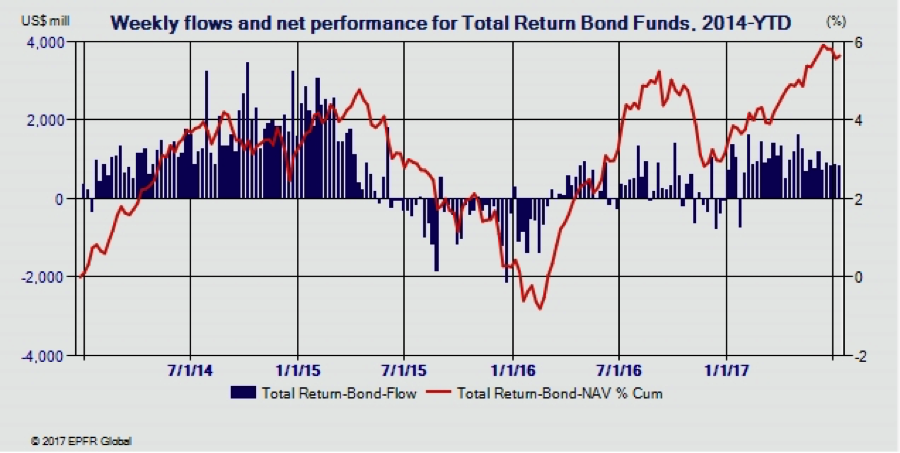

At the asset class level Municipal Bond Funds narrowly avoided their second consecutive weekly outflow, High Yield Bond Funds surrendered over $2 billion and Total Return Bond Funds extended an inflow streak stretching back to late January.

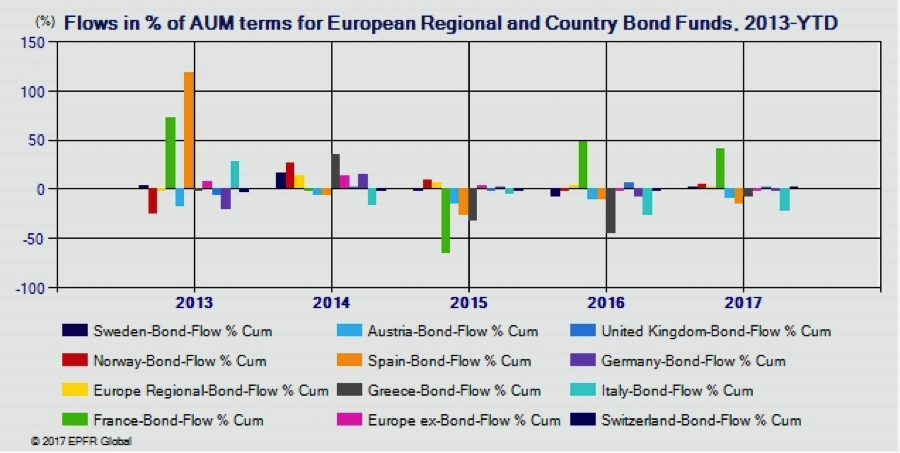

The outflows from Europe Bond Funds were heavily influenced by record-setting redemptions from Spain Bond Funds, with the bulk of those redemptions coming from three domestically-domiciled funds. Investors have now pulled money out of Spain Bond Funds for 23 straight weeks, with outflows accelerating in the wake of signals the ECB is looking to start normalizing its ultra-loose monetary policy. Europe High Yield Bond Funds also saw money flow out for the third straight week.

Emerging Markets Hard Currency Bond Funds posted consecutive weekly outflows for the first time since mid-December as investors reassess the capacity of borrowers to repay their debts if higher U.S. interest rates squeeze commodity prices while making the dollar more expensive in local currency terms. Korea Bond Funds saw a quarter of last week's record-setting inflows redeemed while Thailand Bond Funds snapped a four-week run of outflows with their biggest inflow since early April.

Intermediate Term U.S. Bond Funds recorded the biggest inflows in cash terms among U.S. Bond Fund groups while Intermediate Term Government Funds experienced the biggest redemptions. Long Term Bond Funds topped the list in flows in percentage of AUM terms followed by Short and Long Term Government Funds. Flows into actively managed US Bond Funds continue to level off: at the end of May year-to-date flows into actively managed funds and ETFs were roughly equal, but since early June U.S. Bond ETFs have attracted twice as much new money as their actively managed counterparts.