By Matthew A. Winkler

(Bloomberg Opinion) --As 2018 came to an end, most investors were recoiling from the worst stock market in 10 years, with every benchmark bleeding losses and confusing even the most stalwart money managers. Except Eddie Yoon.

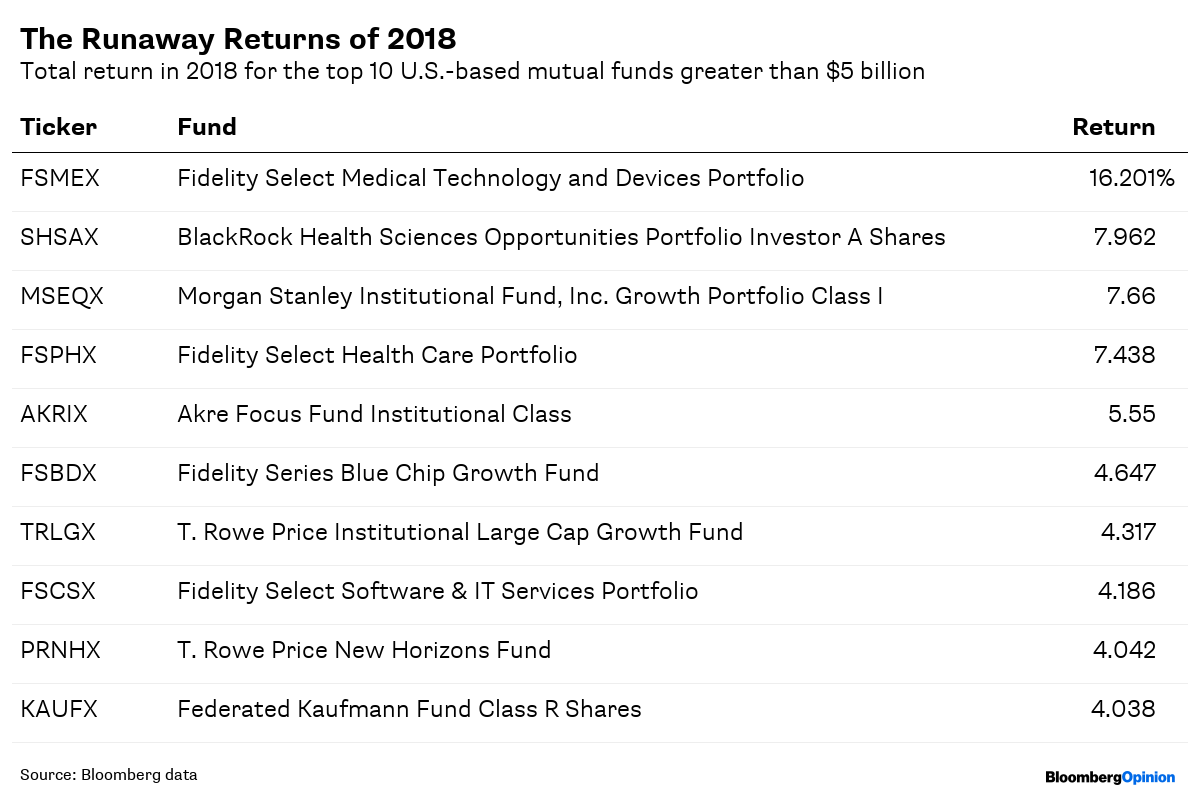

His Fidelity Select Medical Technology and Devices Portfolio has no peers among the 200 U.S.-based mutual funds greater than $5 billion. Fidelity Select Medical, based in Boston, enriched shareholders by more than 16 percent while the Dow Jones Industrial Average, S&P 500 and Nasdaq lost as much as 5 percent.

This is no one-year wonder. The 38-year-old Yoon has consistently outperformed the rest of the market the past decade. He attributes his go-getter instincts to immigrant parents from South Korea who encouraged him to follow them into medicine and become a doctor. Instead he detoured during his pre-med curriculum at Brown University to an internship in financial services and made health care his specialty at J.P. Morgan after he graduated. He joined Fidelity in 2006 and extols health care investing because it makes money in bull and bear cycles alike while saving lives.

Yoon explained his thinking in a telephone interview last month:

Almost every country is getting older. Inside the United States, over 10,000 people turn 65 every day. This is the Medicare population. And utilization really takes a step up when you turn 65, and then it takes another big step when you turn 75. The health care industry is structured in a way where innovation happens in the U.S. and it’s generally exported around the world. So within medical technology — for a lot of these companies — half the revenues are generated in the U.S. and half the revenues are generated outside the U.S.

That makes health care uniquely “recession resistant,” he said.

Since he began managing the fund in 2007, Fidelity Select Medical has crushed every equity benchmark. In the 10 years Yoon delivered 389 percent, the S&P 500, Russell 3000 and S&P Health Care Index gained 274 percent, 276 percent and 297 percent, respectively. During the past five years, Fidelity Select Medical appreciated 106 percent when the S&P 500, Rusell 3000 and MSCI Health Care Index increased 51 percent, 47 percent and 64 percent. Yoon provided a similar bonanza the past three years when Fidelity Select Medical advanced 56 percent against 31 percent, 30 percent and 25 percent, according to data compiled by Bloomberg.

But the reason Fidelity Select Medical’s total return (income plus appreciation) was more than twice that of MSCI Health Care’s 361 companies last year is Yoon’s emphasis on less-risky equipment instead of biotechnology, where “you’re trying to solve problems of human biology.” That’s expensive, and full of thorny questions like “why some people get some cancers and people who have smoked for 15 years don’t get lung cancer.”

Yoon’s penchant “to buy low, sell high” by determining the future value of his favorite companies is the secret sauce of his success. “You don’t want to own the best stories,” he says. “You want to own the best stocks.”

Yoon’s strategy is anticipating earnings and free cash flows in three to five years. “We’re trying to take advantage of where we see insights, and as market prices appreciate, some of those insights become more fully” valued “and when that happens we tend to seek out ideas in other parts of the market.”

While health care equipment makers and suppliers enabled Yoon to outperform his benchmarks, he reduced some of his holdings in the industry, including UnitedHealth, Baxter International Inc., Integra LifeSciences Holdings Corp., HCA Healthcare Inc. and DexCom Inc., according to data compiled by Bloomberg. At the same time he acquired more shares of Becton Dickinson, Abbott Laboratories, Thermo Fisher Scientific Inc., Medtronic Plc. and Intuitive Surgical Inc.

“The best way to create wealth for shareholders is to compound returns,” says Yoon. “It’s not just compounding at any level of risk; you want to do it at the lowest risk possible.”

Sure enough, Yoon’s ability to outperform the health care industry improved steadily over the past 10 years. During the 60 months between 2008 and 2012, Fidelity Select Medical was ahead of MSCI Healthcare in 30 of them, according to data compiled by Bloomberg. Between 2013 and 2017, the fund was the winner in 58 percent of those months and last year the ratio climbed to 75 percent, according to data compiled by Bloomberg.

“I don’t strive to be the No. 1 performing fund in any given year,” says Yoon. “But in the long run I want to deliver best-in-class investment performance.”

The would-be doctor gets another reward: “The great thing about this job is we get to see the cutting edge of science three to five years before it impacts patients.”

Matthew A. Winkler is a Bloomberg Opinion columnist. He is the editor-in-chief emeritus of Bloomberg News.

To contact the author of this story: Matthew A. Winkler at [email protected]

For more columns from Bloomberg View, visit bloomberg.com/view